2.5 — Short Run Profit Maximization

ECON 306 · Microeconomic Analysis · Fall 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microF20

microF20.classes.ryansafner.com

Revenues

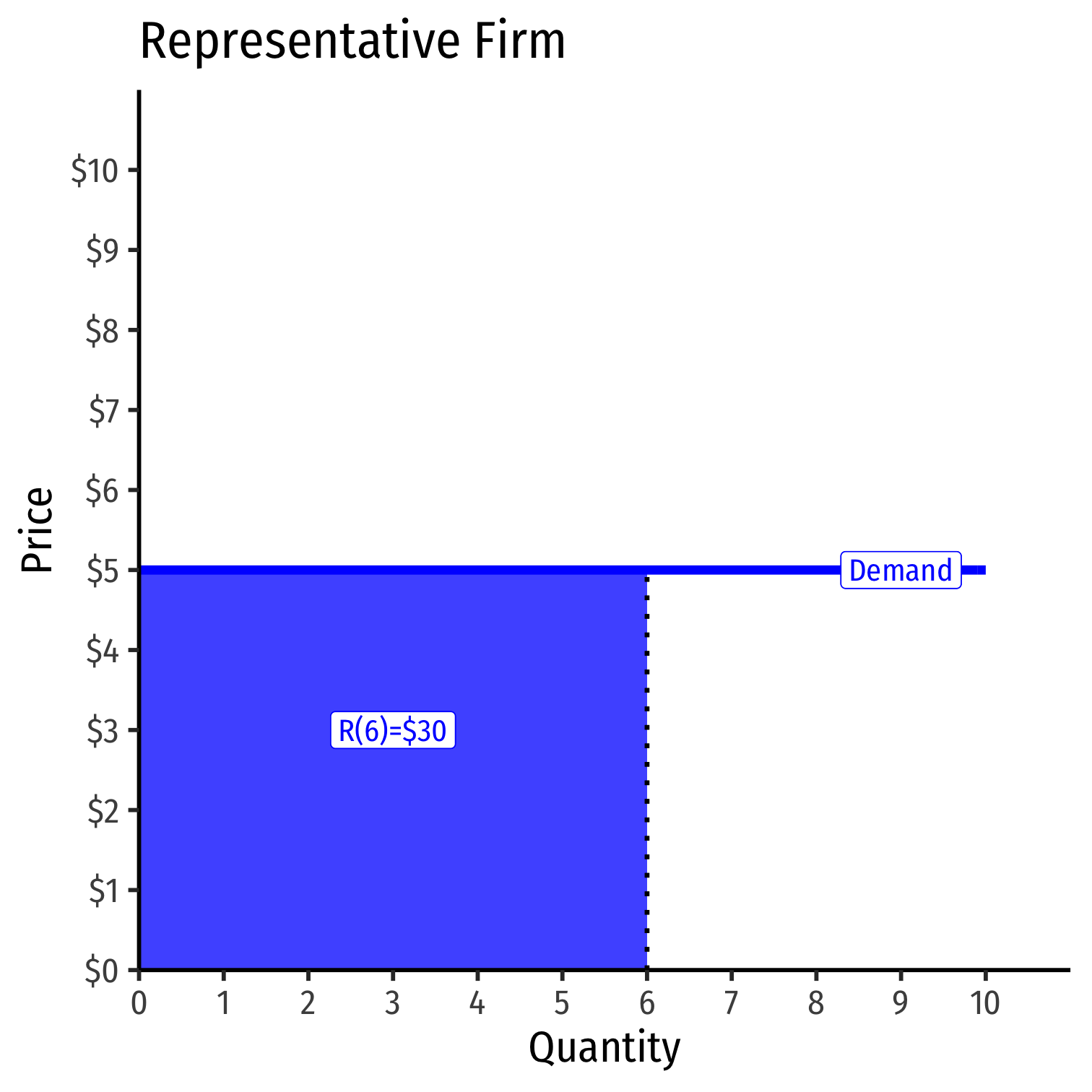

Revenues for Firms in Competitive Industries I

Revenues for Firms in Competitive Industries I

Revenues for Firms in Competitive Industries I

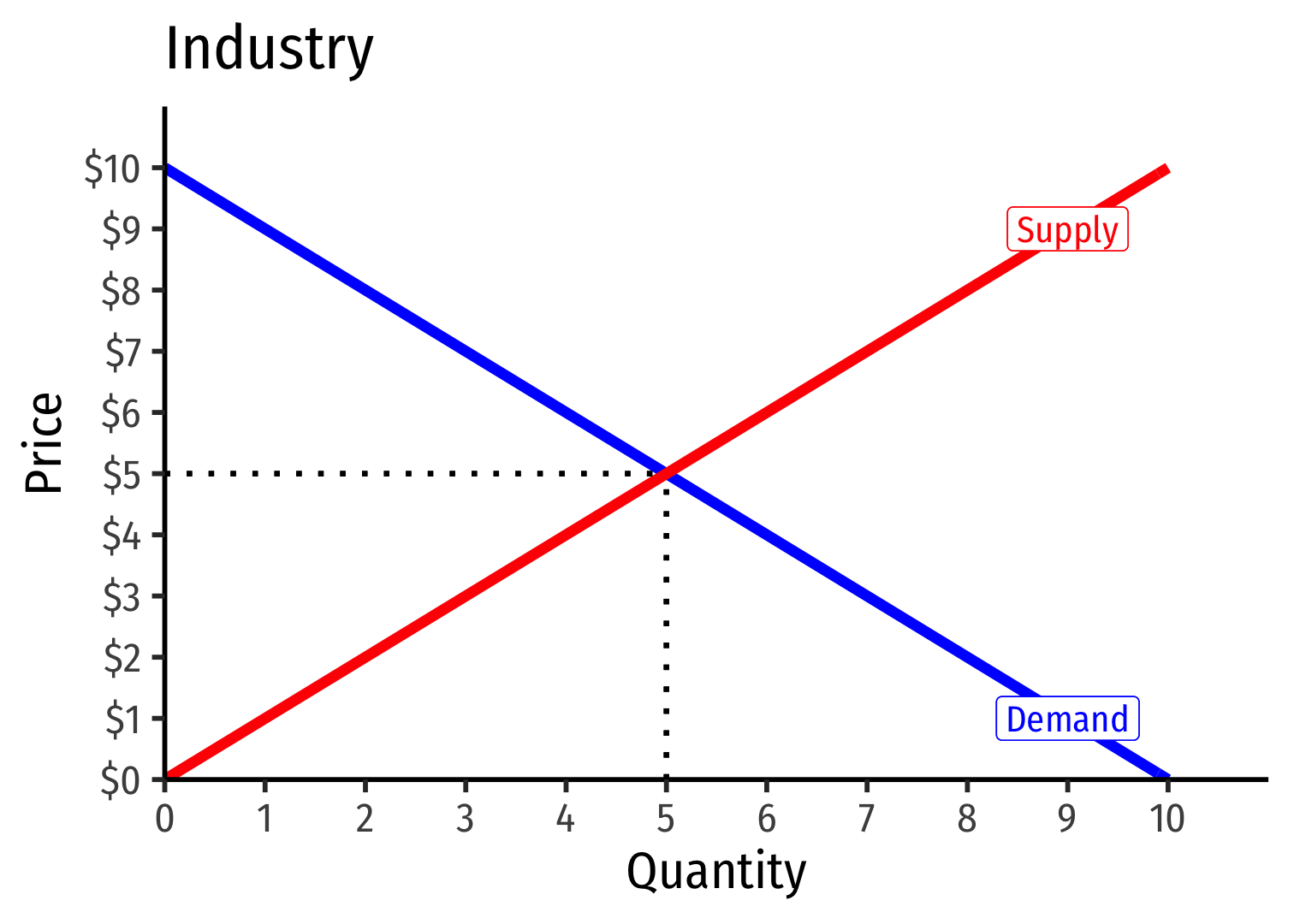

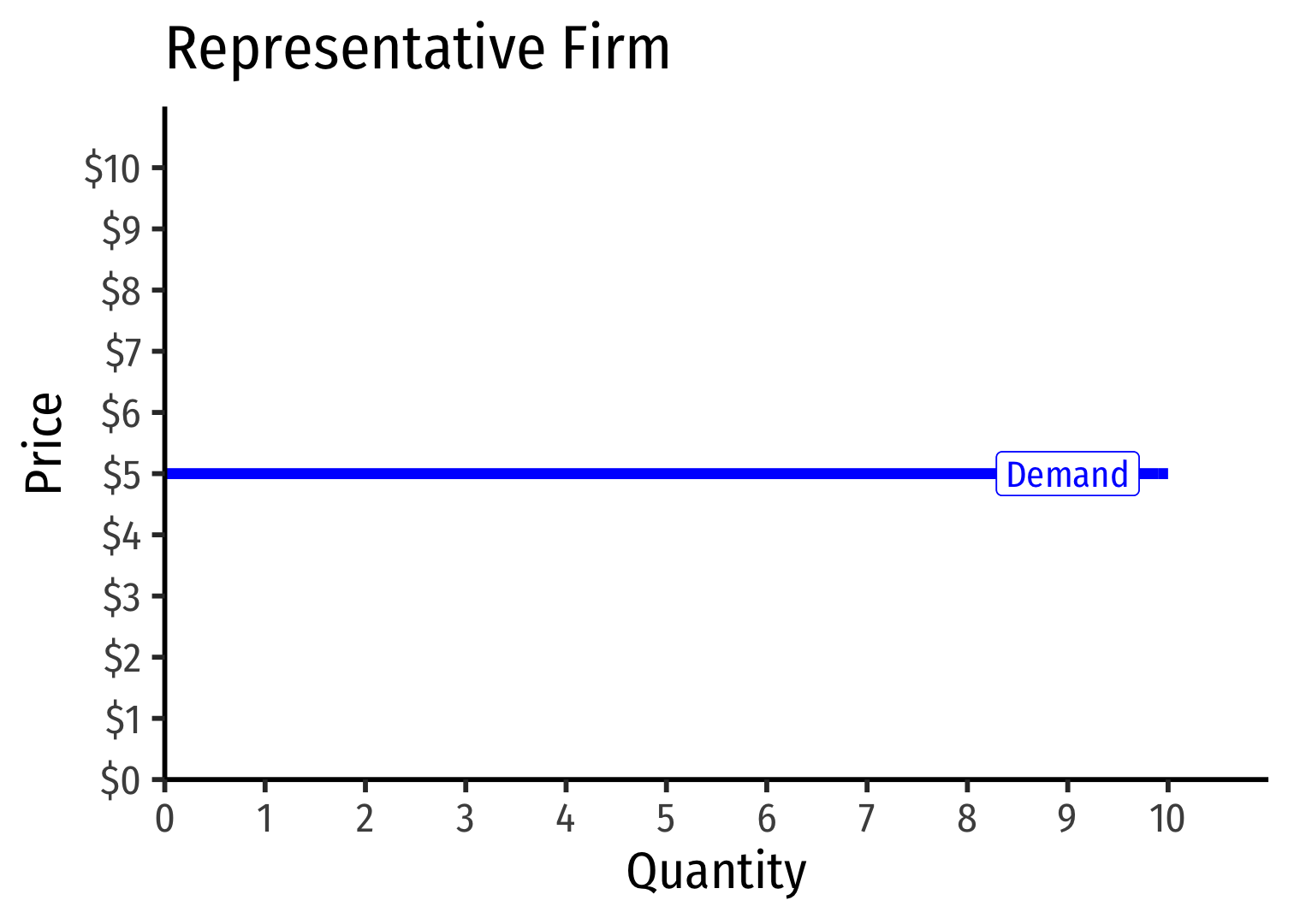

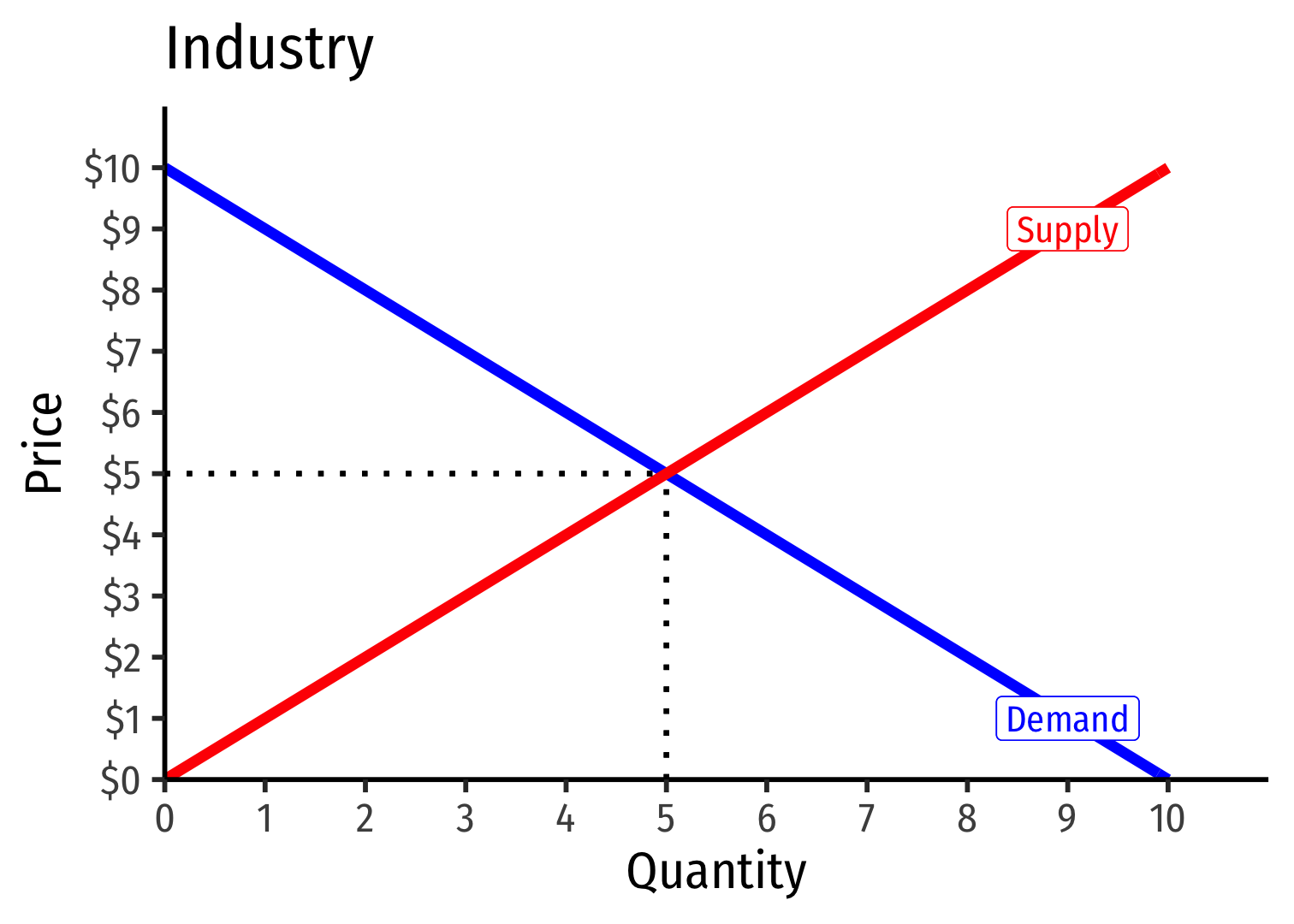

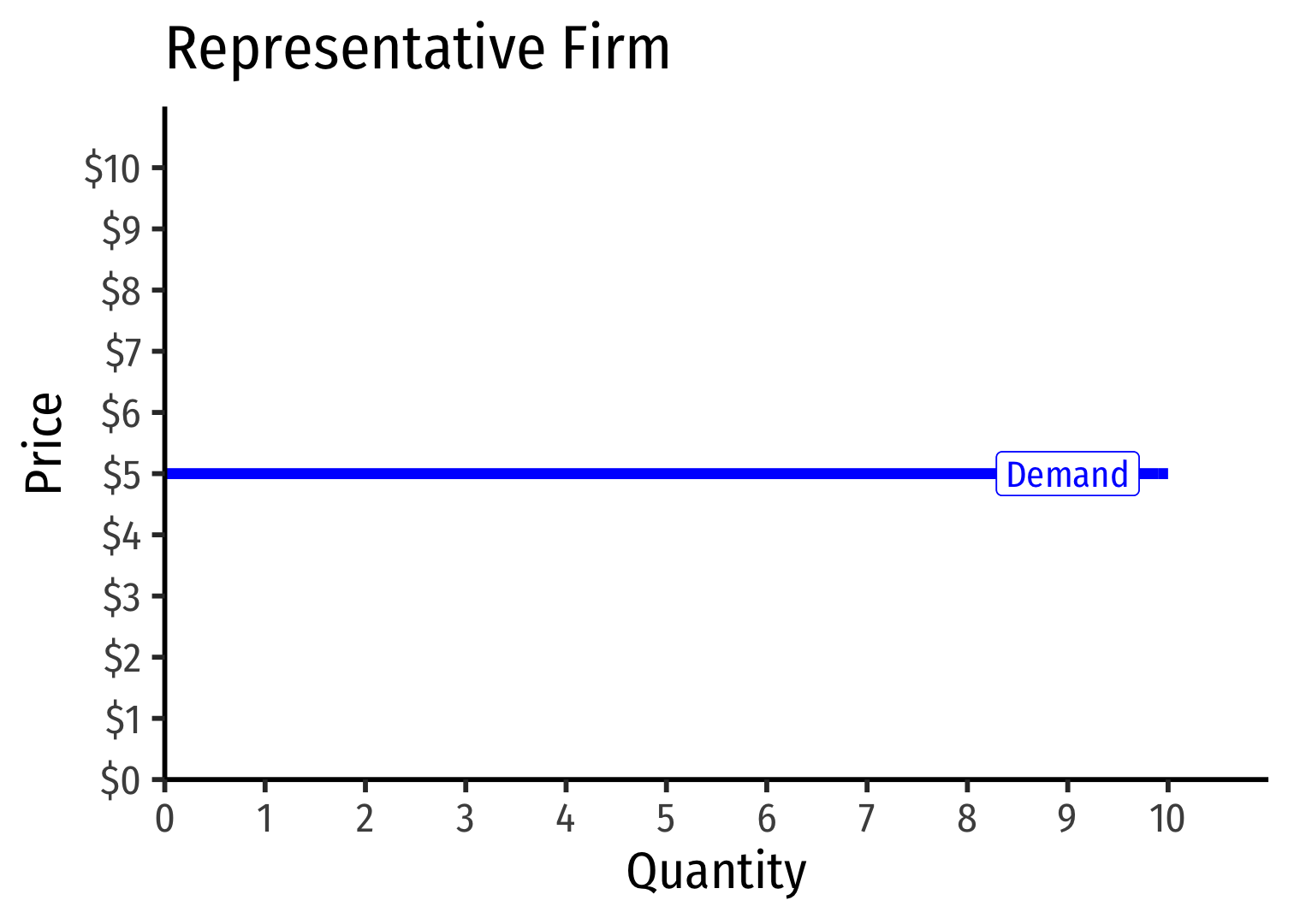

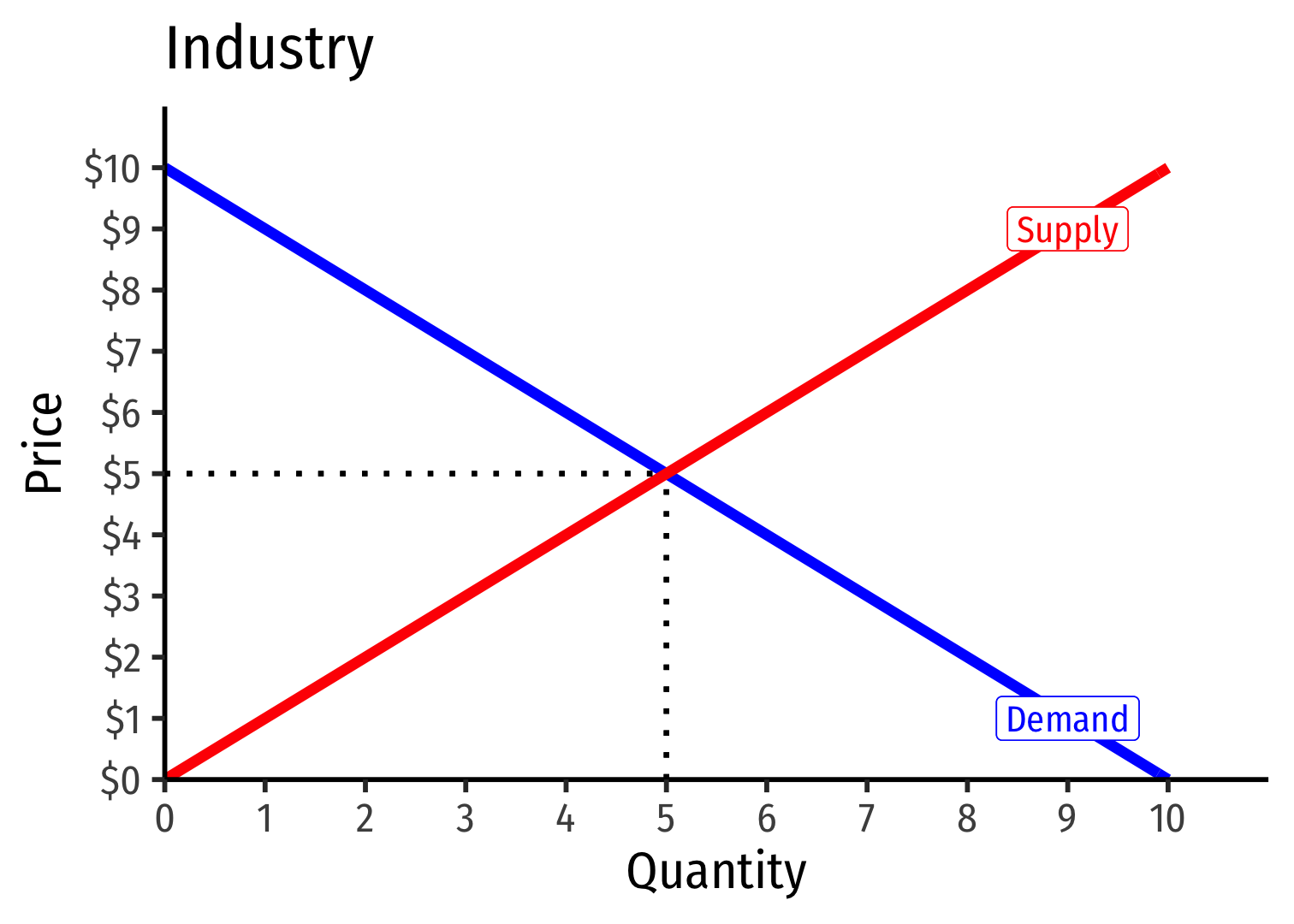

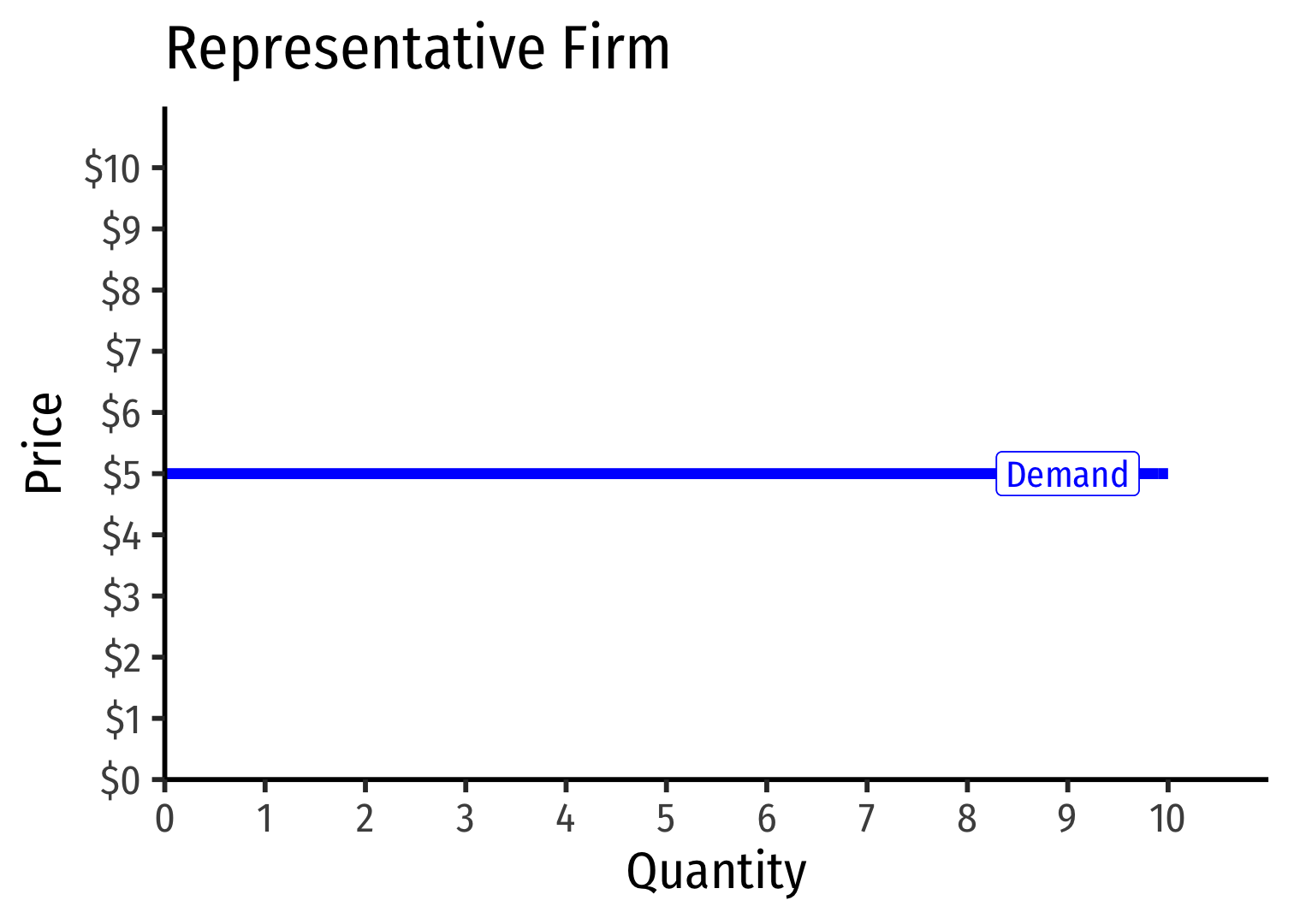

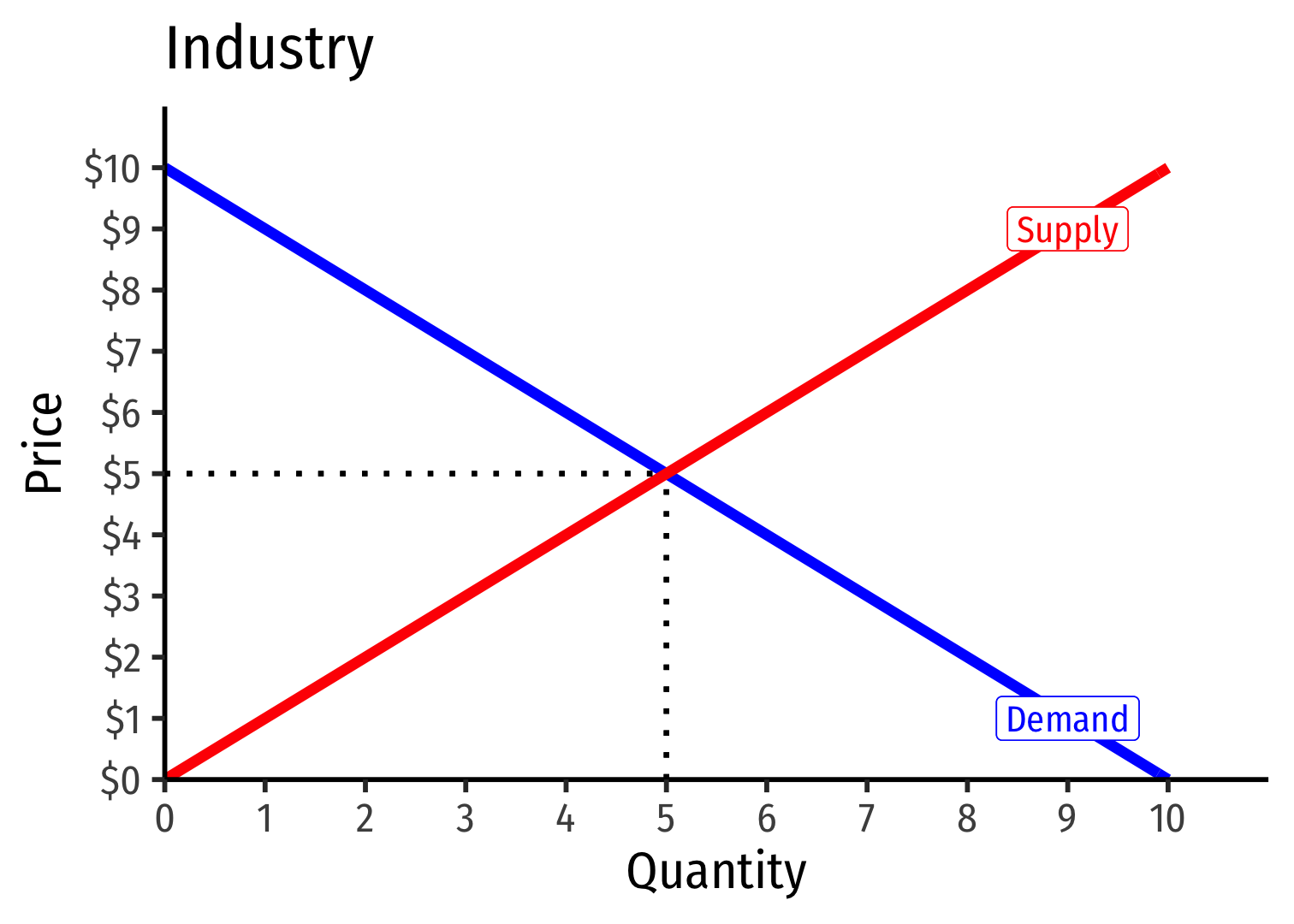

- Demand for a firm's product is perfectly elastic at the market price

Revenues for Firms in Competitive Industries I

Demand for a firm's product is perfectly elastic at the market price

Where did the supply curve come from? You'll see

Revenues for Firms in Competitive Industries II

- Total Revenue R(q)=pq

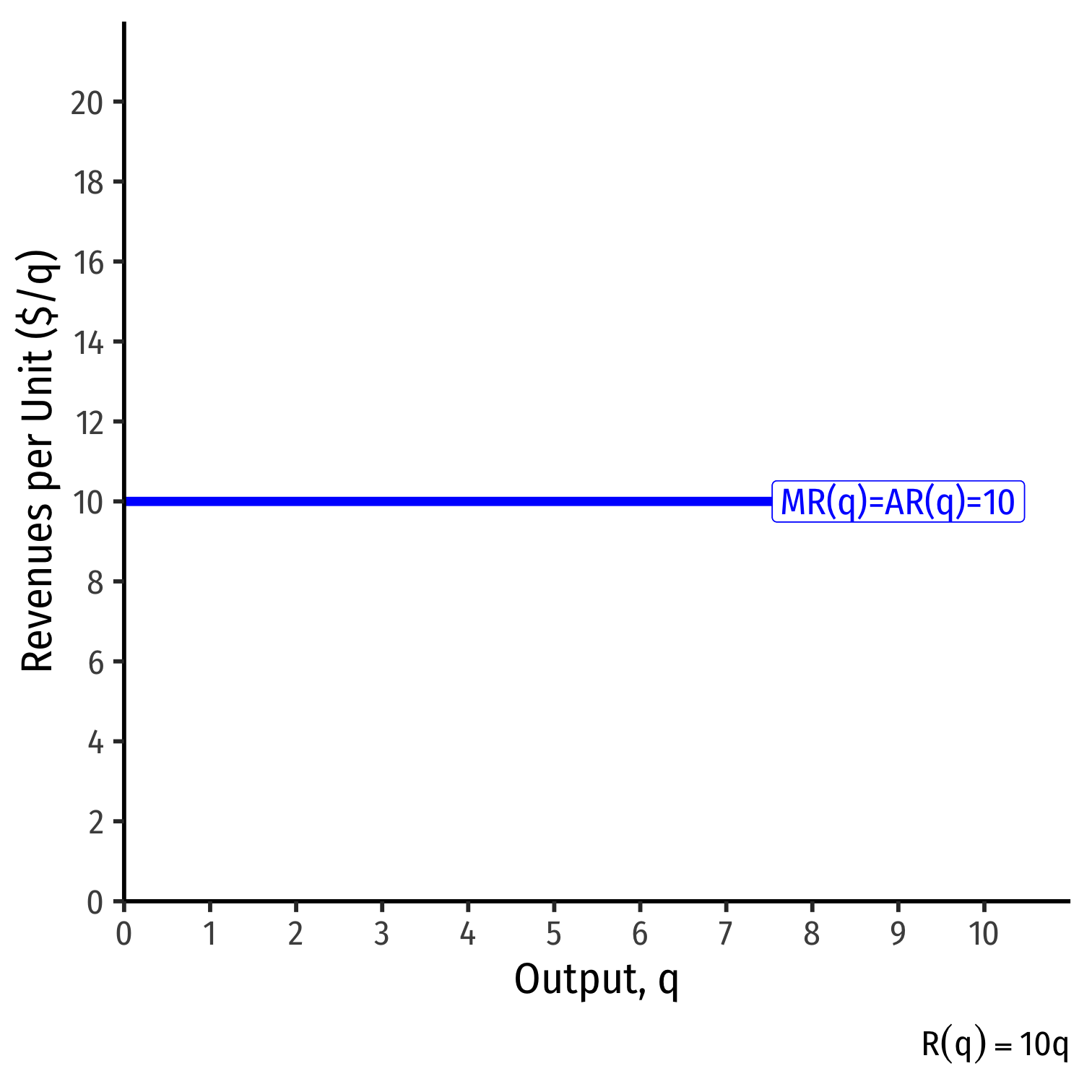

Average and Marginal Revenues

- Average Revenue: revenue per unit of output

AR(q)=Rq

- Is always equal to the price! Why?

Average and Marginal Revenues

Average Revenue: revenue per unit of output AR(q)=Rq

- Is always equal to the price! Why?

Marginal Revenue: change in revenues for each additional unit of output sold: MR(q)=ΔR(q)Δq≈R2−R1q2−q1

- Calculus: first derivative of the revenues function

- For a competitive firm, always equal to the price!

Average and Marginal Revenues: Example

Example: A firm sells bushels of wheat in a very competitive market. The current market price is $10/bushel.

Average and Marginal Revenues: Example

Example: A firm sells bushels of wheat in a very competitive market. The current market price is $10/bushel.

For the 1st bushel sold:

What is the total revenue?

What is the average revenue?

Average and Marginal Revenues: Example

Example: A firm sells bushels of wheat in a very competitive market. The current market price is $10/bushel.

For the 1st bushel sold:

What is the total revenue?

What is the average revenue?

For the 2nd bushel sold:

What is the total revenue?

What is the average revenue?

What is the marginal revenue?

