3.1 — The Supply and Demand Model

ECON 306 · Microeconomic Analysis · Fall 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microF20

microF20.classes.ryansafner.com

Equilibrium

Recall: 2 Major Models of Economics as a “Science”

Optimization

Agents have objectives they value

Agents face constraints

Make tradeoffs to maximize objectives within constraints

Recall: 2 Major Models of Economics as a “Science”

Optimization

Agents have objectives they value

Agents face constraints

Make tradeoffs to maximize objectives within constraints

Equilibrium

Agents compete with others over scarce resources

Agents adjust behaviors based on prices

Stable outcomes when adjustments stop

Recall: Optimization and Equilibrium

If people can learn and change their behavior, they will always switch to a higher-valued option

If there are no alternatives that are better, people are at an optimum

If everyone is at an optimum, the system is in equilibrium

Equilibrium Analysis: Questions to Answer

Where do prices come from?

How do they change?

How consumers and producers to respond to changes?

Equilibrium Analysis

An equilibrium is an allocation of resources such that no individual has an incentive to alter their behavior

In markets: "market-clearing" prices where quantity supplied equals quantity demanded

Partial Equilibrium Analysis

We will only look at "partial equilibrium" in a single market

Changes in one market often affect other markets, affecting the "general equilibrium"

- e.g. a change in the price of corn will affect the market for wheat, soybeans, flax, cereal, sugar, candy, ethanol, gasoline, automobiles, etc...

- think of all of the complements, substitutes, upstream and downstream goods in production...

- General equilibrium is too complicated for undergraduate courses...

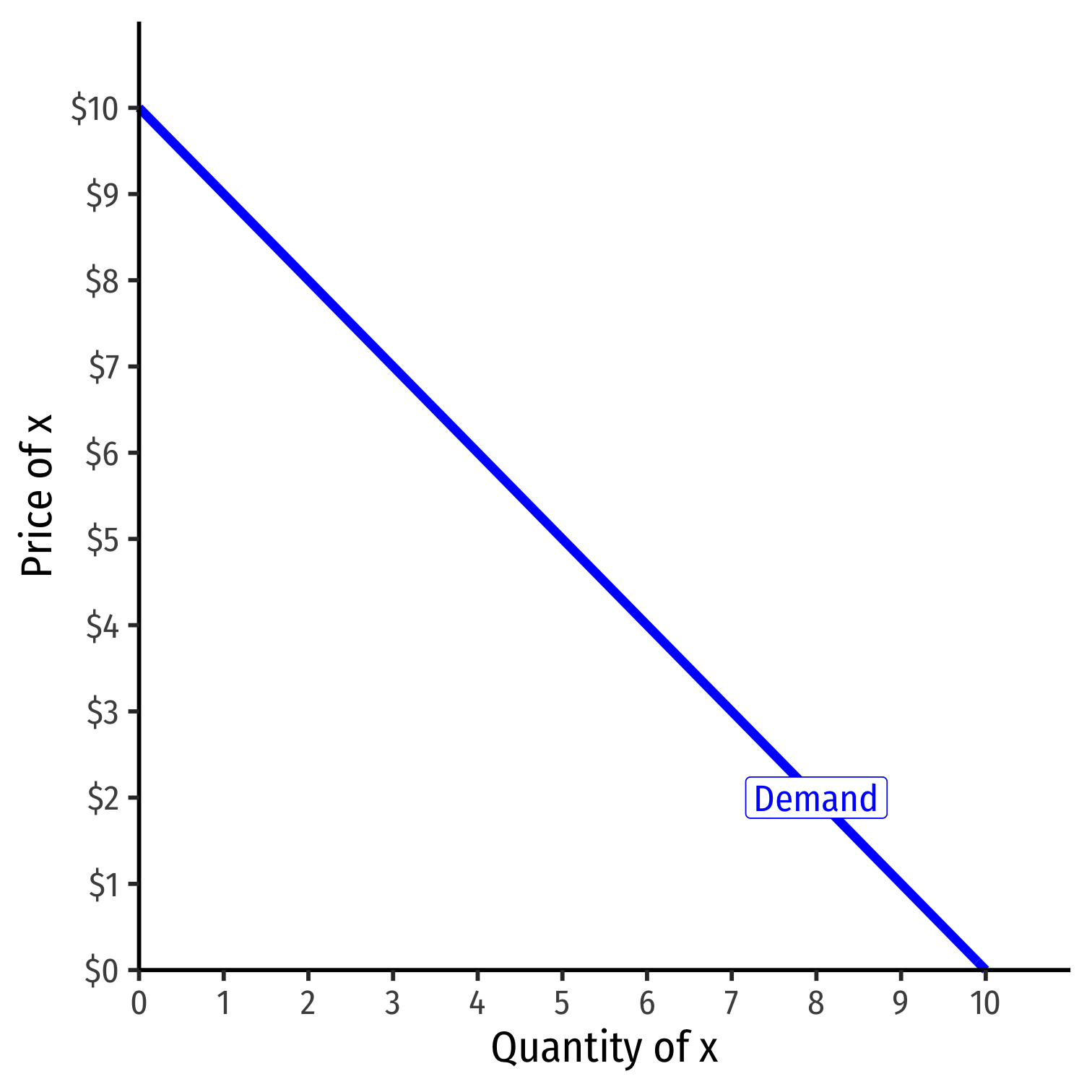

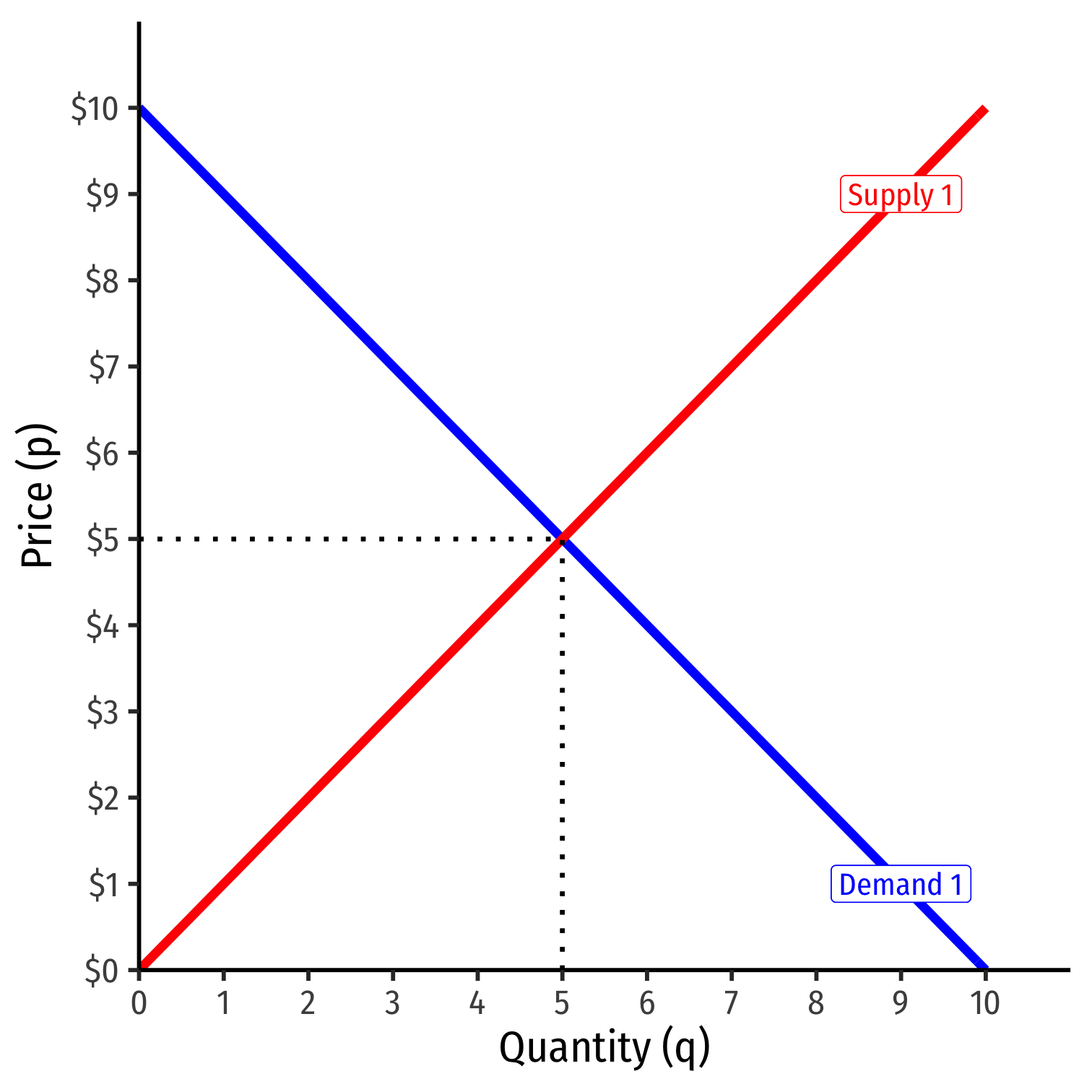

Recall: Demand

Demand Function

- Demand function relates quantity to price

Example: q=10−p

- Not graphable (wrong axes)!

Inverse Demand Function

- Inverse demand function relates price to quantity

- Take demand function and solve for p

Example: p=10−q

- Graphable (price on vertical axis)!