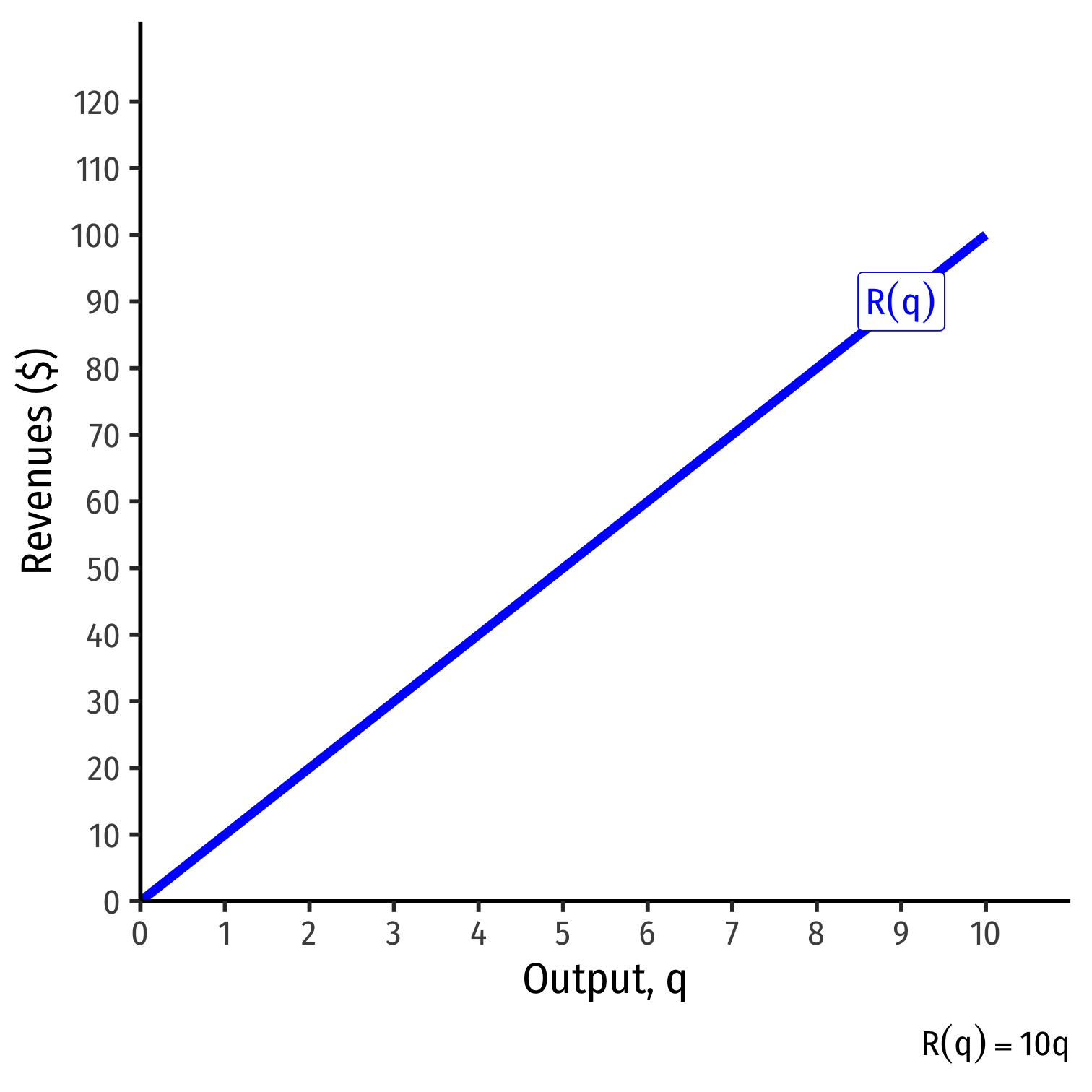

Total Revenue, Example: Visualized

| q | R(q) |

|---|---|

| 0 | 0 |

| 1 | 10 |

| 2 | 20 |

| 3 | 30 |

| 4 | 40 |

| 5 | 50 |

| 6 | 60 |

| 7 | 70 |

| 8 | 80 |

| 9 | 90 |

| 10 | 100 |

Average and Marginal Revenue, Example: Visualized

| q | R(q) | AR(q) | MR(q) |

|---|---|---|---|

| 0 | 0 | − | − |

| 1 | 10 | 10 | 10 |

| 2 | 20 | 10 | 10 |

| 3 | 30 | 10 | 10 |

| 4 | 40 | 10 | 10 |

| 5 | 50 | 10 | 10 |

| 6 | 60 | 10 | 10 |

| 7 | 70 | 10 | 10 |

| 8 | 80 | 10 | 10 |

| 9 | 90 | 10 | 10 |

| 10 | 100 | 10 | 10 |

Recall: The Firm's Two Problems

- 1st Stage: firm's profit maximization problem:

Choose: < output >

In order to maximize: < profits >

We'll cover this later...first we'll explore:

2nd Stage: firm's cost minimization problem:

Choose: < inputs >

In order to minimize: < cost >

Subject to: < producing the optimal output >

- Minimizing costs ⟺ maximizing profits

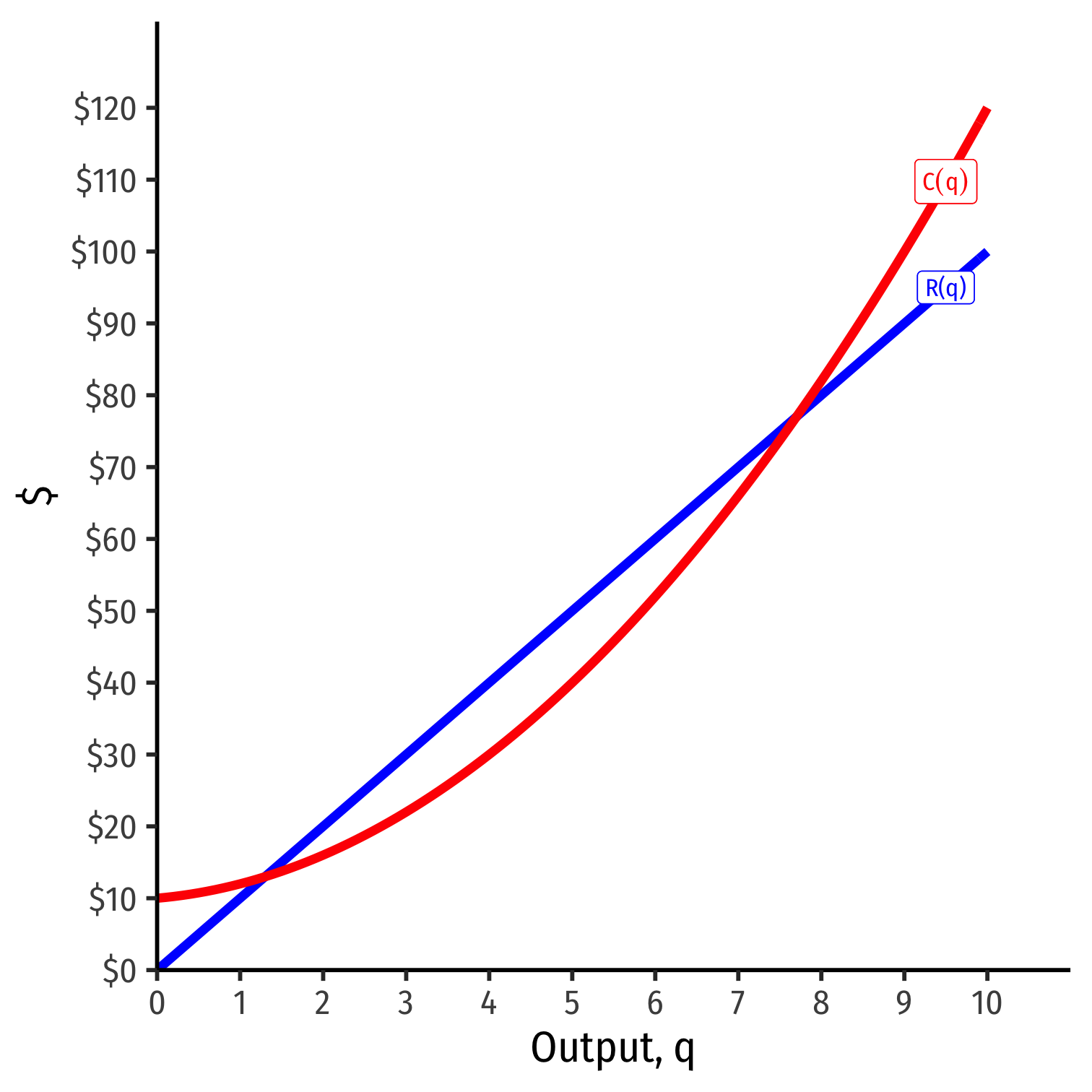

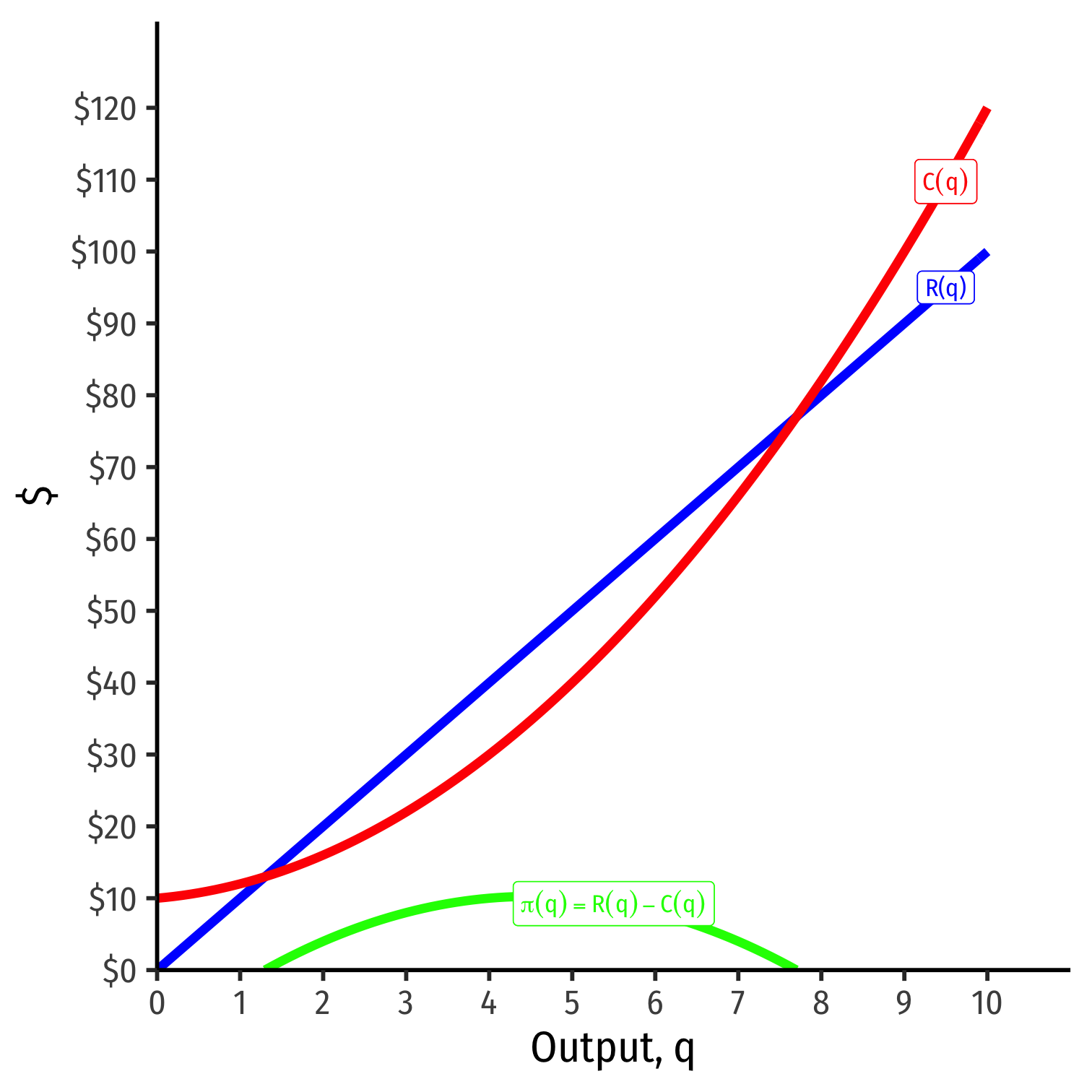

Visualizing Total Profit As R(q)−C(q)

- π(q)=R(q)−C(q)

Visualizing Total Profit As R(q)−C(q)

- π(q)=R(q)−C(q)

Visualizing Total Profit As R(q)−C(q)

π(q)=R(q)−C(q)

Graph: find q∗ to max π⟹q∗ where max distance between R(q) and C(q)

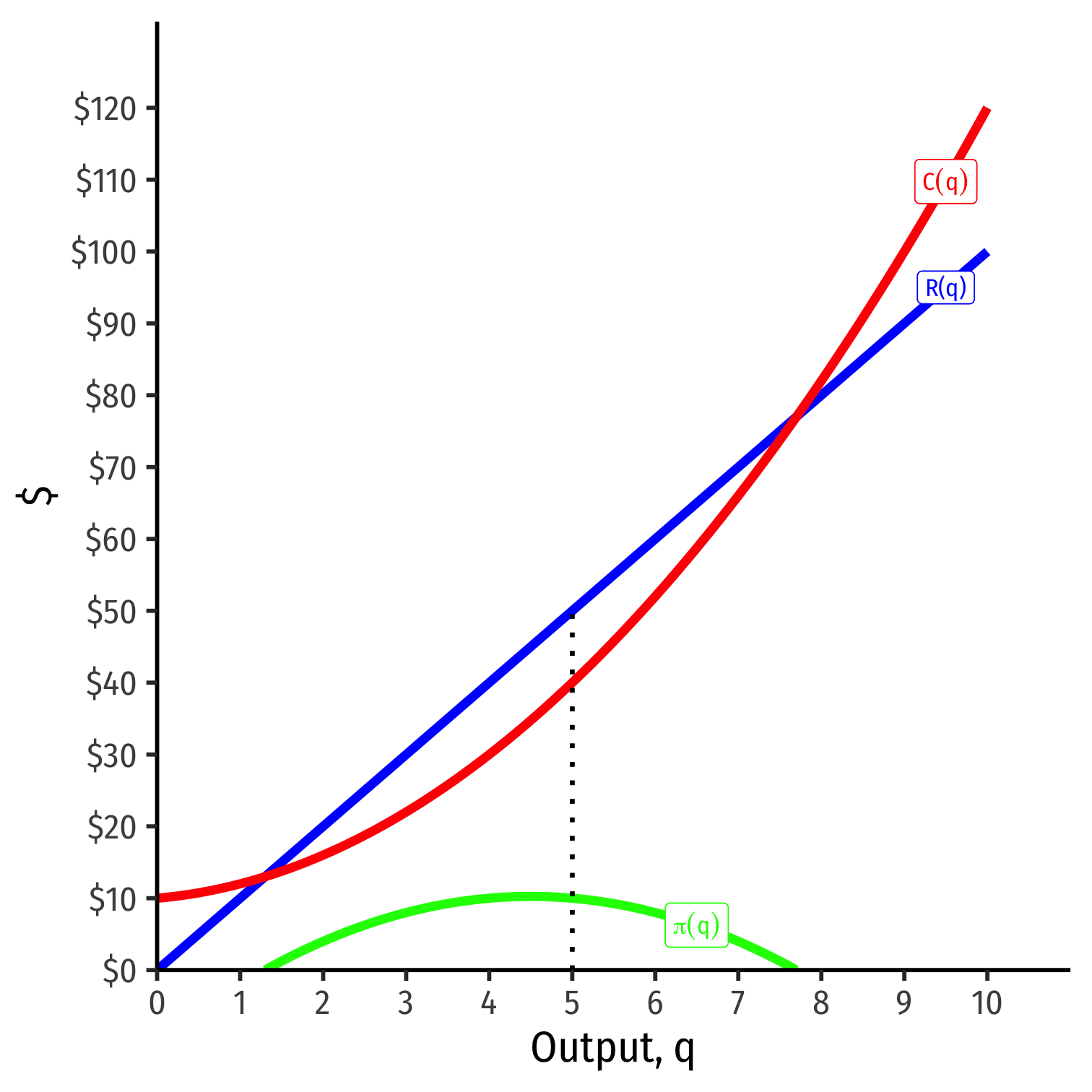

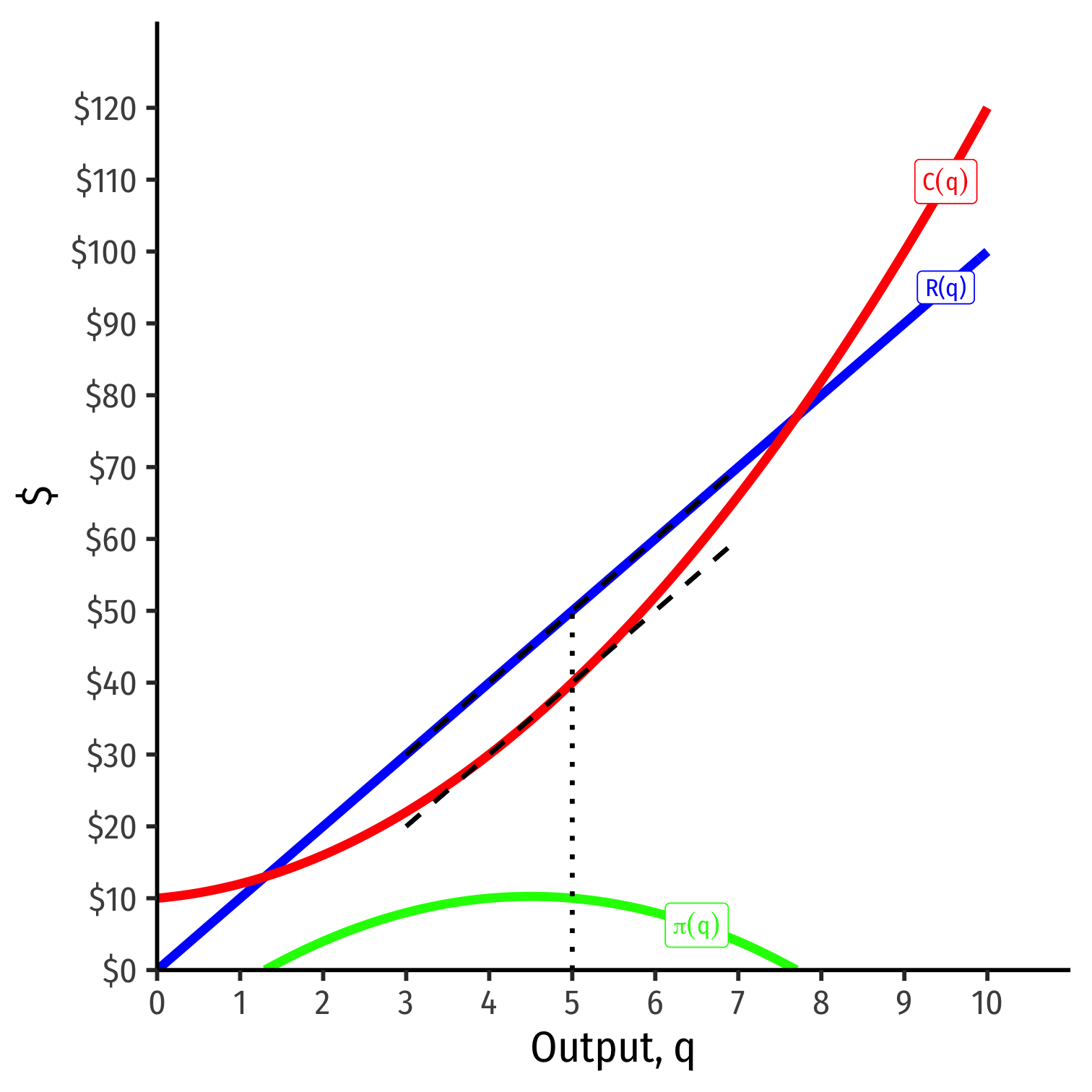

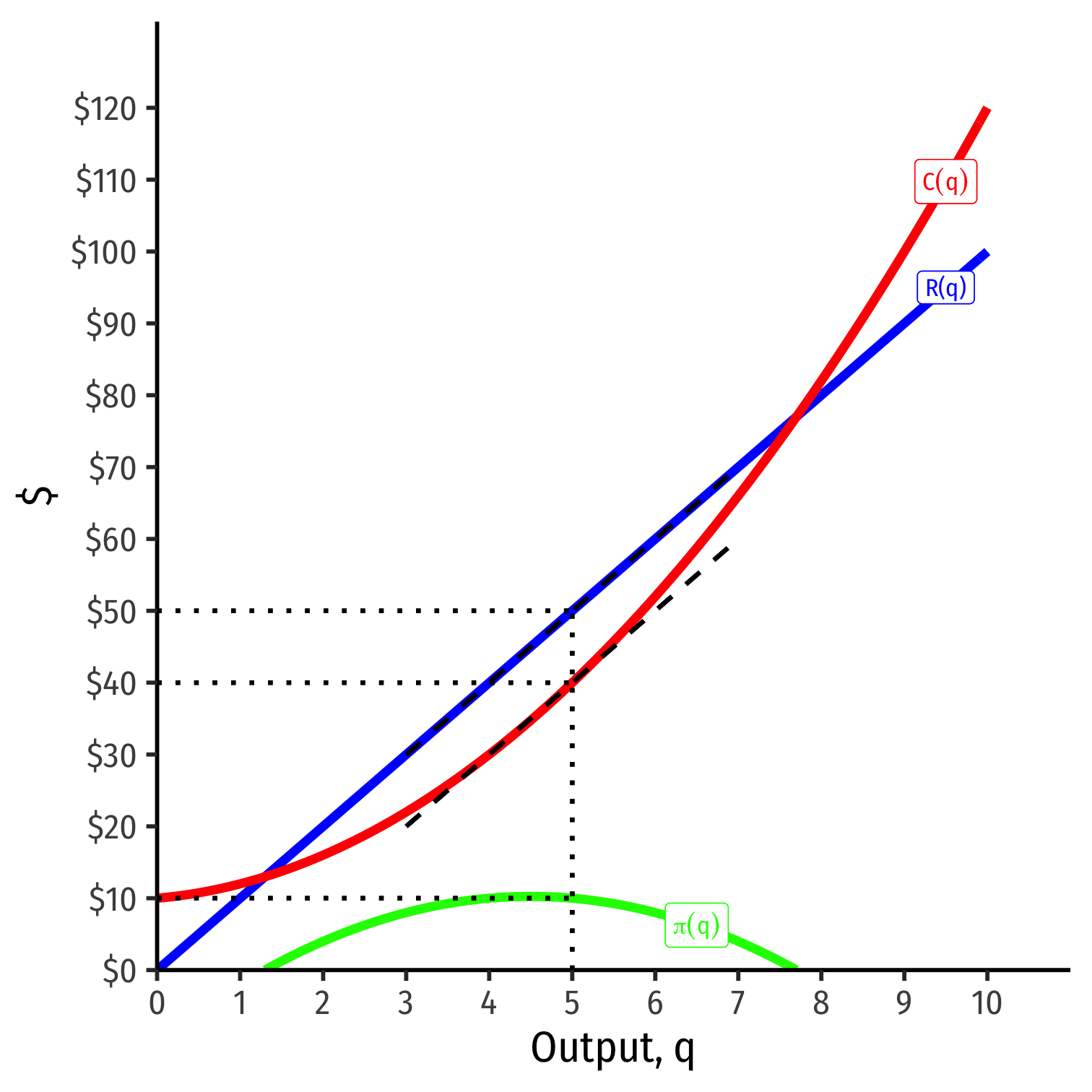

Visualizing Total Profit As R(q)−C(q)