Inverse Demand Function

- Inverse demand function relates price to quantity

- Take demand function and solve for p

Example: p=10−q

- Vertical intercept ("Choke price"): price where qD=0 ($10), just high enough to discourage any purchases

Inverse Demand Function

Read two ways:

Horizontally: at any given price, how many units person wants to buy

Vertically: at any given quantity, the maximum willingness to pay (WTP) for that quantity

- This way will be very useful later

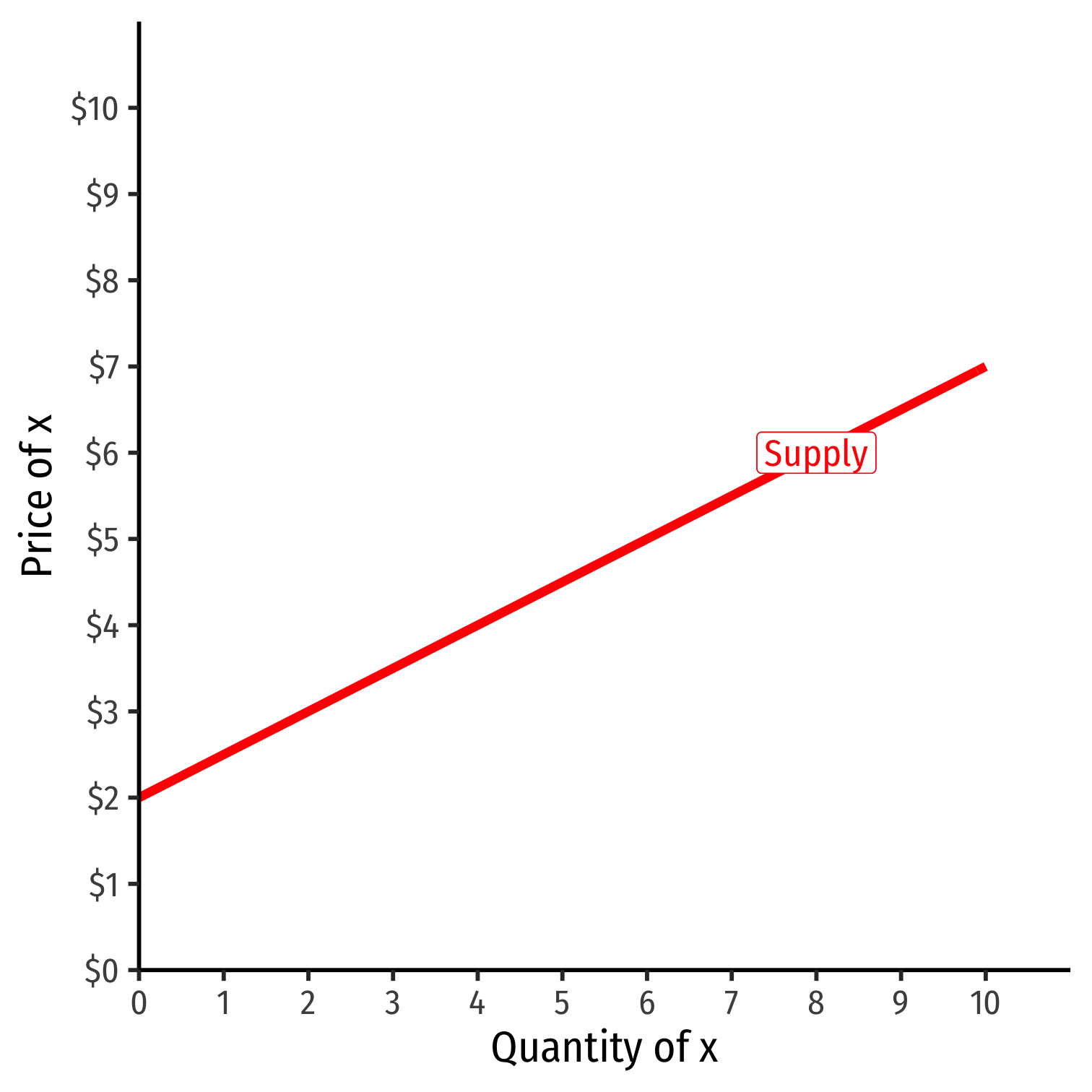

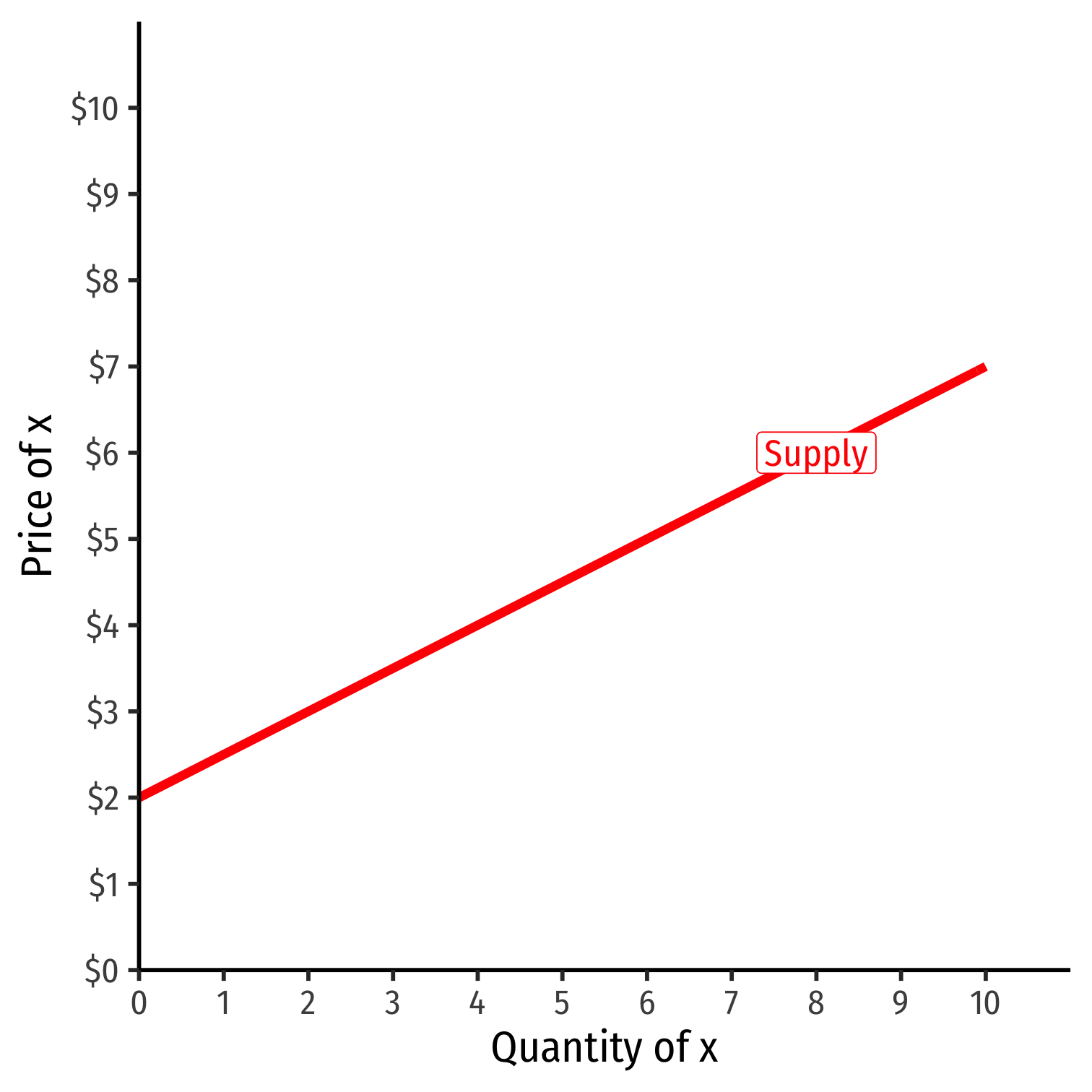

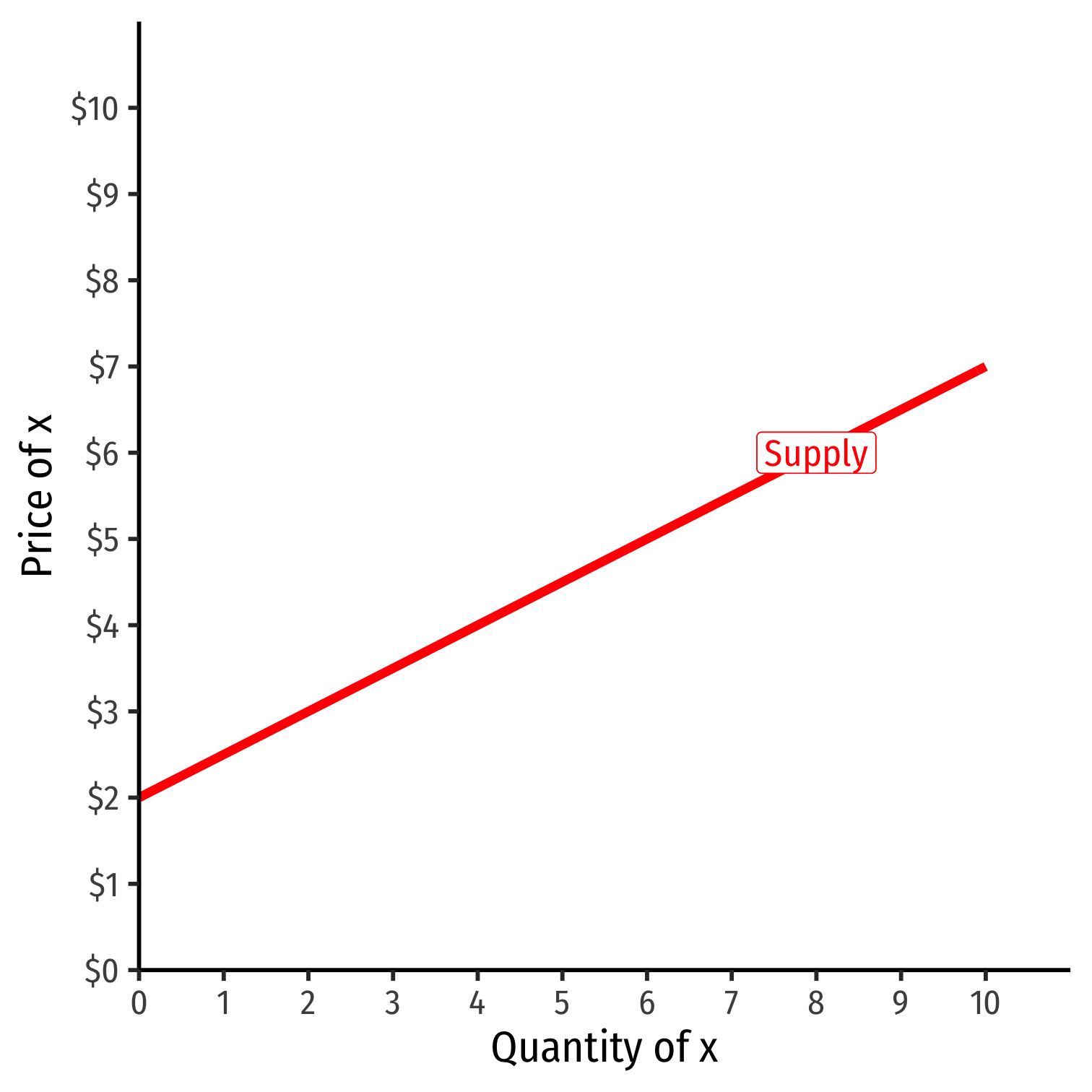

Recall: Supply

Supply Function

- Supply function relates quantity to price

Example: q=2p−4

- Not graphable (wrong axes)!