π(q)=R(q)−C(q)

Graph: find q∗ to max π⟹q∗ where max distance between R(q) and C(q)

Slopes must be equal: MR(q)=MC(q)

Visualizing Total Profit As R(q)−C(q)

π(q)=R(q)−C(q)

Graph: find q∗ to max π⟹q∗ where max distance between R(q) and C(q)

Slopes must be equal: MR(q)=MC(q)

- At q∗=5:

- R(q)=50

- C(q)=40

- π(q)=10

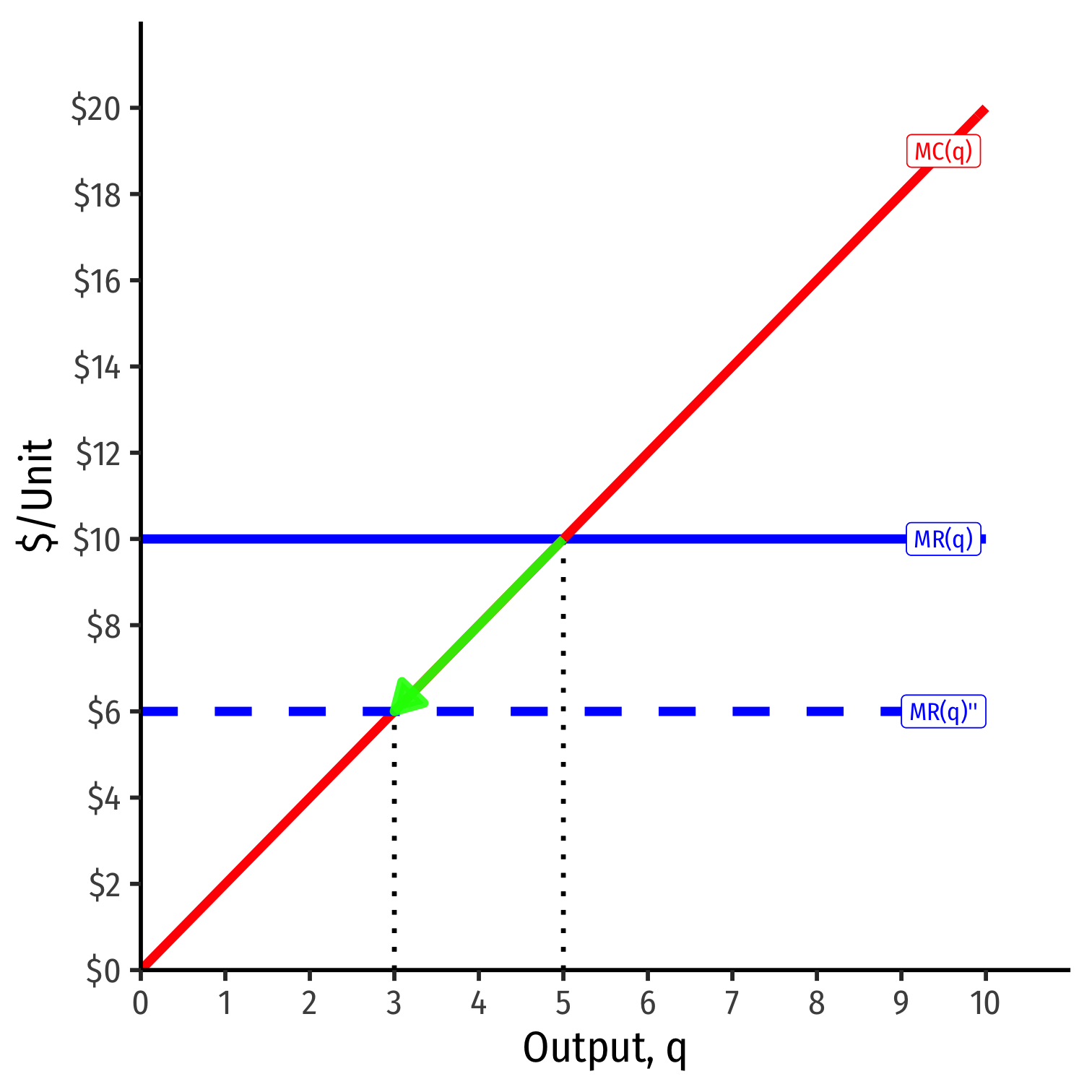

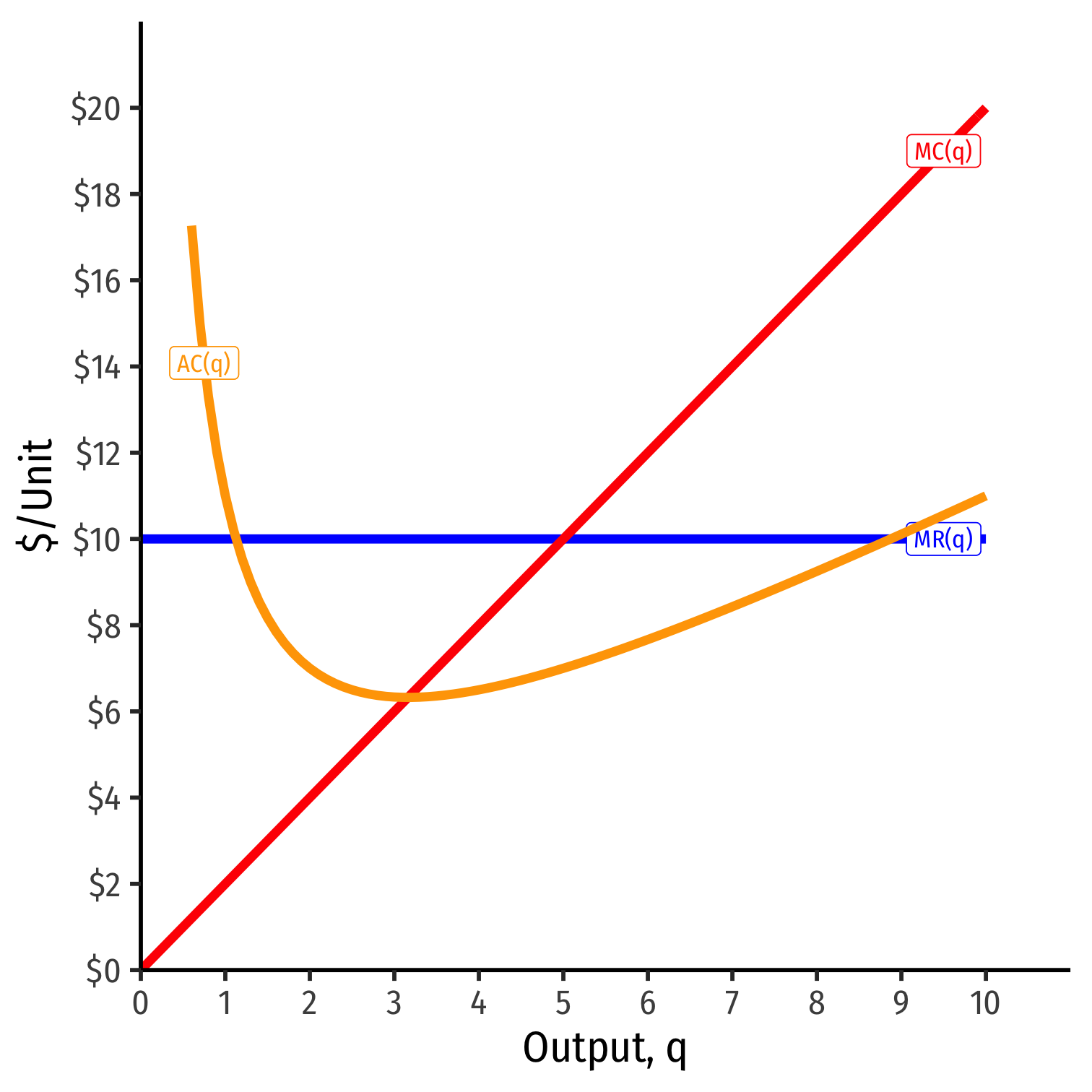

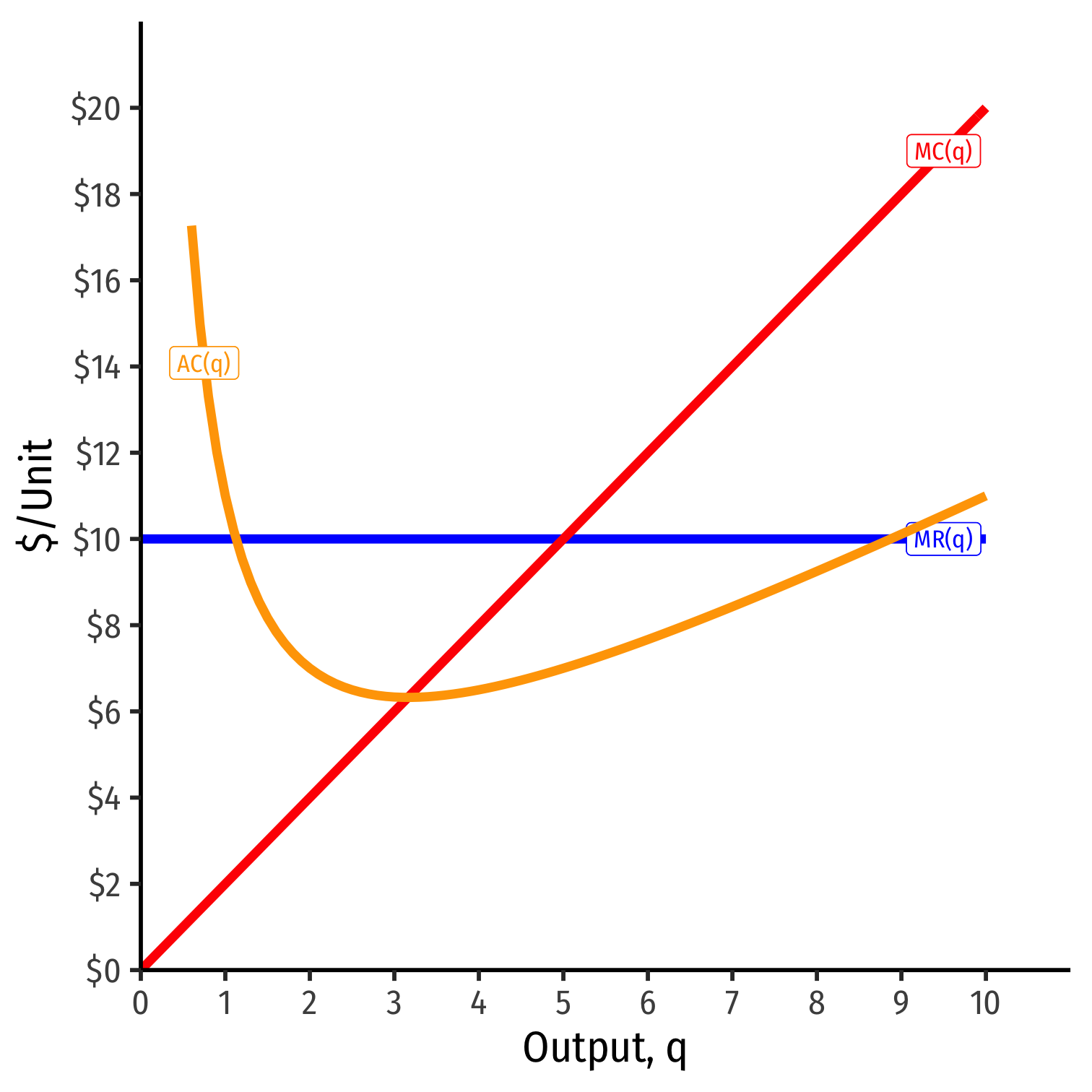

Visualizing Profit Per Unit As MR(q) and MC(q)

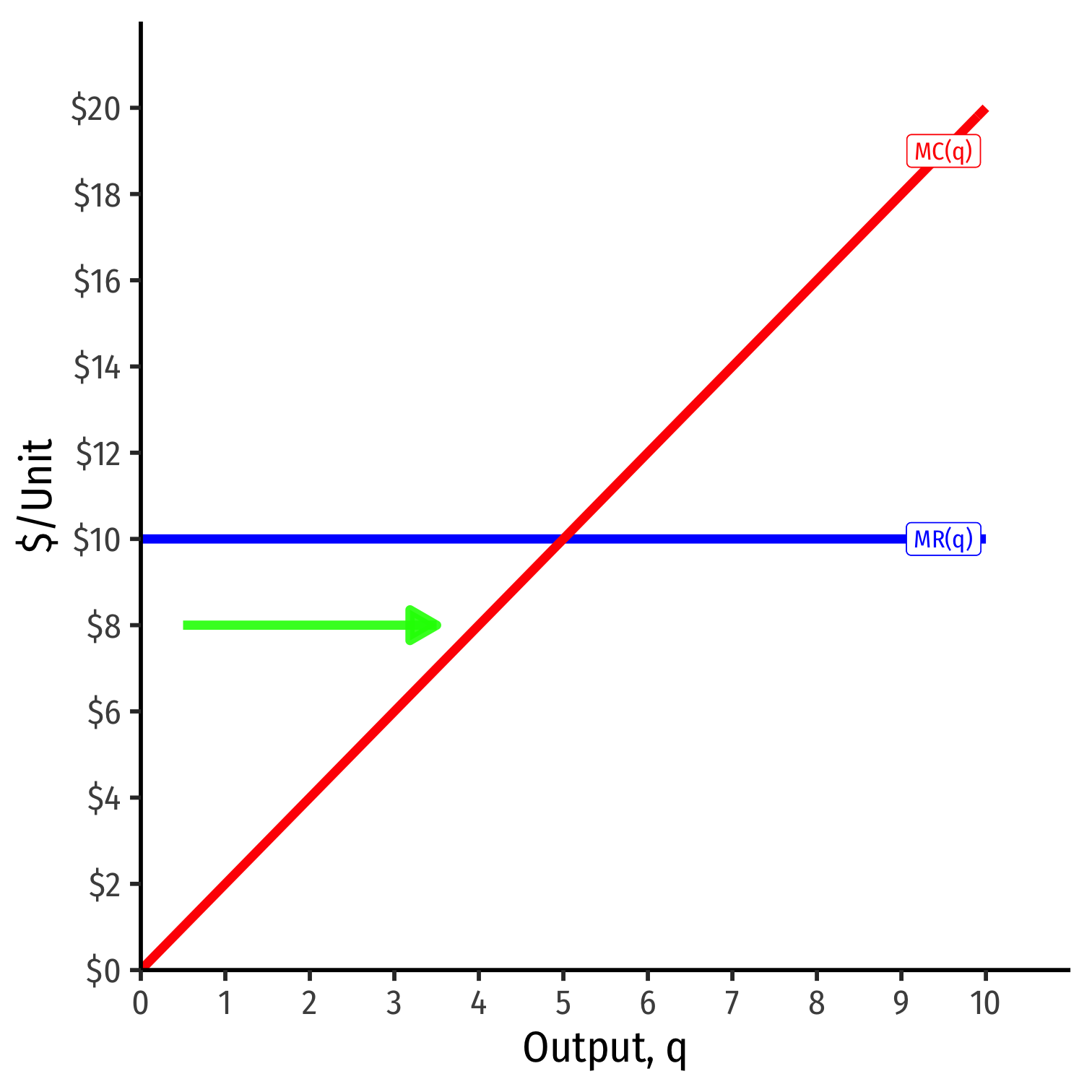

- At low output q<q∗, can increase π by producing more: MR(q)>MC(q)

Visualizing Profit Per Unit As MR(q) and MC(q)