Inverse Supply Function

- Inverse supply function relates price to quantity

- Take supply function, solve for p

Example: p=2+0.5q

- Graphable (price on vertical axis)!

Inverse Supply Function

- Inverse supply function relates price to quantity

- Take supply function, solve for p

Example: p=2+0.5q

- Graphable (price on vertical axis)!

Inverse Supply Function

Example: p=2+0.5q

Slope: 0.5

Vertical intercept called the "Choke price": price where qS=0 ($2), just low enough to discourage any sales

Inverse Supply Function

Read two ways:

Horizontally: at any given price, how many units firm wants to sell

Vertically: at any given quantity, the minimum willingness to accept (WTA) for that quantity

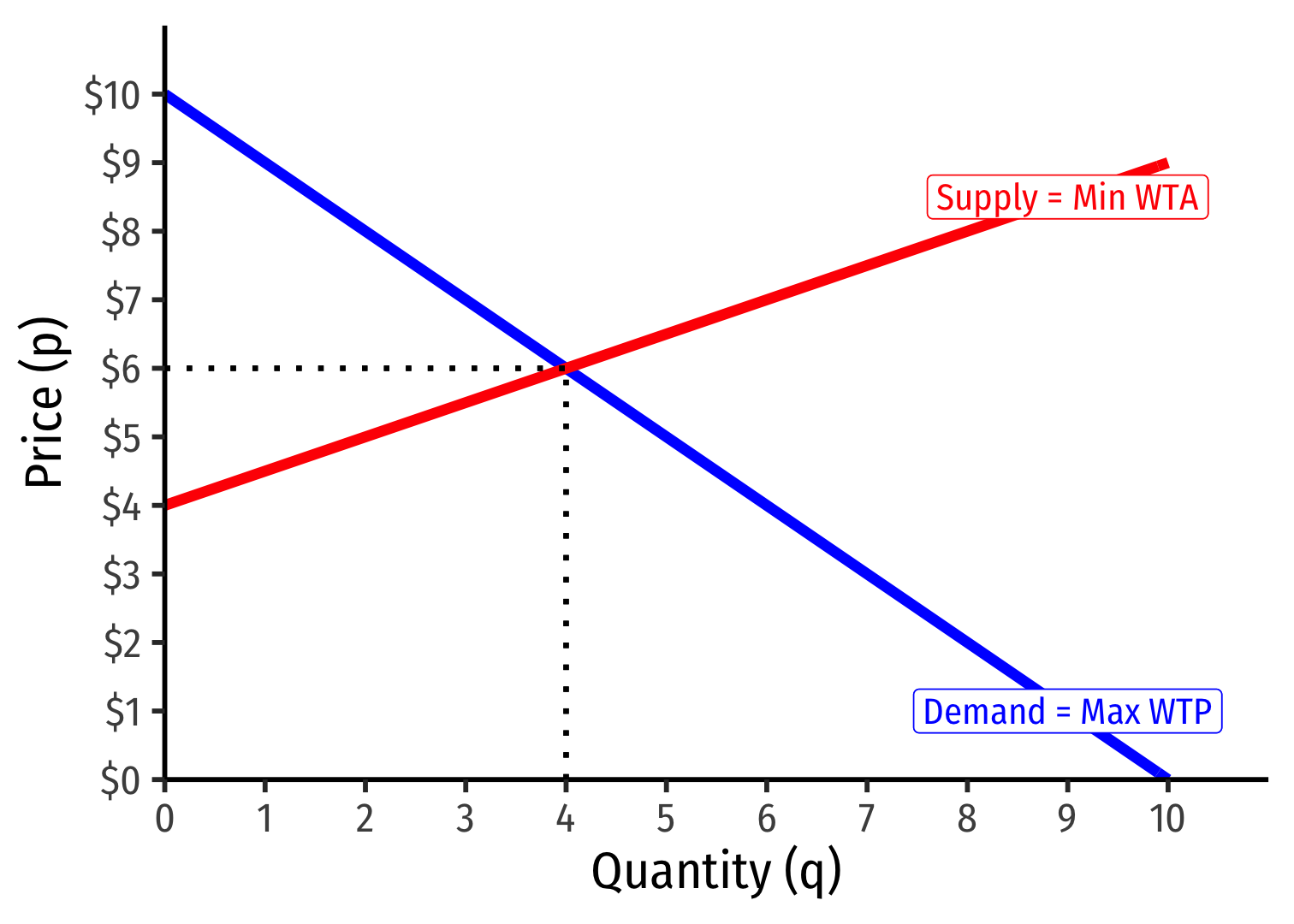

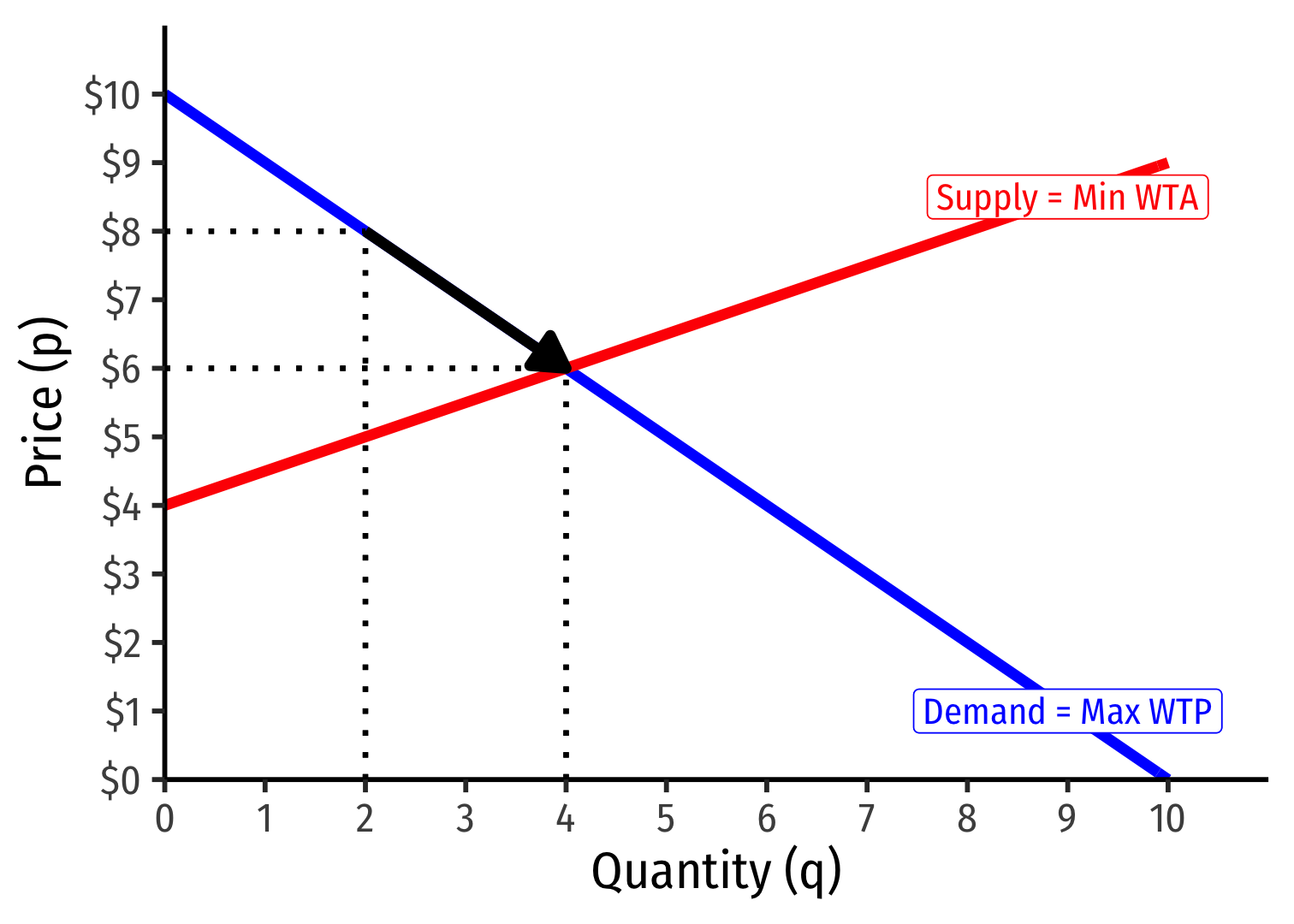

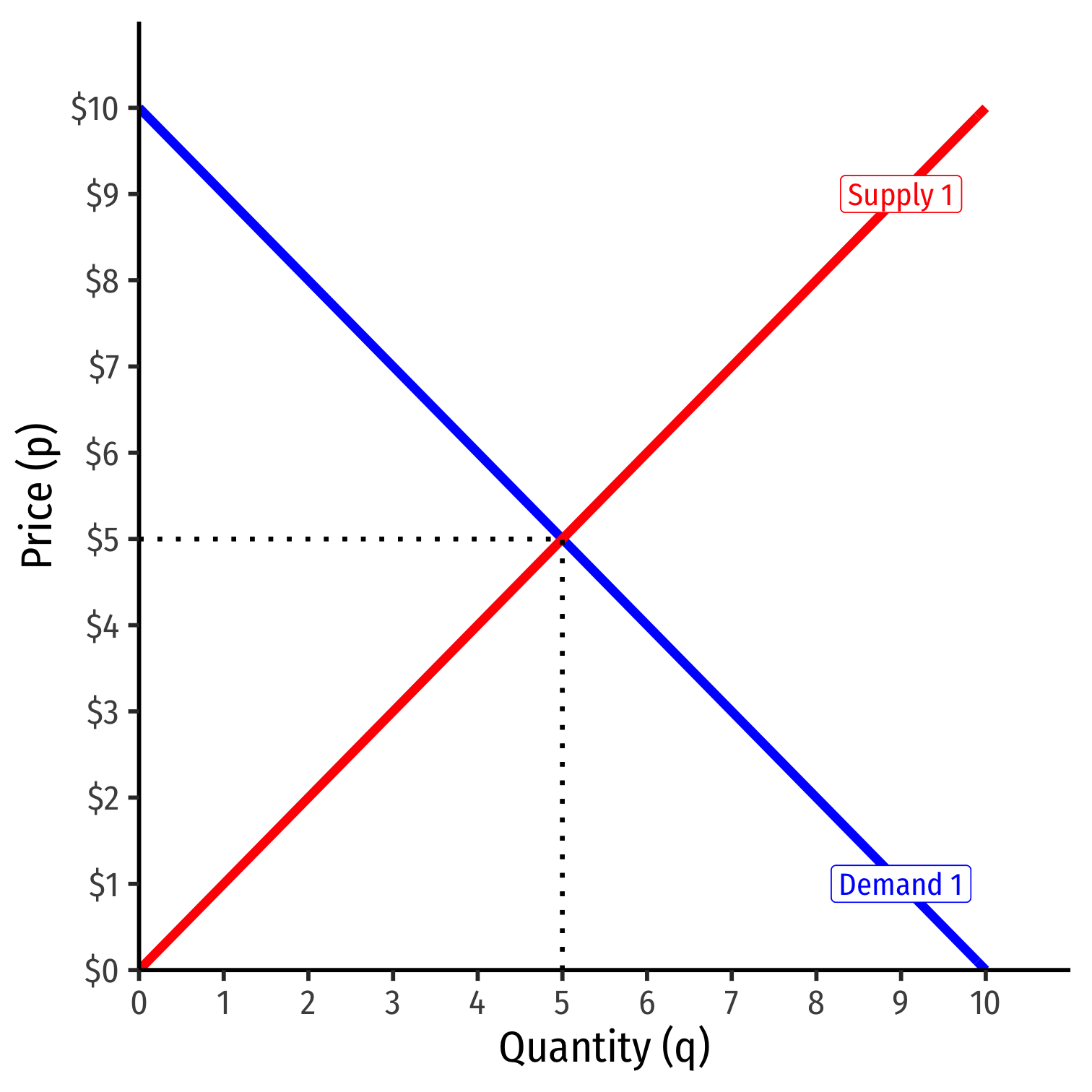

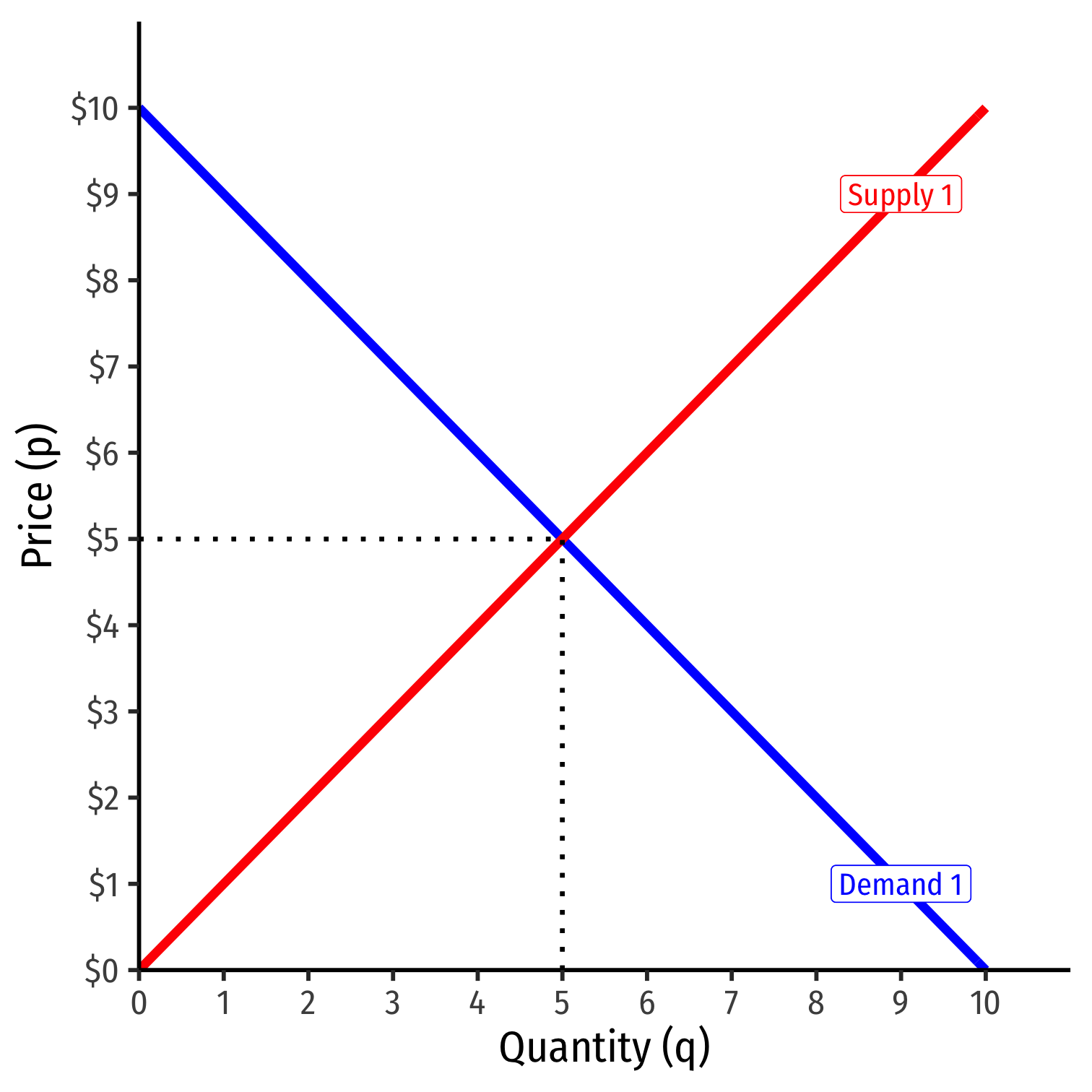