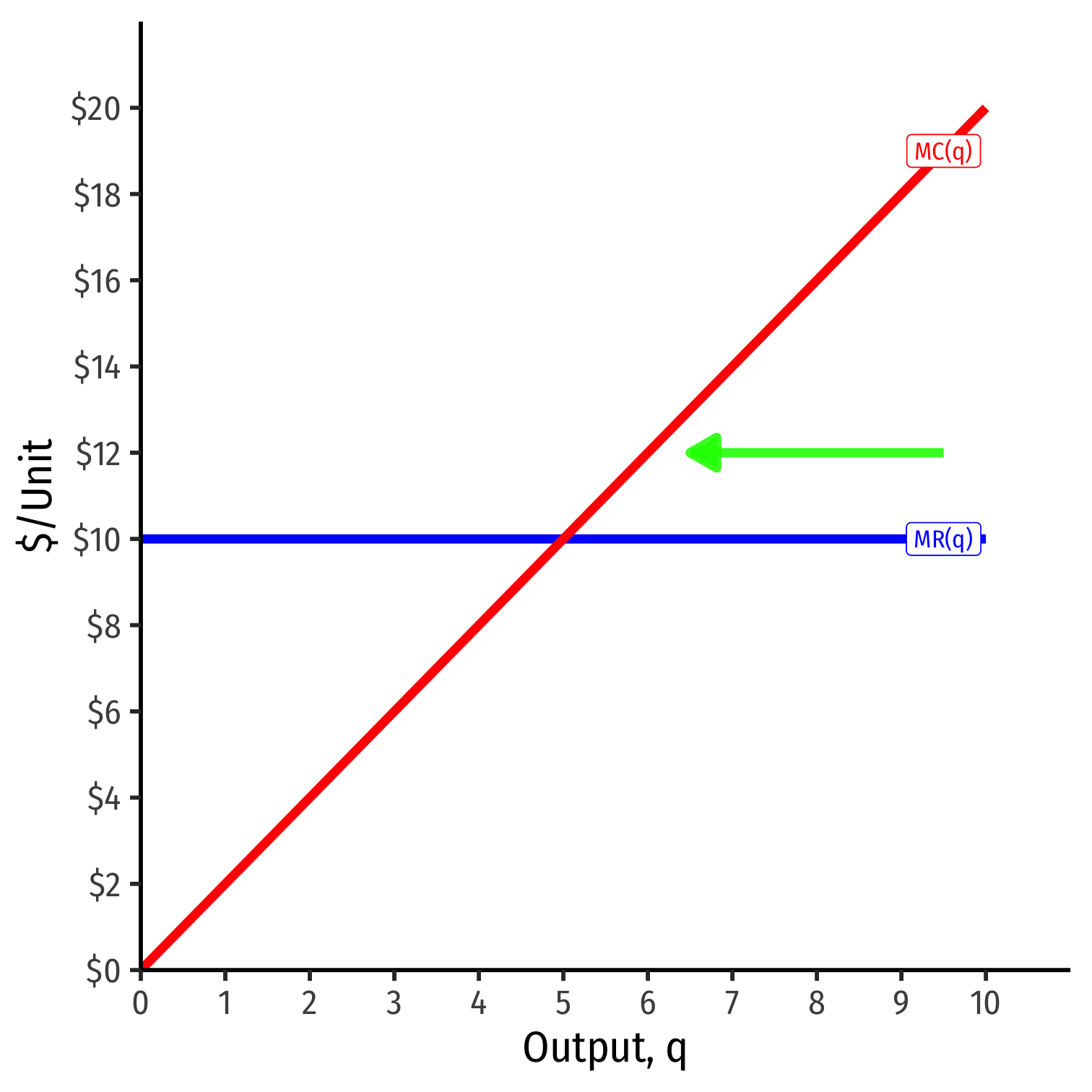

- At high output q>q∗, can increase π by producing less: MR(q)<MC(q)

Visualizing Profit Per Unit As MR(q) and MC(q)

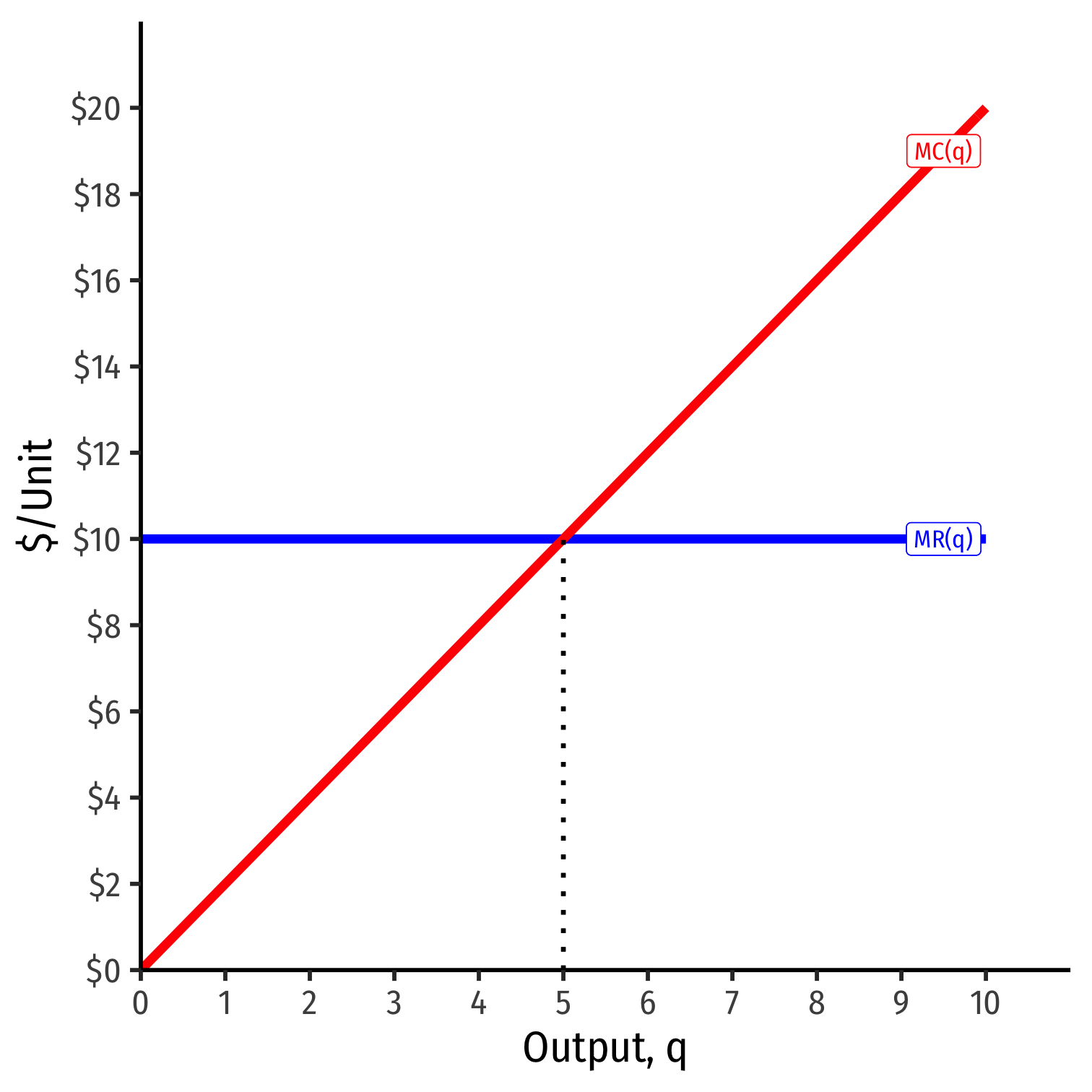

- π is maximized where MR(q)=MC(q)

Comparative Statics

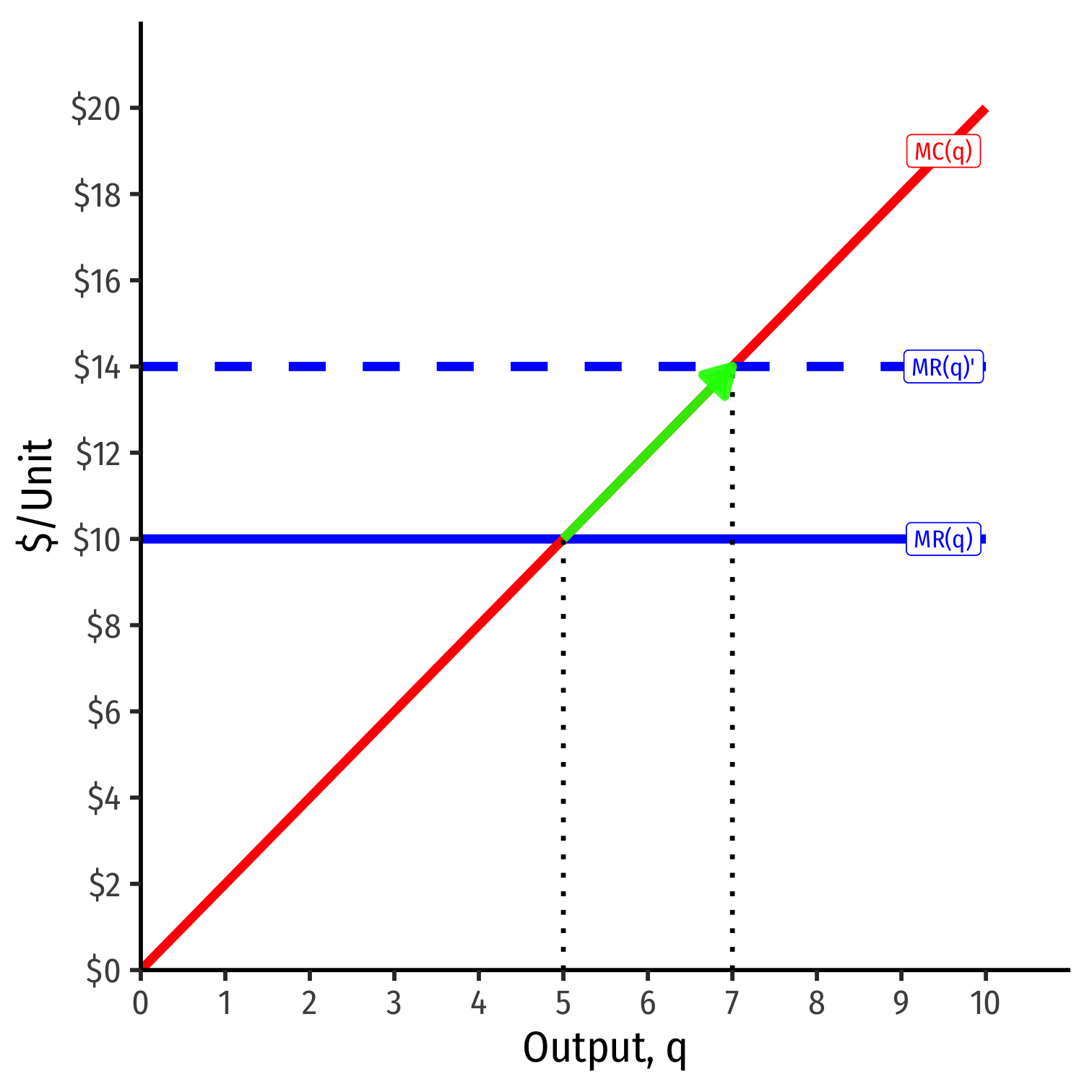

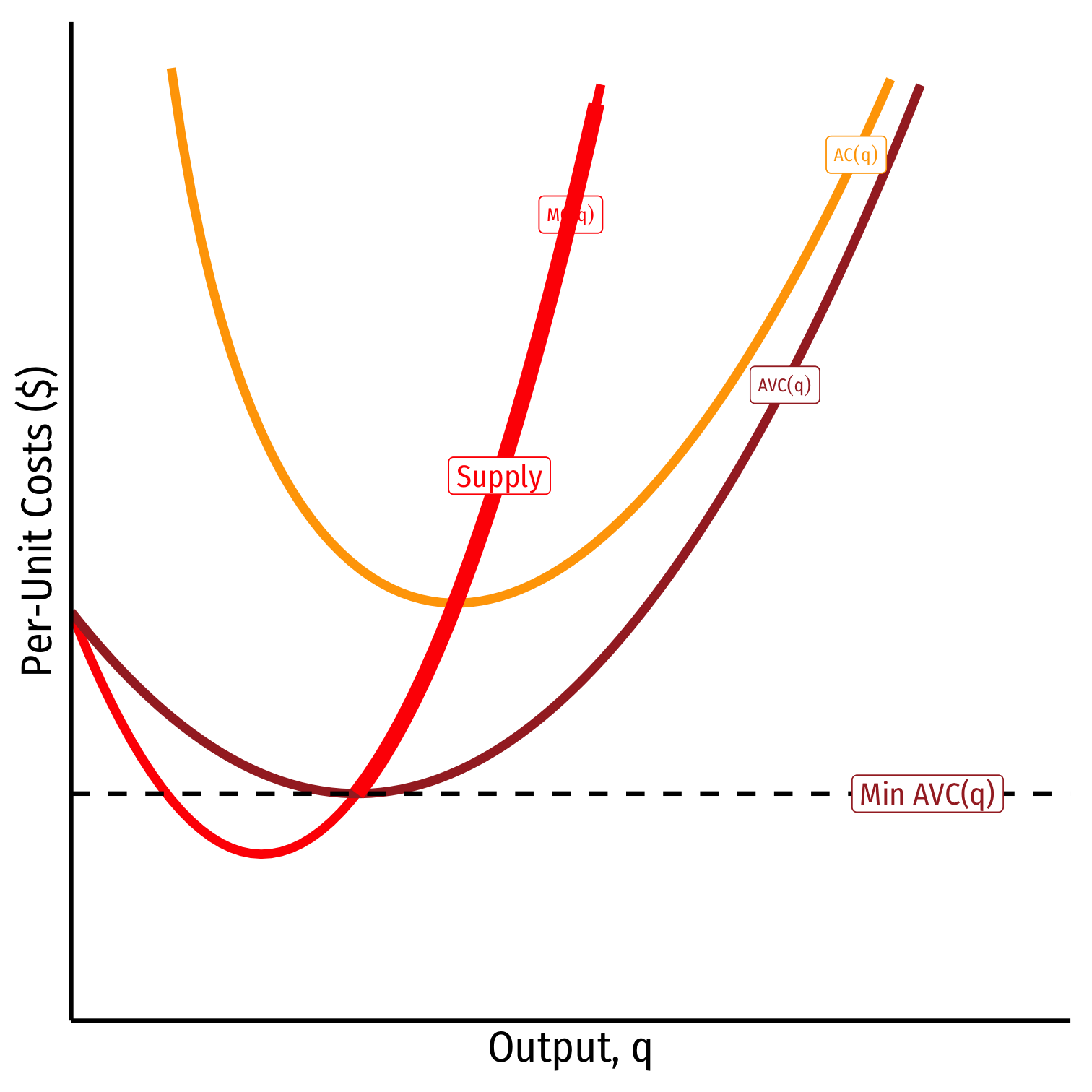

If Market Price Changes I

Suppose the market price increases

Firm (always setting MR=MC) will respond by producing more

If Market Price Changes II

Suppose the market price decreases

Firm (always setting MR=MC) will respond by producing more

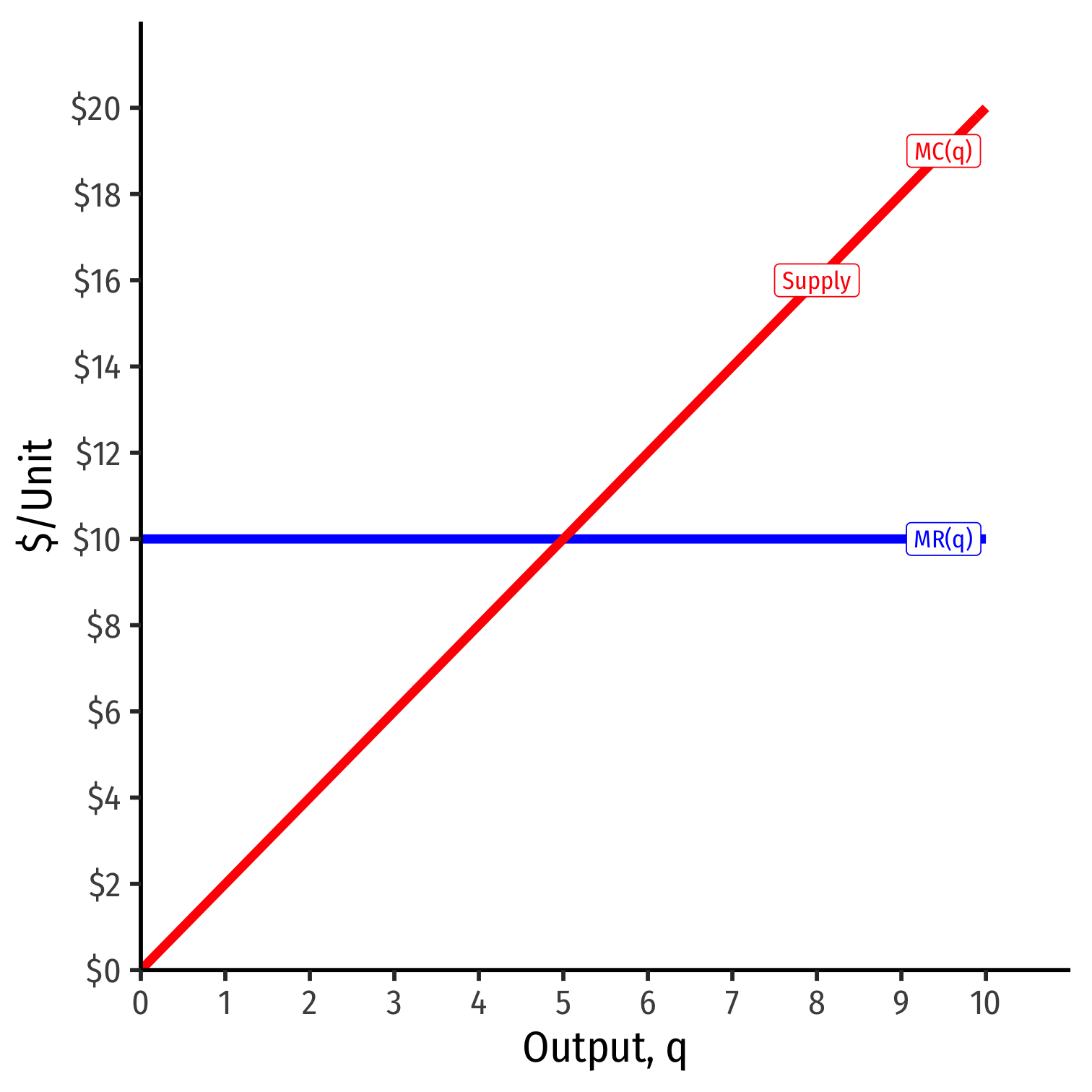

If Market Price Changes II

The firm's marginal cost curve is its (inverse) supply curve† Supply=MC(q)

- How it will supply the optimal amount of output in response to the market price

There is an exception to this! We will see shortly!

† Mostly...there is an exception we will see shortly!

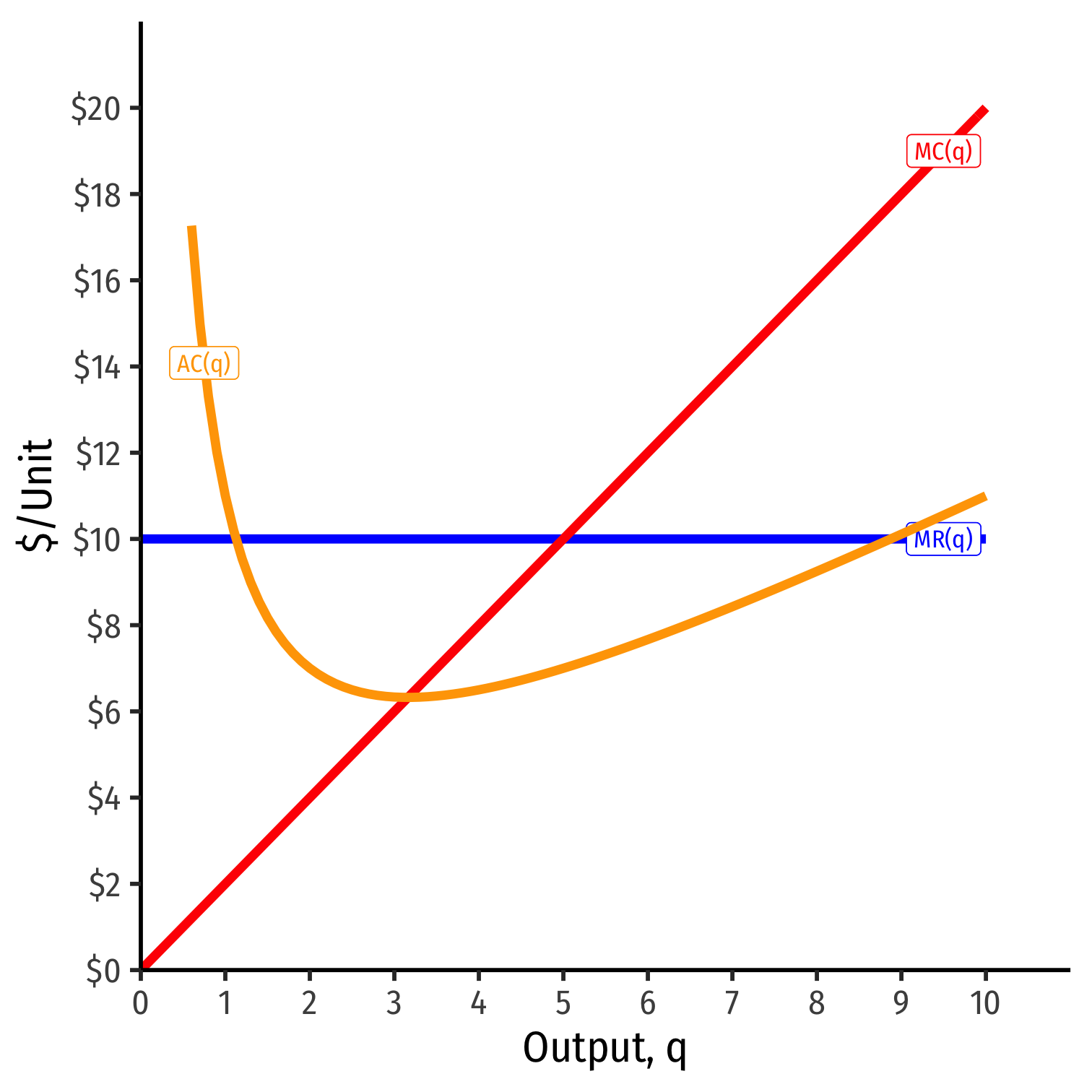

Calculating Profit

Calculating Average Profit as AR(q)−AC(q)

- Profit is

π(q)=R(q)−C(q)

Calculating Average Profit as AR(q)−AC(q)

Profit is π(q)=R(q)−C(q)

Profit per unit can be calculated as: π(q)q=AR(q)−AC(q)=p−AC(q)

Calculating Average Profit as AR(q)−AC(q)

Profit is π(q)=R(q)−C(q)

Profit per unit can be calculated as: π(q)q=AR(q)−AC(q)=p−AC(q)

Multiply by q to get total profit: π(q)=q[p−AC(q)]

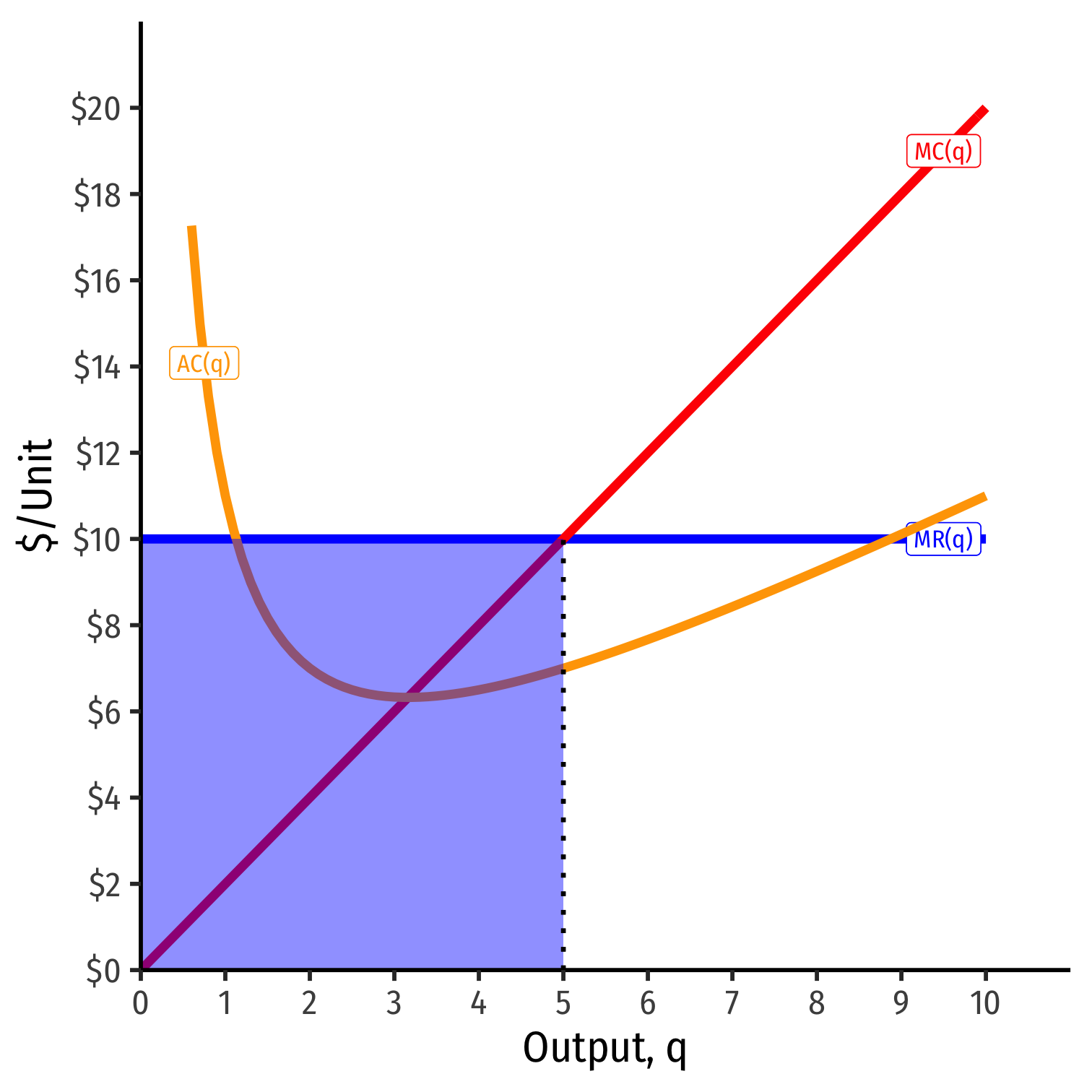

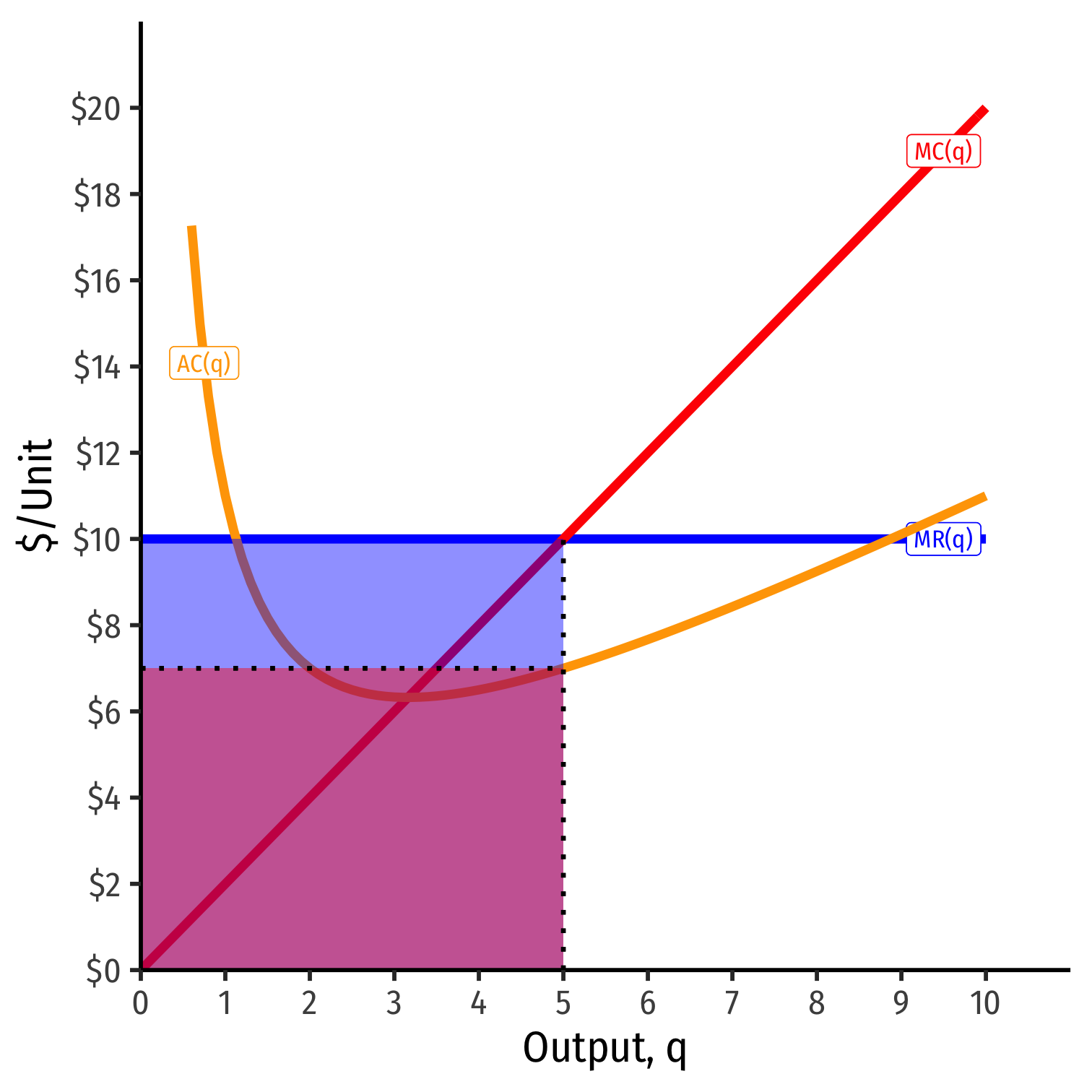

Calculating Average Profit as AR(q)−AC(q)

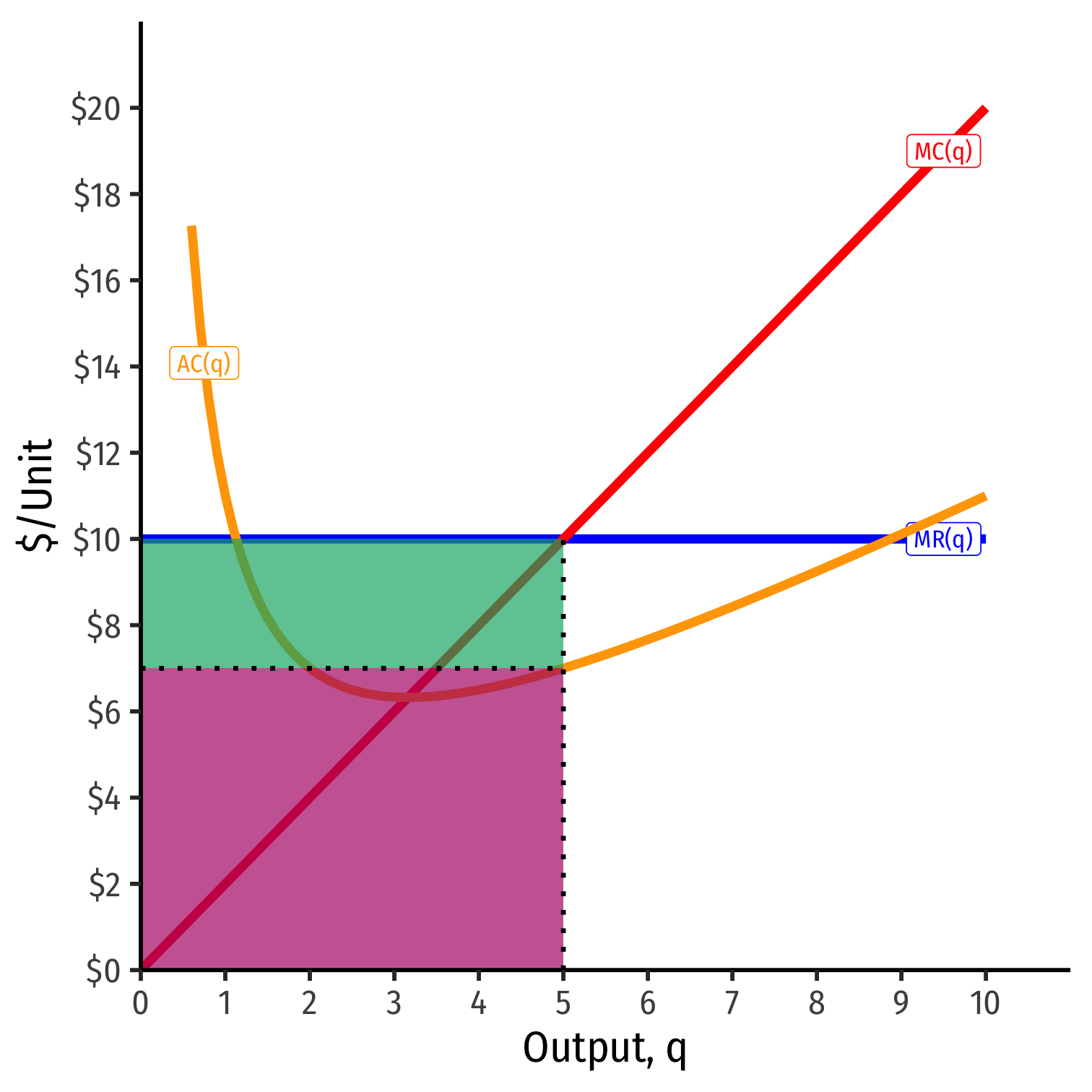

At market price of p* = $10

At q* = 5 (per unit):

At q* = 5 (totals):

## geom_segment: arrow = NULL, arrow.fill = NULL, lineend = butt, linejoin = round, na.rm = FALSE## stat_identity: na.rm = FALSE## position_identityCalculating Average Profit as AR(q)−AC(q)

At market price of p* = $10

At q* = 5 (per unit):

- AR(5) = $10/unit

At q* = 5 (totals):

- R(5) = $50

Calculating Average Profit as AR(q)−AC(q)

At market price of p* = $10

At q* = 5 (per unit):

- AR(5) = $10/unit

- AC(5) = $7/unit

At q* = 5 (totals):

- R(5) = $50

- C(5) = $35

Calculating Average Profit as AR(q)−AC(q)

At market price of p* = $10

At q* = 5 (per unit):

- AR(5) = $10/unit

- AC(5) = $7/unit

- Aπ(5) = $3/unit

At q* = 5 (totals):

- R(5) = $50

- C(5) = $35

- π = $15

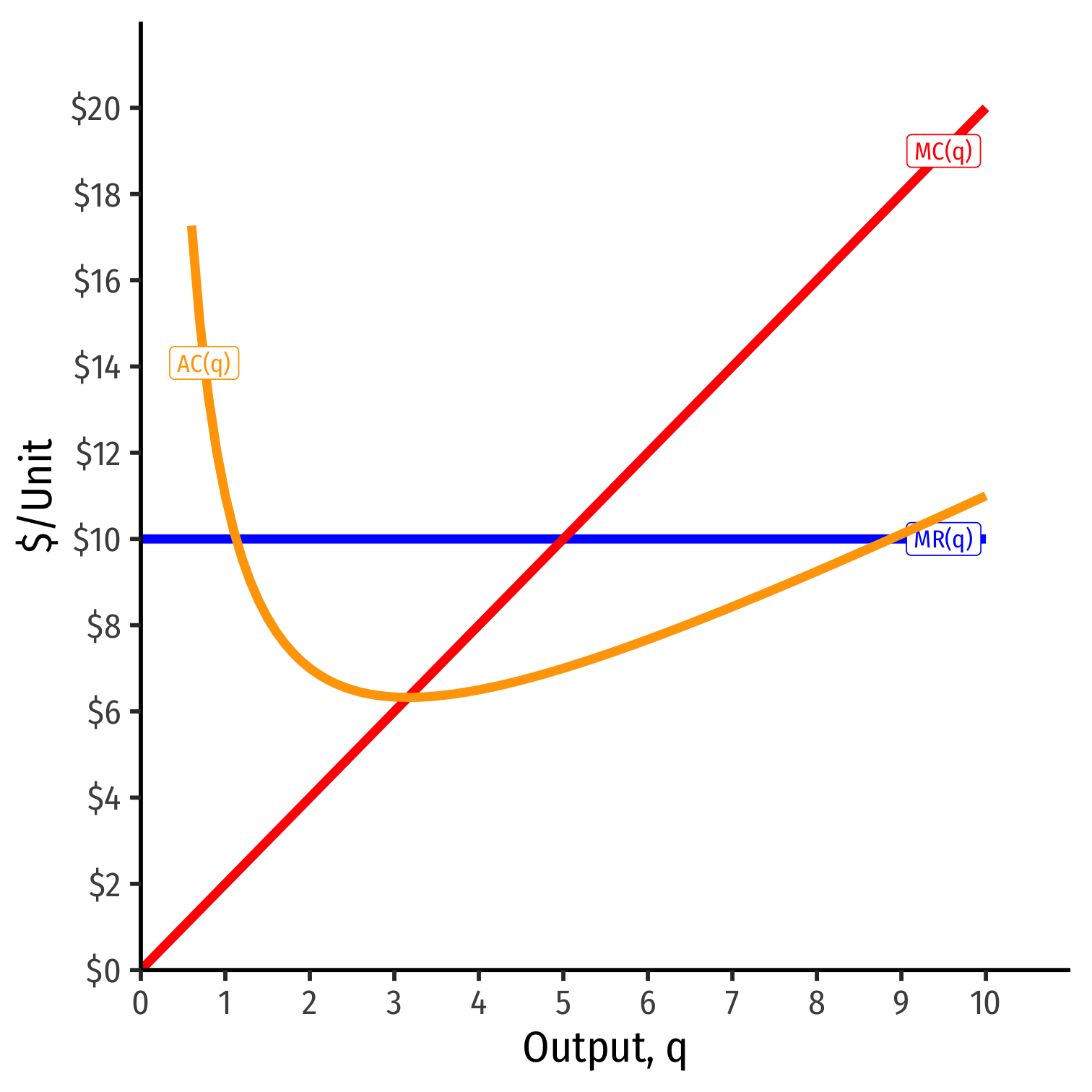

Calculating Average Profit as AR(q)−AC(q)