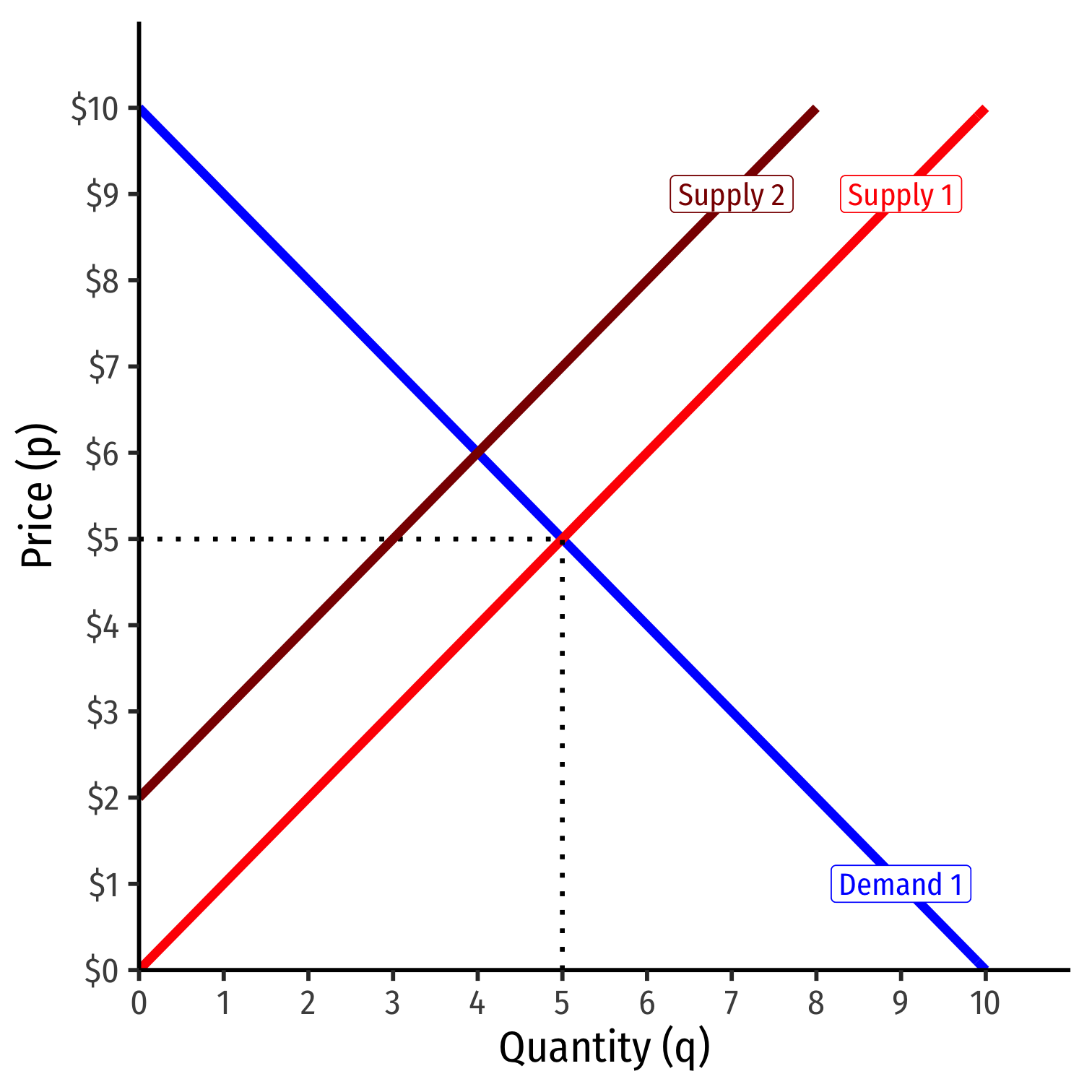

Market Equilibrium

Market Equilibrium

Market-clearing (equilibrium) price (p∗): $6.00

Market-clearing (equilibrium) quantity exchanged (q∗): 4

Why Markets Tend to Equilibrate

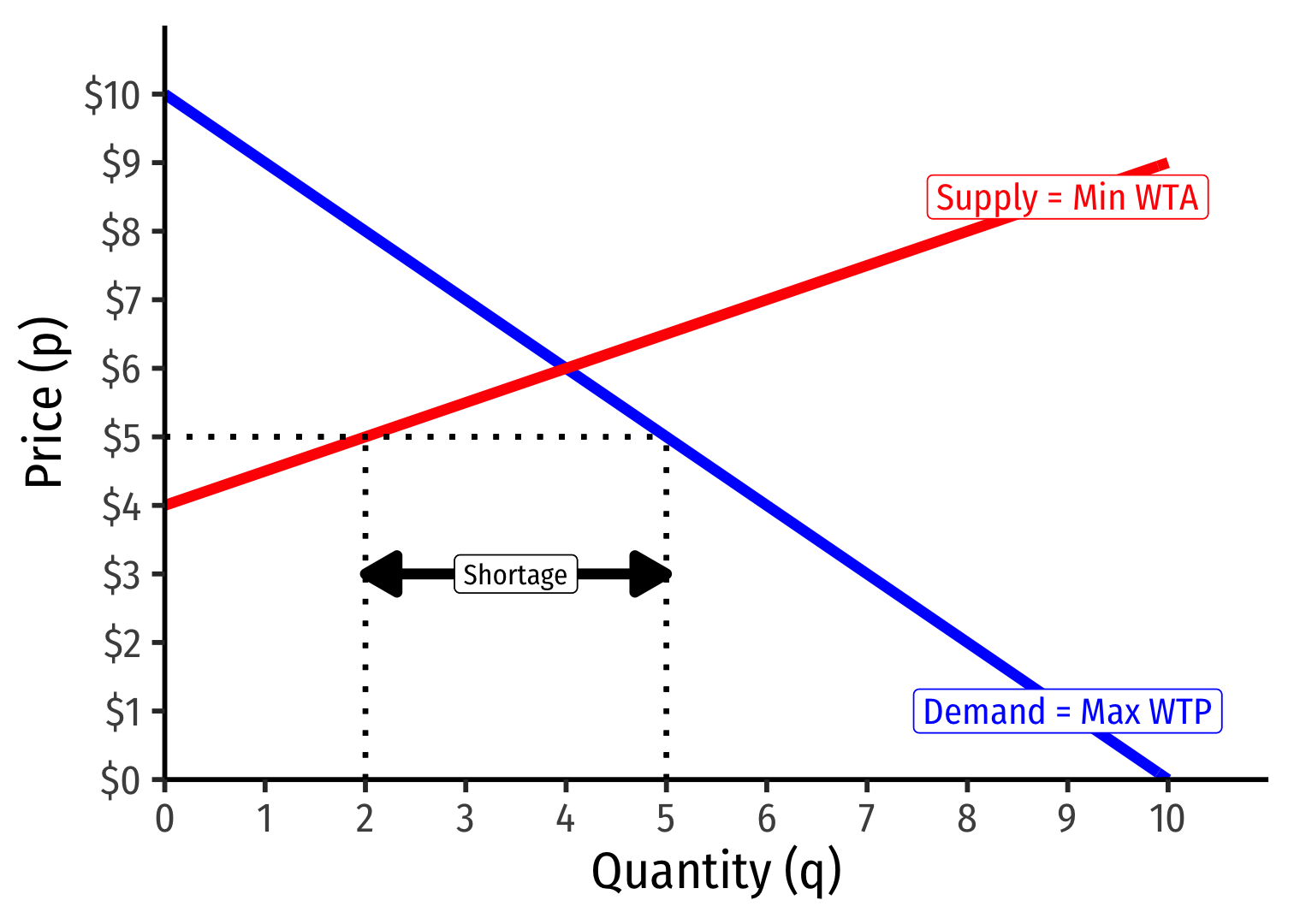

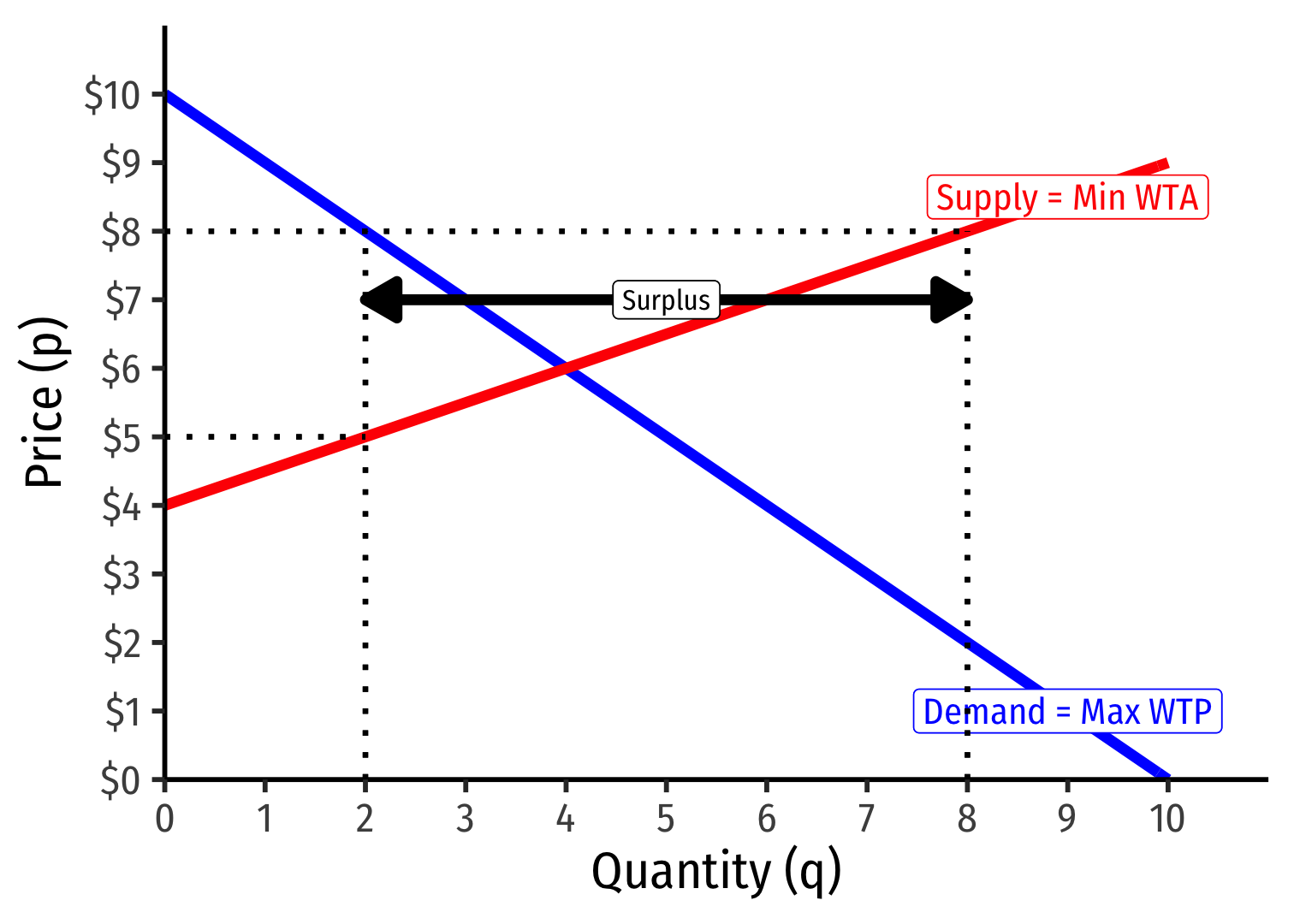

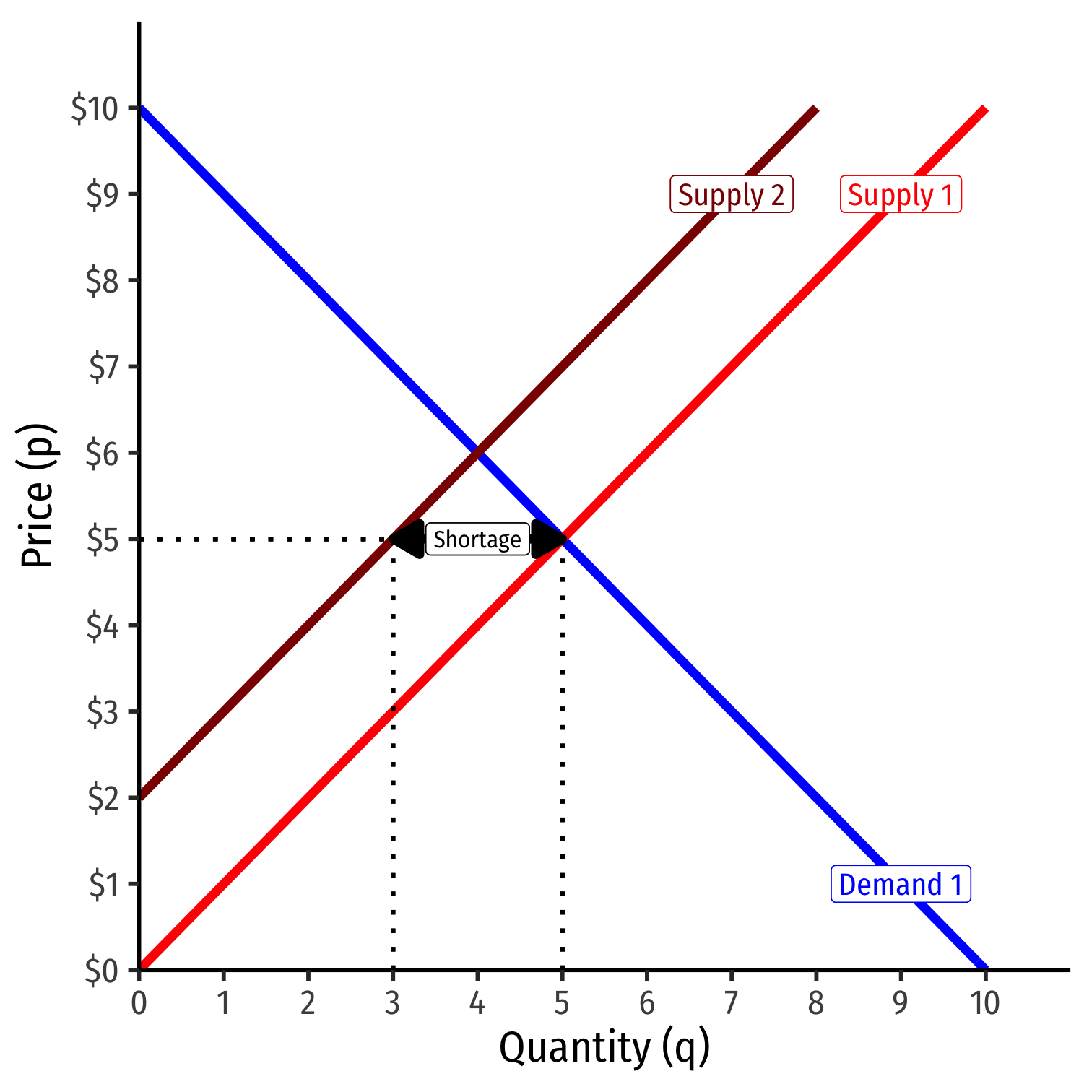

Excess Demand I

Example: Consider any price below $6, such as $5:

Qd=5Qs=2

Qd>Qs: excess demand

A shortage of 3 units

Excess Demand II

Example: Consider any price below $6, such as $5:

Qd=5Qs=2

Qd>Qs: excess demand

A shortage of 3 units

Sellers will not supply more than 2 units

For 2 units, some buyers are willing to pay more than $5

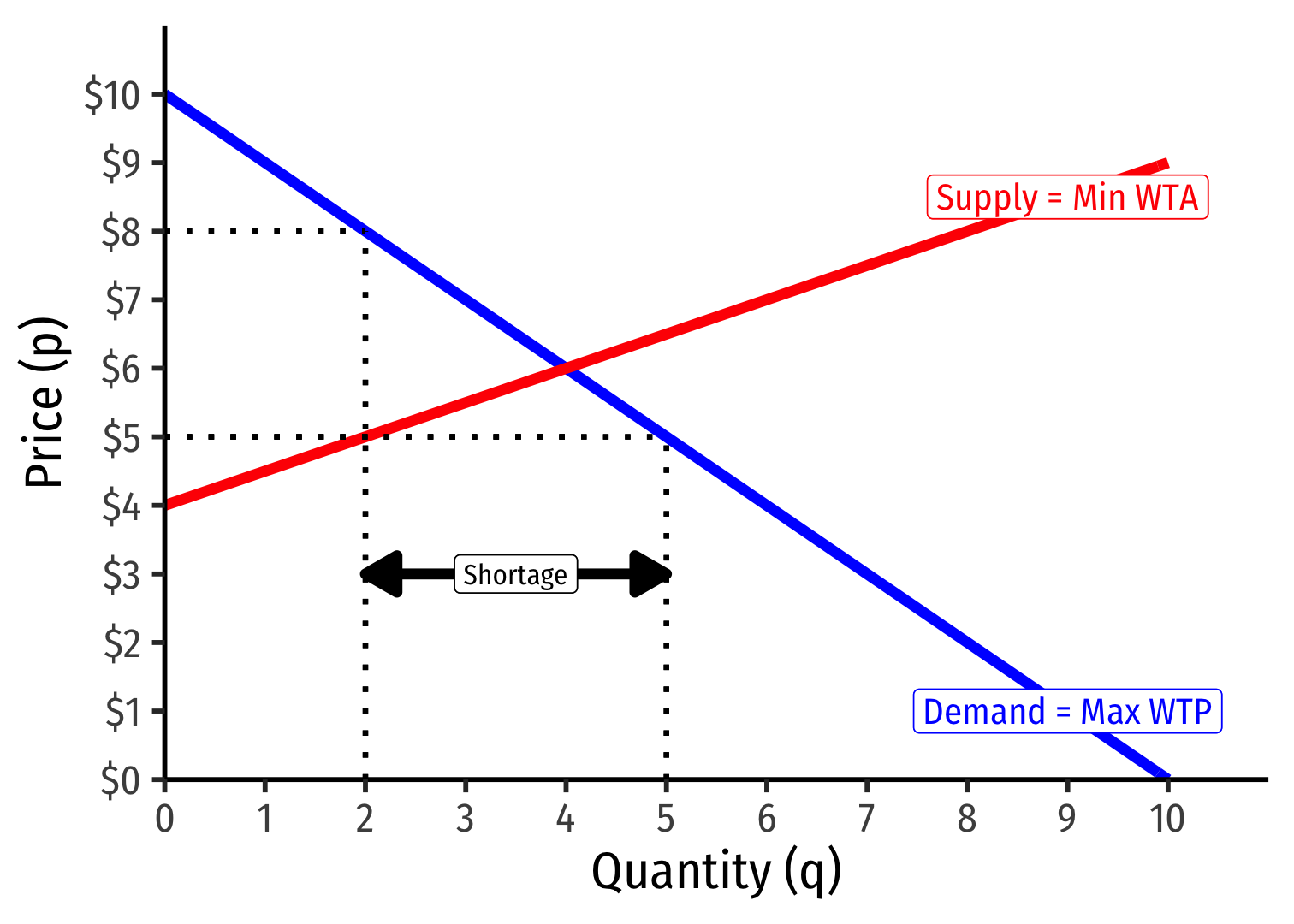

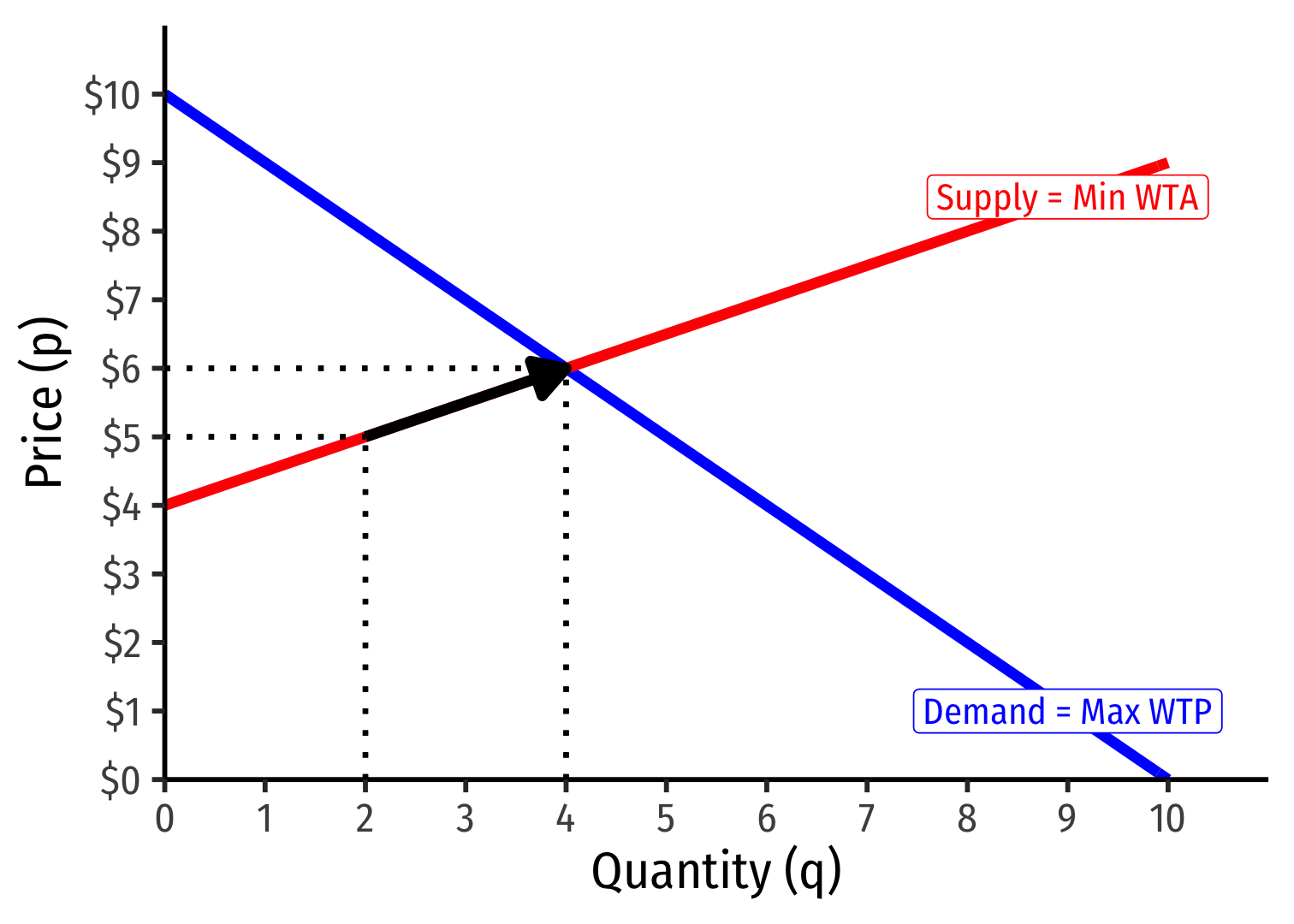

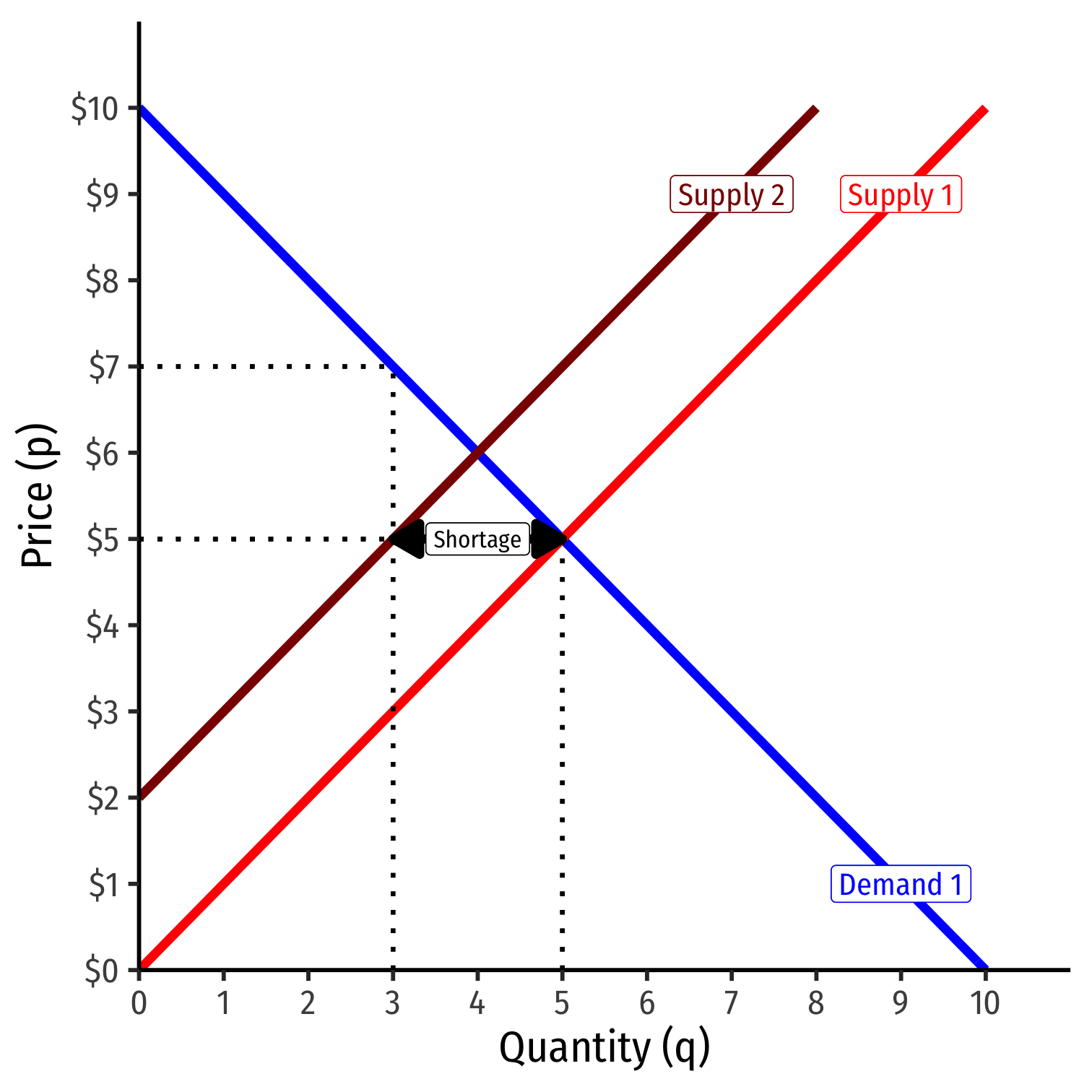

Excess Demand III

Example: Consider any price below $6, such as $5:

Qd=5Qs=2

Qd>Qs: excess demand

A shortage of 3 units

Buyers will raise their bids against one another, raising the price

At higher prices, sellers willing to sell more!

Until equilibrium, no pressure for change, Qd=Qs

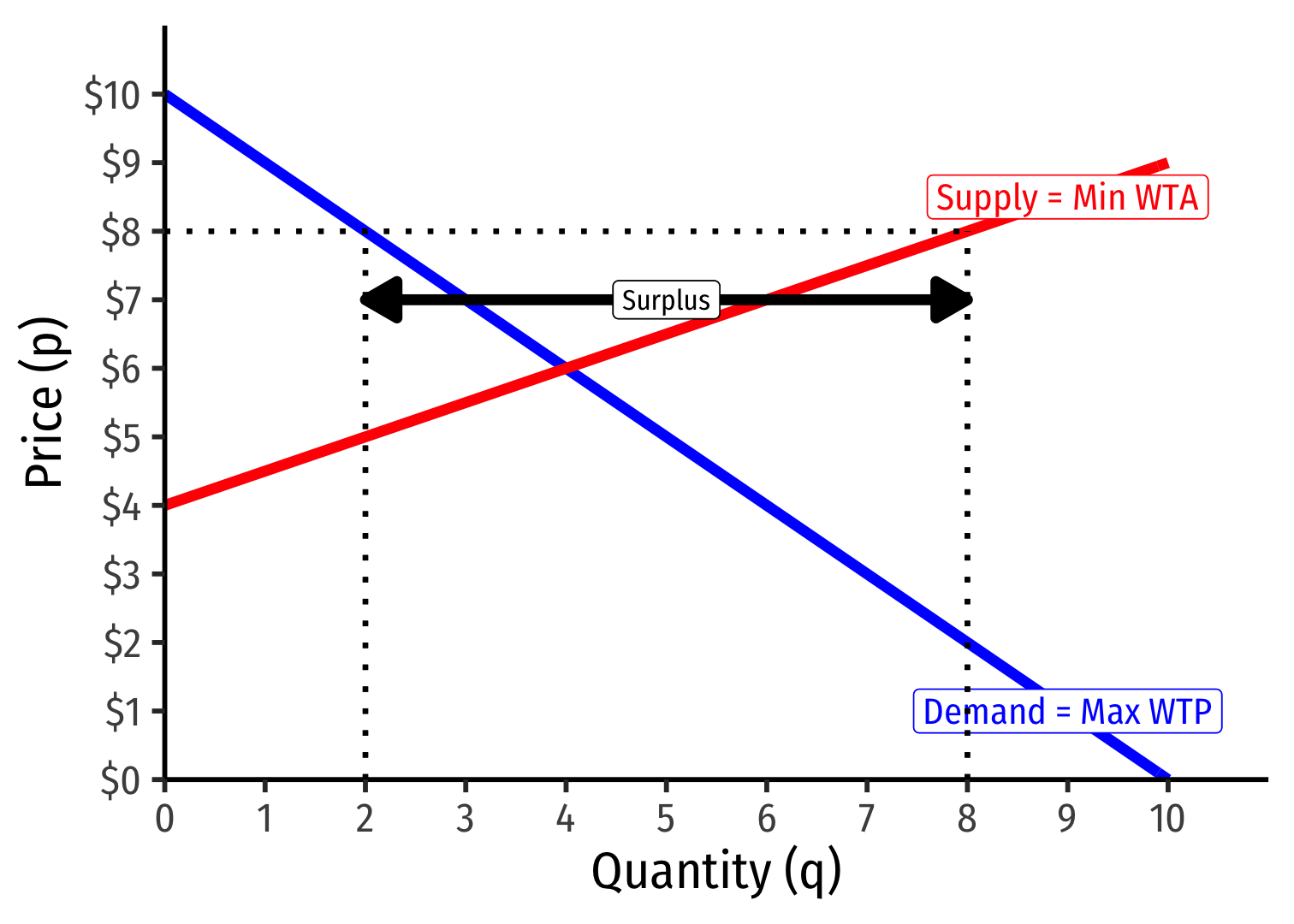

Excess Supply I

Example: Consider any price above $6, such as $7:

Qd=2Qs=8

Qd<Qs: excess supply

A surplus of 6 units

Excess Supply II

Example: Consider any price above $6, such as $7:

Qd=2Qs=8

Qd<Qs: excess supply

A surplus of 6 units

Buyers will not buy more than 2 units