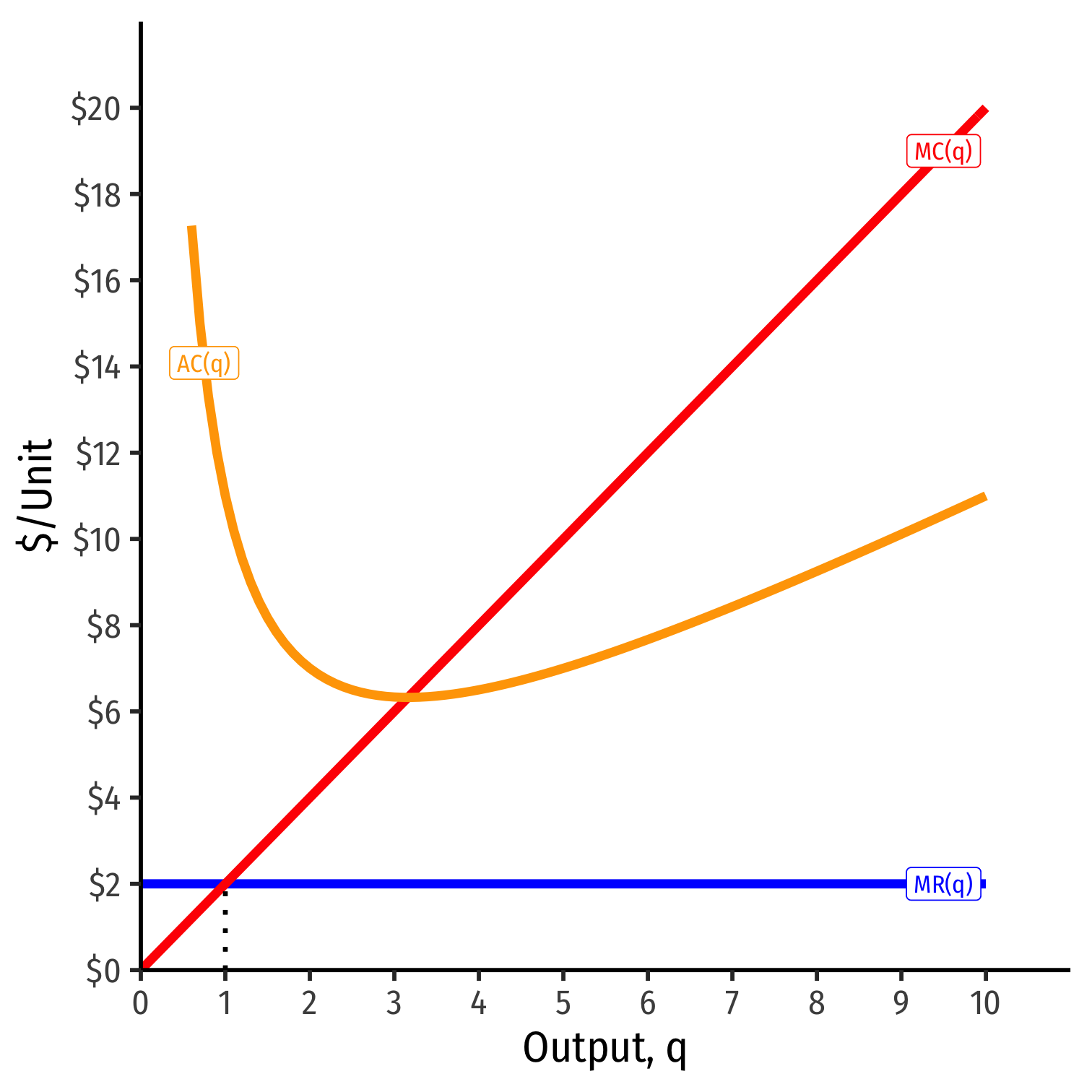

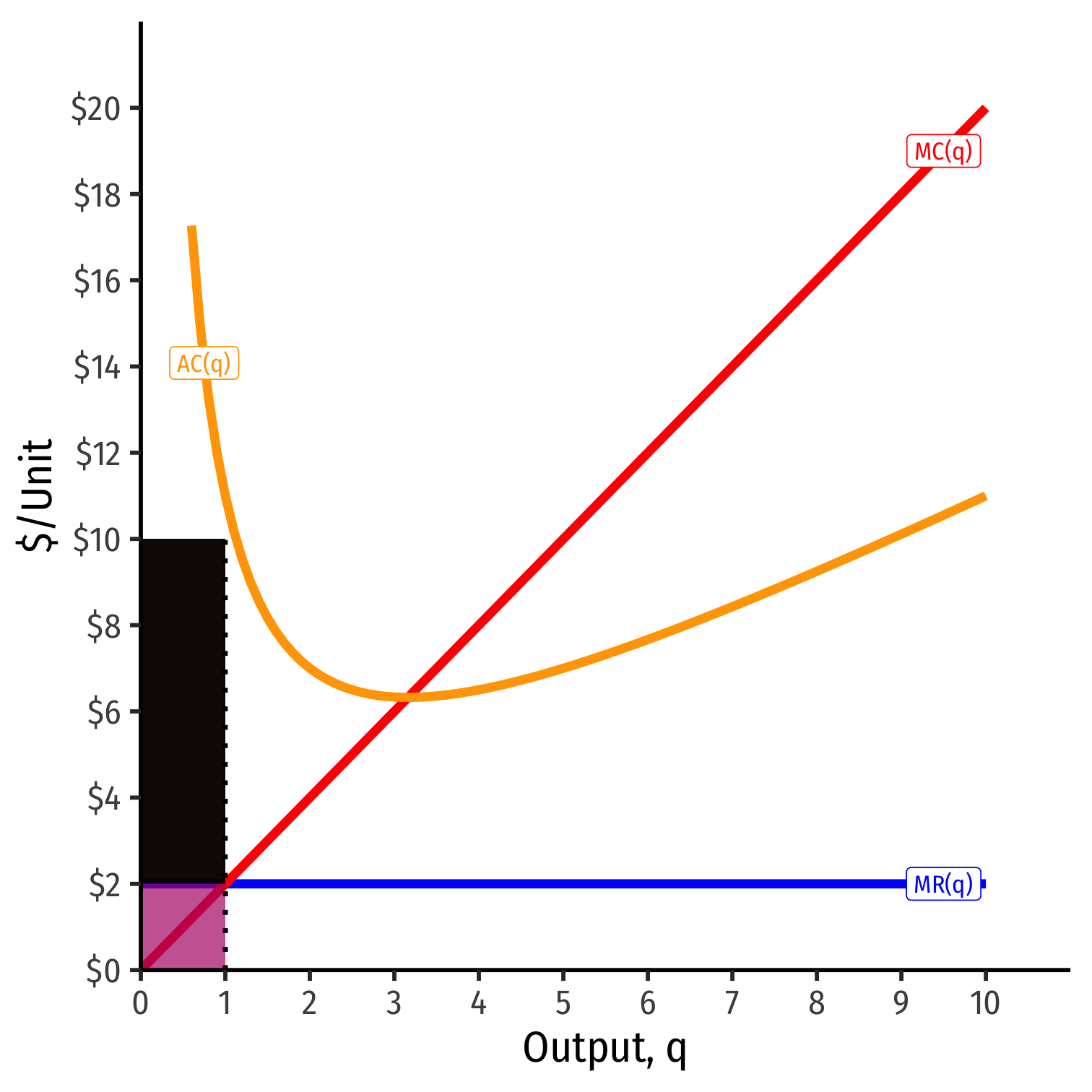

At market price of p* = $2

At q* = 1 (per unit):

At q* = 1 (totals):

Calculating Average Profit as AR(q)−AC(q)

At market price of p* = $2

At q* = 1 (per unit):

- AR(1) = $2/unit

At q* = 1 (totals):

- R(1) = $2

Calculating Average Profit as AR(q)−AC(q)

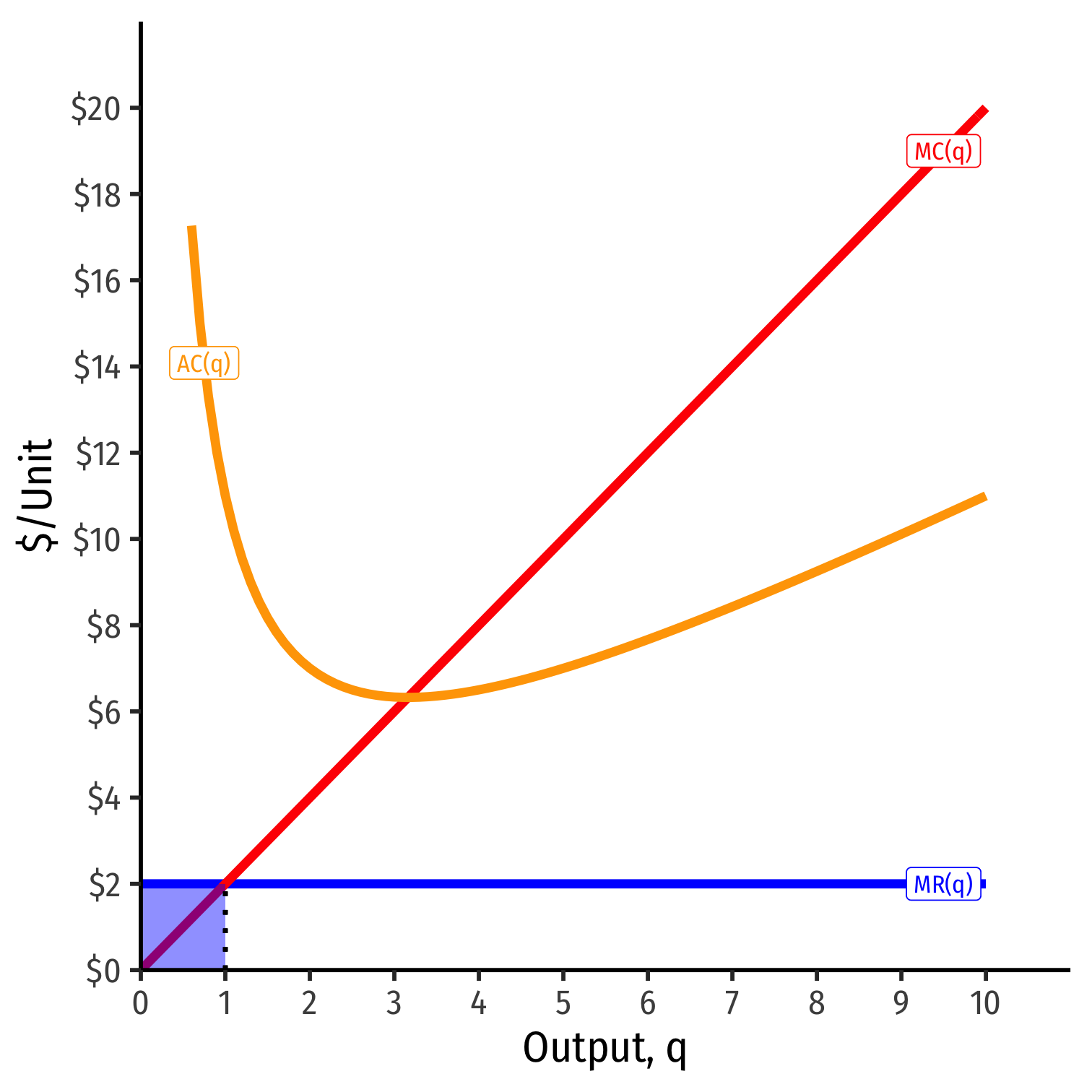

At market price of p* = $2

At q* = 1 (per unit):

- AR(1) = $2/unit

- AC(1) = $10/unit

At q* = 1 (totals):

- R(1) = $2

- C(1) = $10

Calculating Average Profit as AR(q)−AC(q)

At market price of p* = $2

At q* = 1 (per unit):

- AR(1) = $2/unit

- AC(1) = $10/unit

- Aπ(1) = -$8/unit

At q* = 1 (totals):

- R(1) = $2

- C(1) = $10

- π(1) = -$8

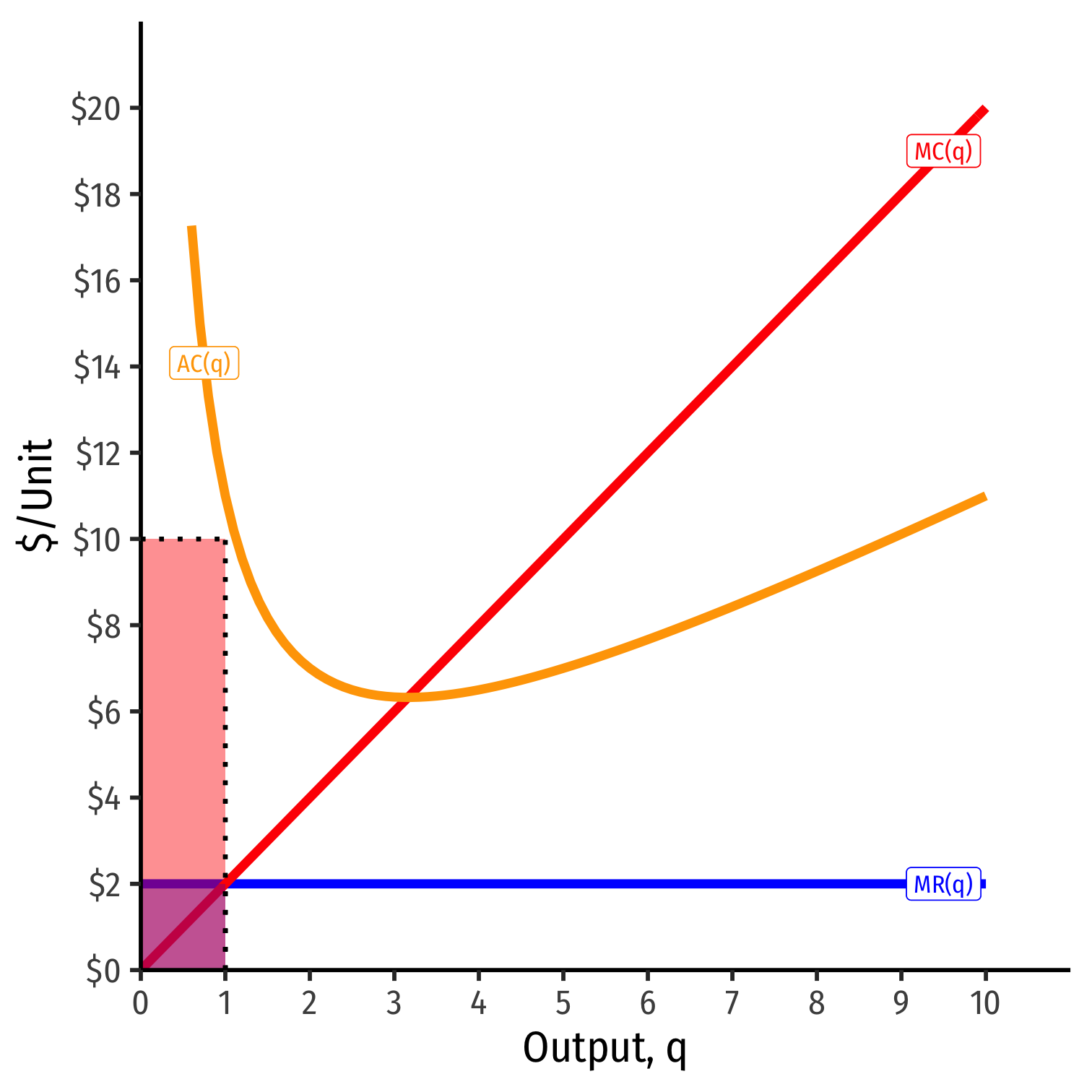

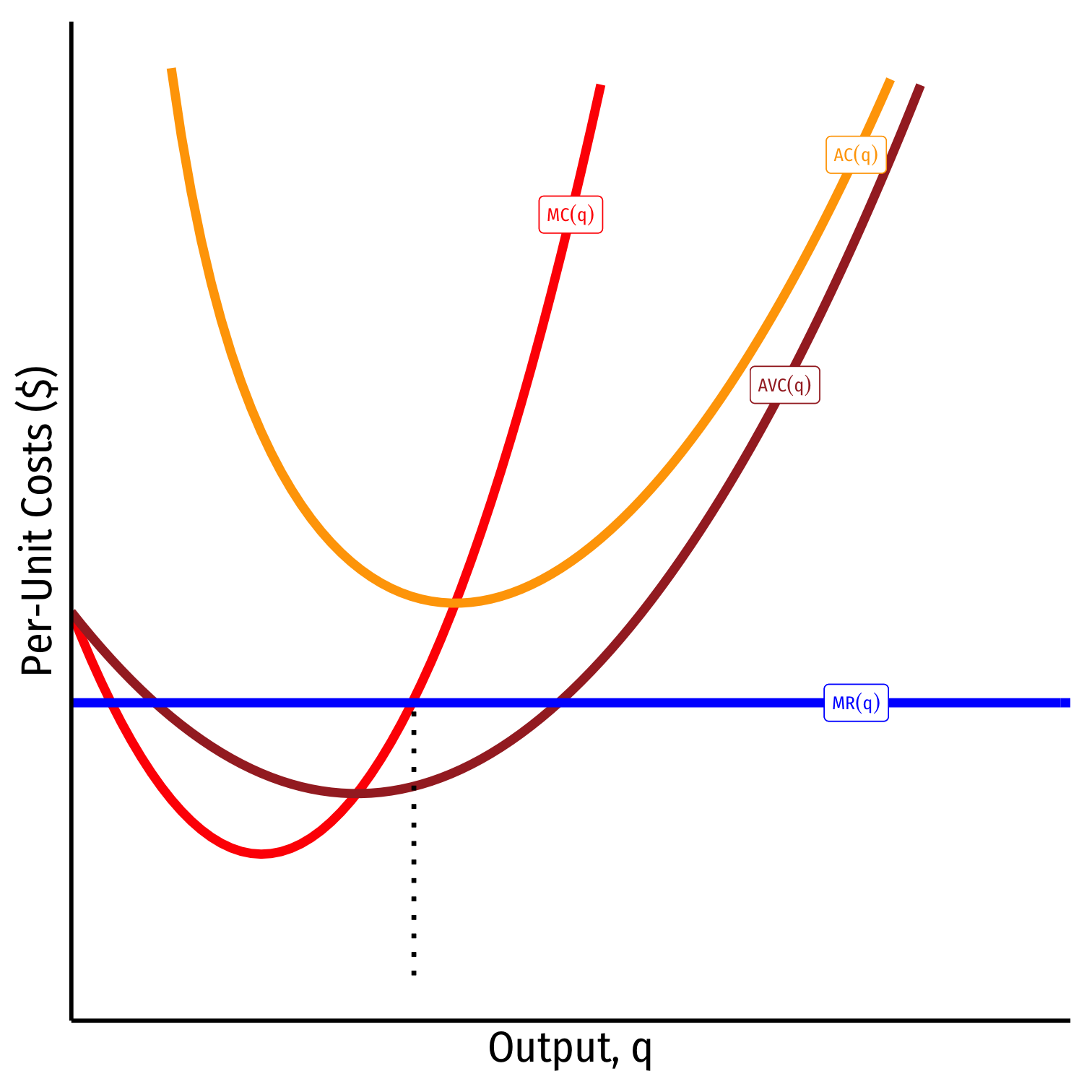

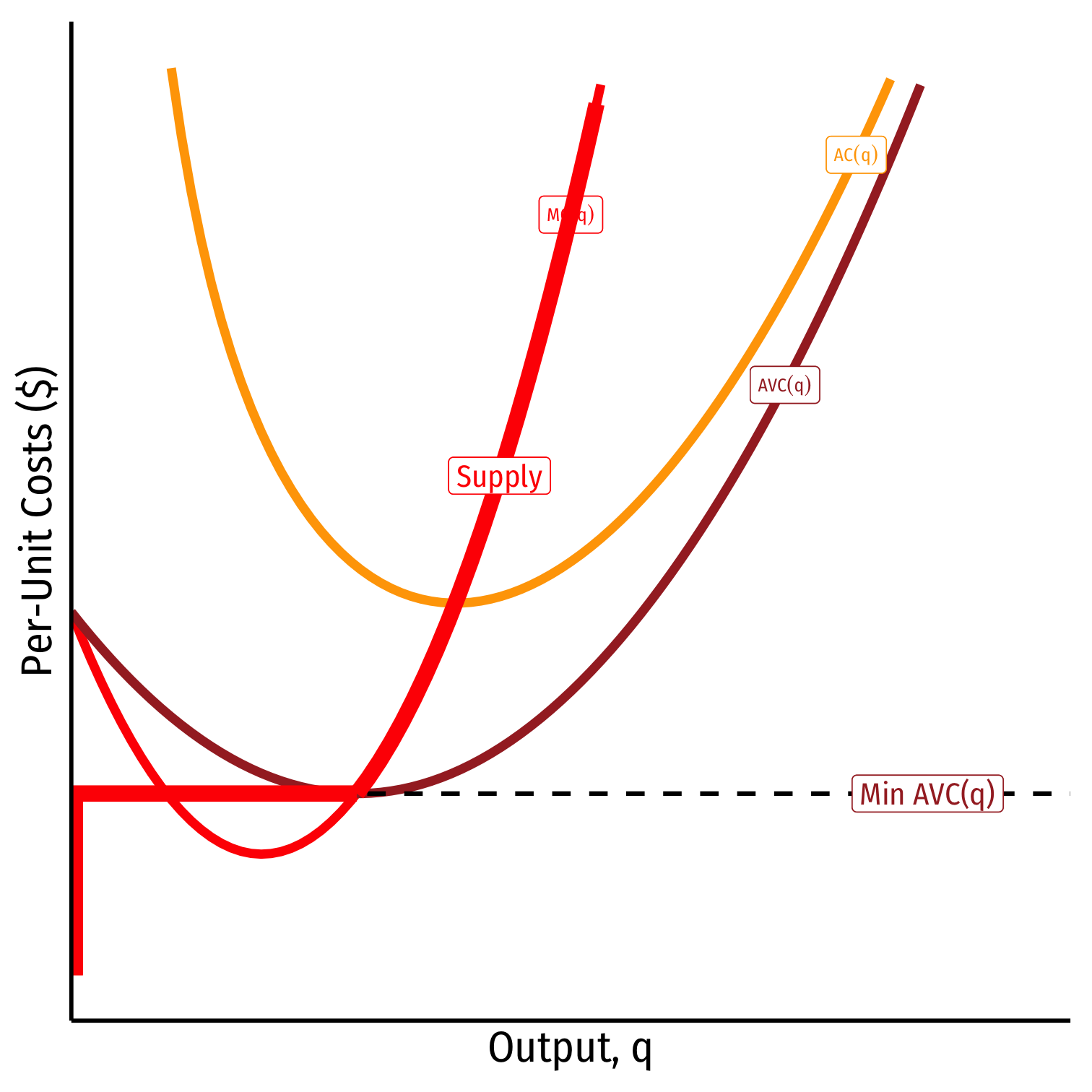

Short-Run Shut-Down Decisions

Short-Run Shut-Down Decisions

What if a firm's profits at q∗ are negative (i.e. it earns losses)?

Should it produce at all?

Short-Run Shut-Down Decisions

Suppose firm chooses to produce nothing (q=0):

If it has fixed costs (f>0), its profits are:

π(q)=pq−C(q)

Short-Run Shut-Down Decisions

Suppose firm chooses to produce nothing (q=0):

If it has fixed costs (f>0), its profits are:

π(q)=pq−C(q)π(q)=pq−f−VC(q)

Short-Run Shut-Down Decisions

Suppose firm chooses to produce nothing (q=0):

If it has fixed costs (f>0), its profits are:

π(q)=pq−C(q)π(q)=pq−f−VC(q)π(0)=−f

Short-Run Shut-Down Decisions

- A firm should choose to produce nothing (q=0) only when:

π from producing<π from not producing

Short-Run Shut-Down Decisions

- A firm should choose to produce nothing (q=0) only when:

π from producing<π from not producingπ(q)<−f

Short-Run Shut-Down Decisions

- A firm should choose to produce nothing (q=0) only when:

π from producing<π from not producingπ(q)<−fpq−VC(q)−f<−f

Short-Run Shut-Down Decisions

- A firm should choose to produce nothing (q=0) only when:

π from producing<π from not producingπ(q)<−fpq−VC(q)−f<−fpq−VC(q)<0

Short-Run Shut-Down Decisions

- A firm should choose to produce nothing (q=0) only when:

π from producing<π from not producingπ(q)<−fpq−VC(q)−f<−fpq−VC(q)<0pq<VC(q)

Short-Run Shut-Down Decisions

- A firm should choose to produce nothing (q=0) only when:

π from producing<π from not producingπ(q)<−fpq−VC(q)−f<−fpq−VC(q)<0pq<VC(q)p<AVC(q)

Short-Run Shut-Down Decisions

- Shut down price: firm will shut down production in the short run when p<AVC(q)

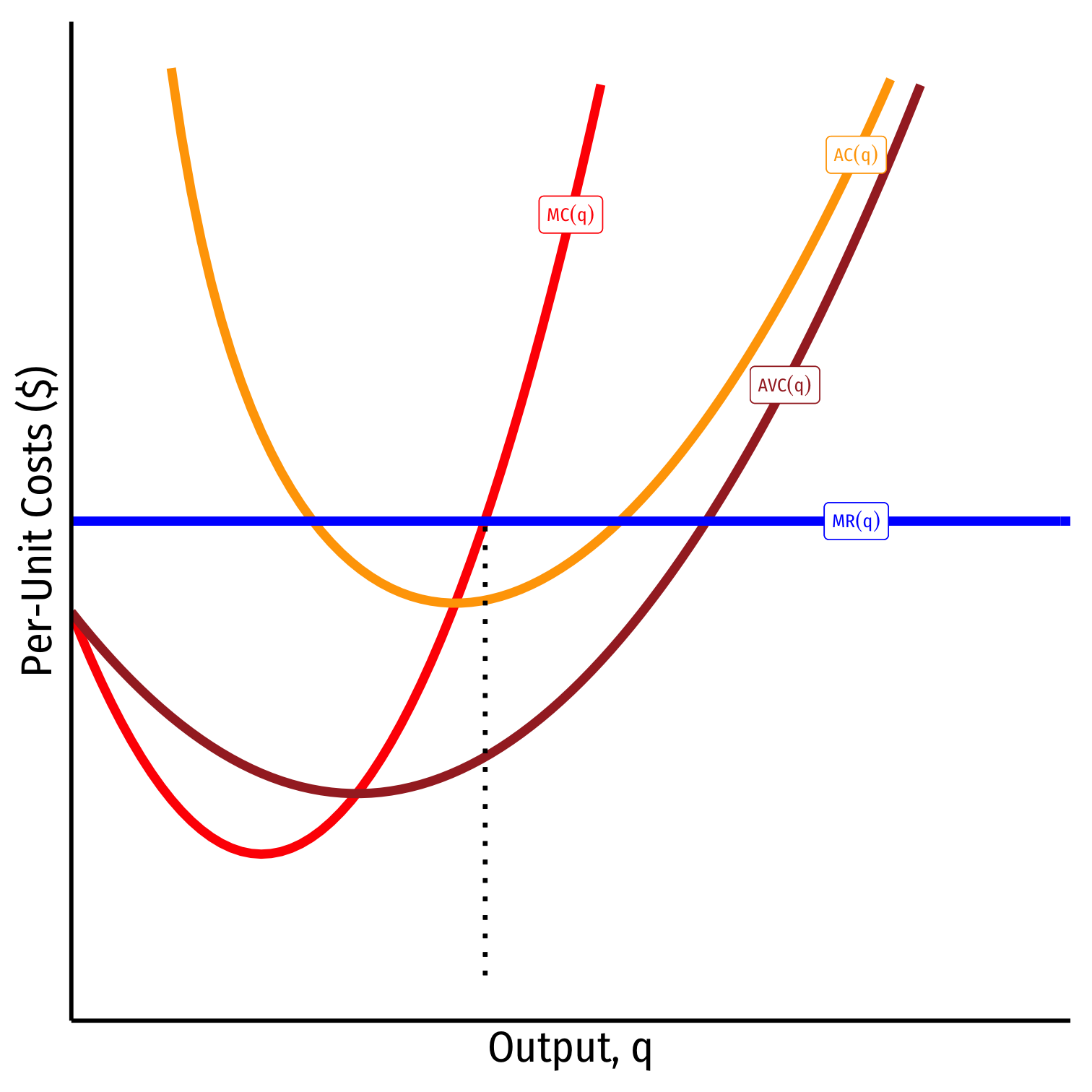

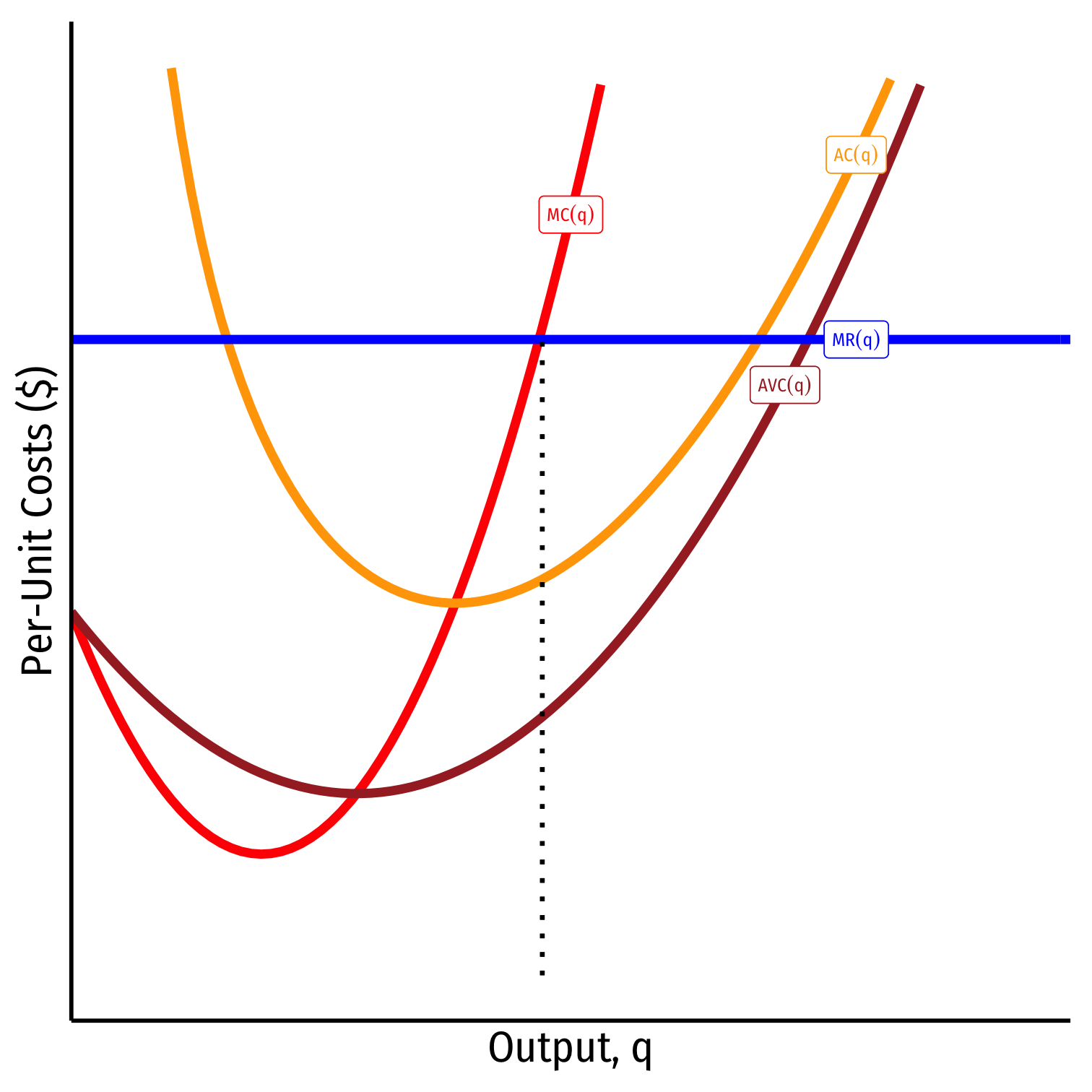

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

The Firm's Short Run Supply Decision

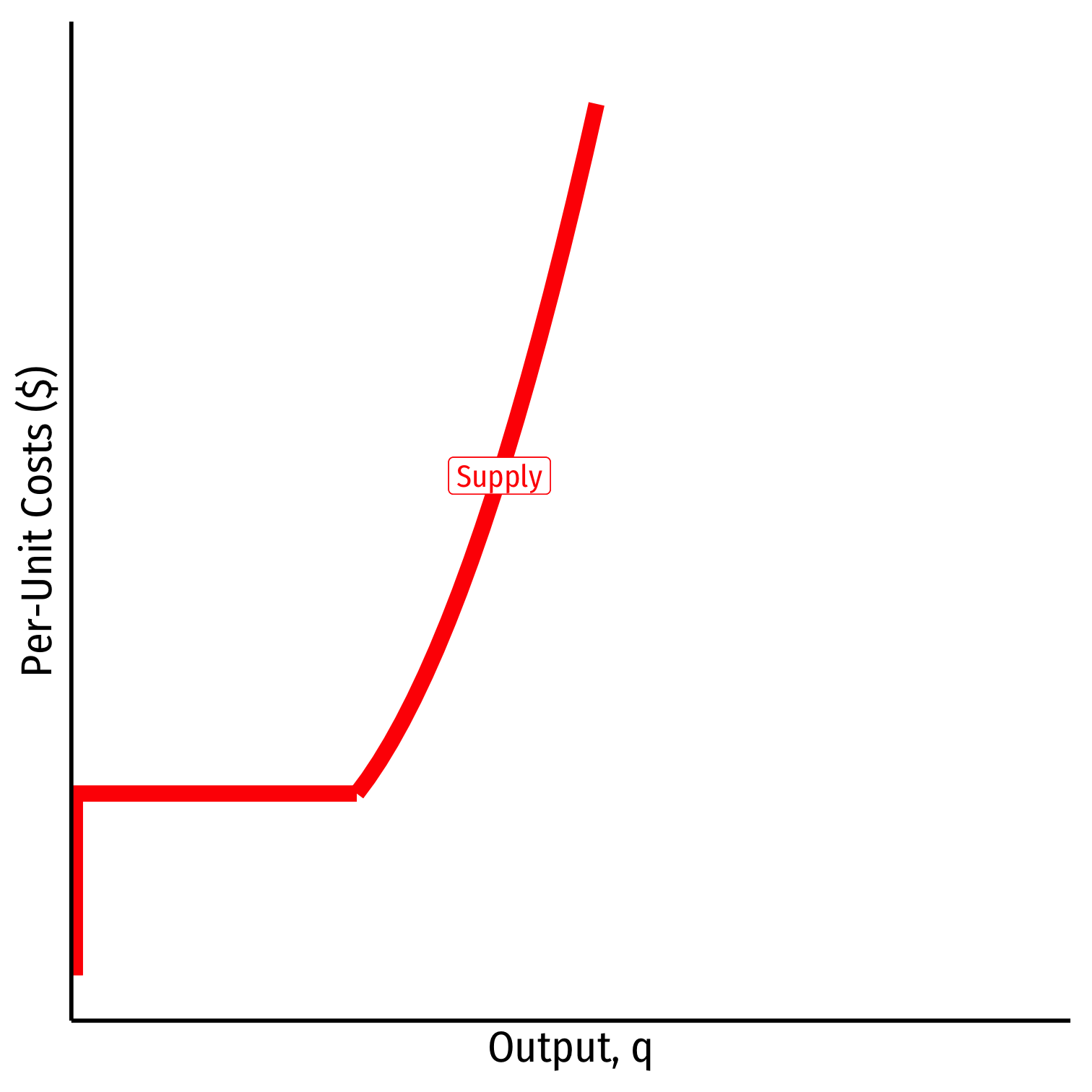

Firm's short run (inverse) supply:

The Firm's Short Run Supply Decision

Firm's short run (inverse) supply:

Summary:

1. Choose q∗ such that MR(q)=MC(q)

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

3. Shut down if p<AVC(q)

Summary:

1. Choose q∗ such that MR(q)=MC(q)

2. Profit π=q[p−AC(q)]

3. Shut down if p<AVC(q)

Firm's short run (inverse) supply:

{p=MC(q)if p≥AVCq=0If p<AVC

Choosing the Profit-Maximizing Output q∗: Example

Example: Bob's barbershop gives haircuts in a very competitive market, where barbers cannot differentiate their haircuts. The current market price of a haircut is $15. Bob's daily short run costs are given by:

C(q)=0.5q2MC(q)=q

How many haircuts per day would maximize Bob's profits?

How much profit will Bob earn per day?

Find Bob's shut down price.

Write Bob's short-run inverse supply function.