For 2 units, some sellers willing to accept less than $8

Excess Supply III

Example: Consider any price above $6, such as $7:

Qd=2Qs=8

Qd<Qs: excess supply

A surplus of 6 units

Sellers will lower their asking prices against one another, lowering the price

At lower prices, buyers willing to buy more!

Until equilibrium, no pressure for change, Qd=Qs

Why Markets Tend to Equilibrate

Comparative Statics

Ceterus Paribus I

Supply function and demand function relate quantity (supplied or demanded) to price only

- Describes how buyers/sellers respond to changes in market price

Certainly there are many other factors that influence how much a buyer or seller will purchase at a particular price!

- income, preferences, prices of other goods, expectations, etc.

A supply or demand function (or graph) requires "ceterus paribus" (all else equal)

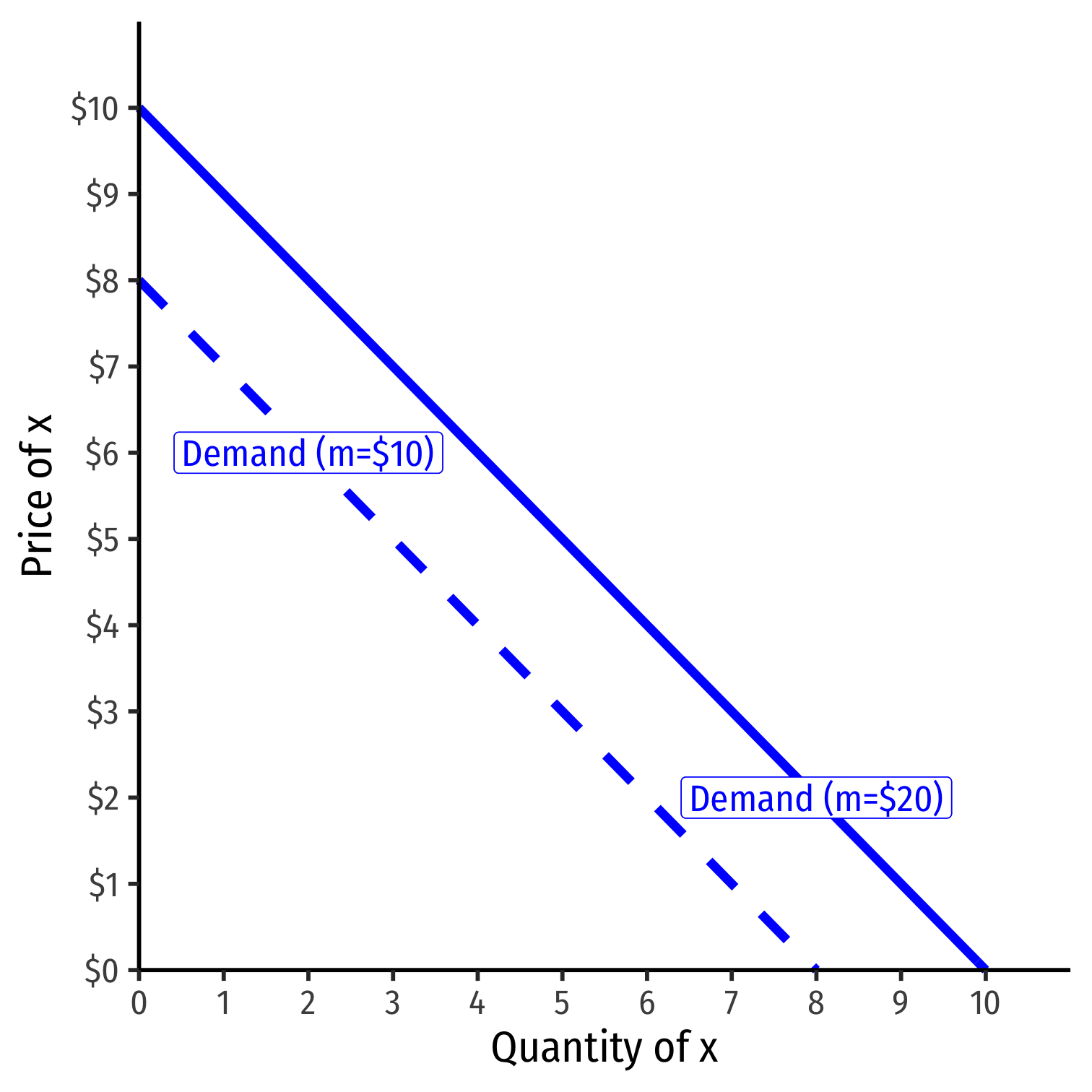

Recall (for example), Demand I

- A consumer's demand (for good x) depends on current prices & income:

qDx=qDx(m,px,py)

- How does demand for x change?

- Income effects (ΔqDxΔm): how qDx changes with changes in income

- Cross-price effects (ΔqDxΔpy): how qDx changes with changes in prices of other goods (e.g. y)

- (Own) Price effects (ΔqDxΔpx): how qDx changes with changes in price (of x)

See Class 1.7 for a reminder.

Recall (for example), Demand II

A change in one of the "determinants of demand" will shift demand curve!

- Change in income m

- Change in price of other goods py (substitutes or complements)

- Change in preferences or expectations about good x

- Change in number of buyers

Shows up in (inverse) demand function by a change in intercept (choke price)!

Again, see my Visualizing Demand Shifters

Ceterus Paribus II

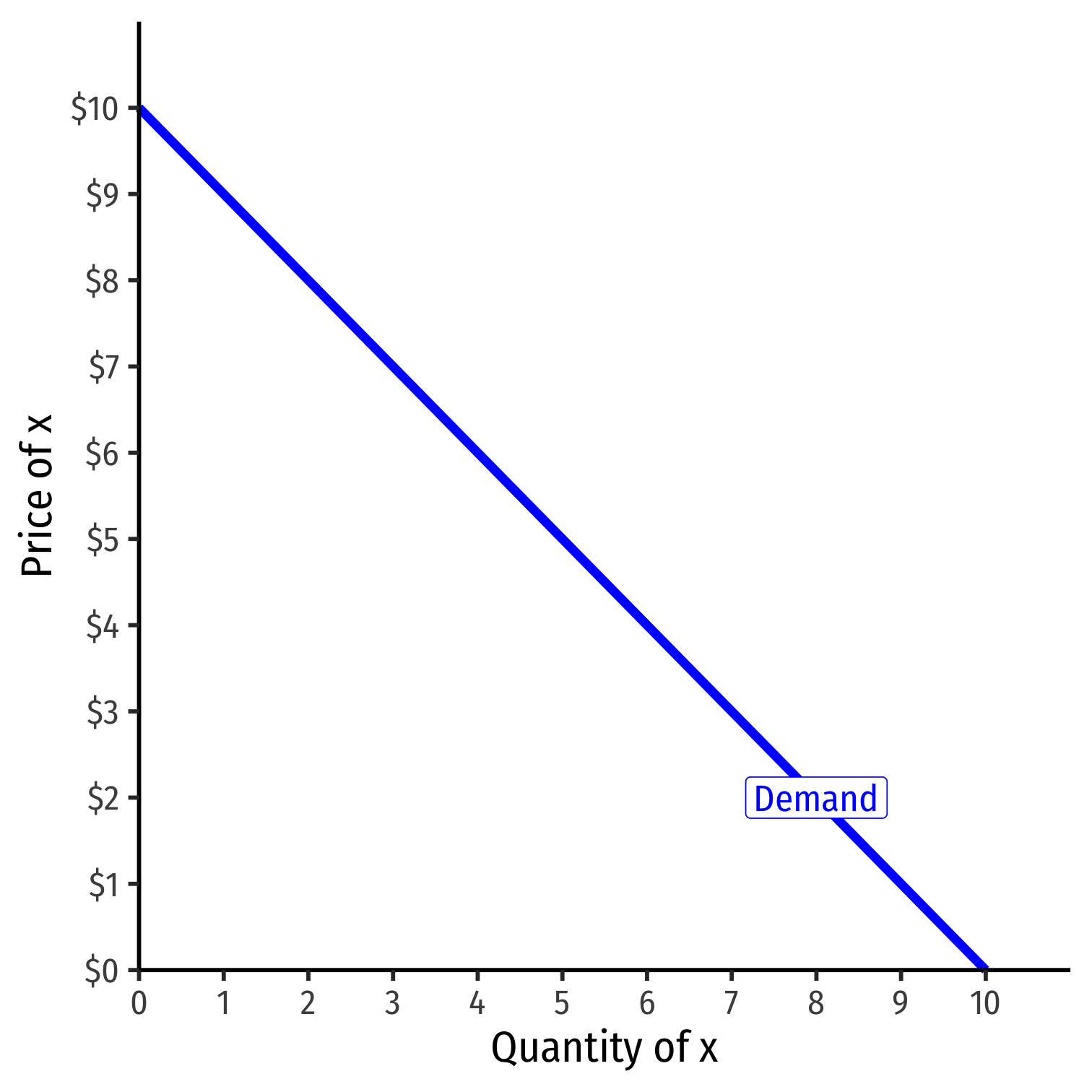

Consider our demand function: qD=10−p

If the market price (p) changes (perhaps because supply changes), that results in a change in quantity demanded (qD)

- We move along the existing demand curve

Ceterus paribus has not been violated

Ceterus Paribus III

Consider our demand function: qD=10−p

If the something other than price changes (income, preferences, price of a complement, etc), that results in a change in demand

- We need to draw a new demand curve (or demand function)

qD=12−p

- Ceterus paribus has been violated

Ceterus Paribus IV

- There is a big difference between a change in "quantity demanded" and a change in "demand"!

Ceterus Paribus IV

- There is a big difference between a change in "quantity demanded" and a change in "demand"!

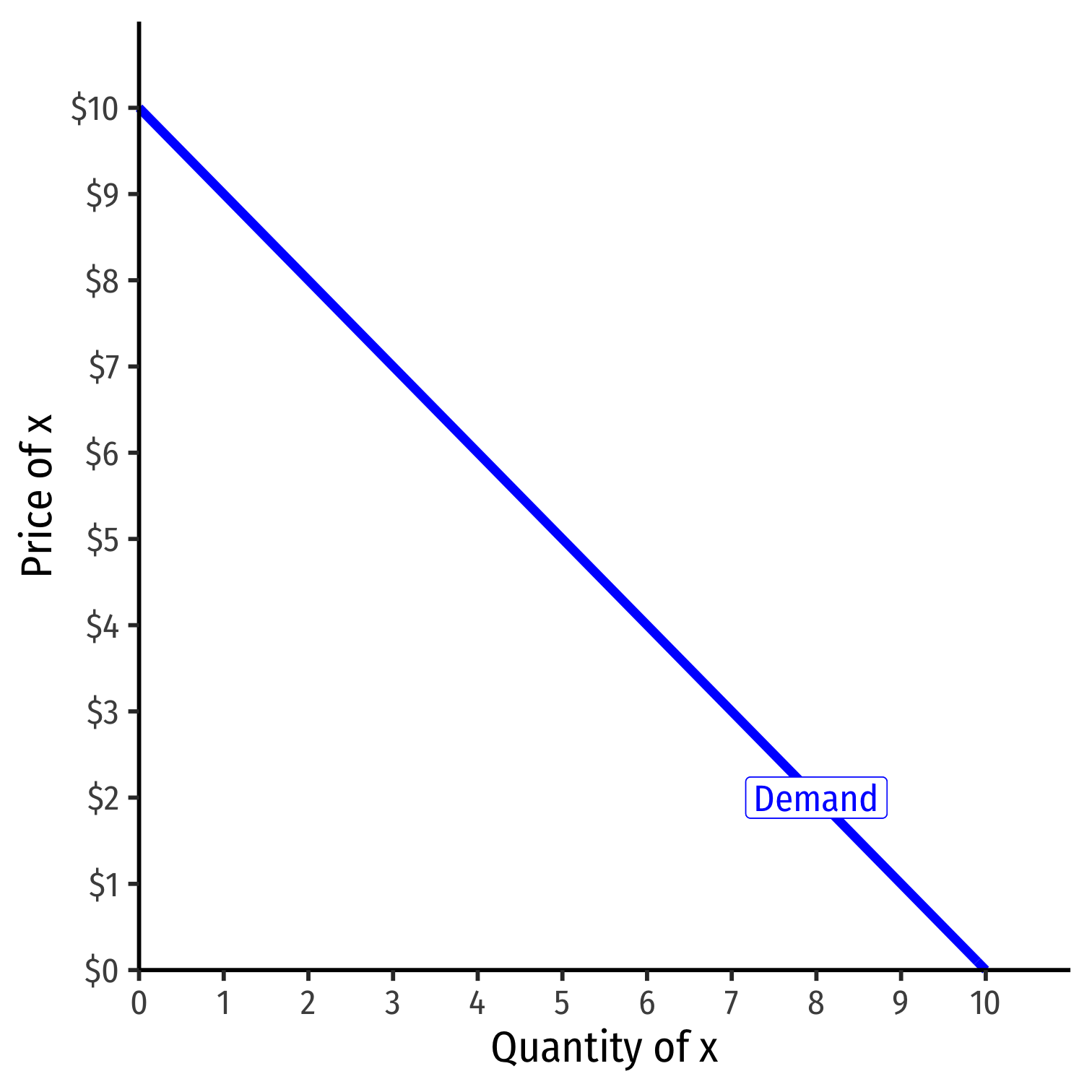

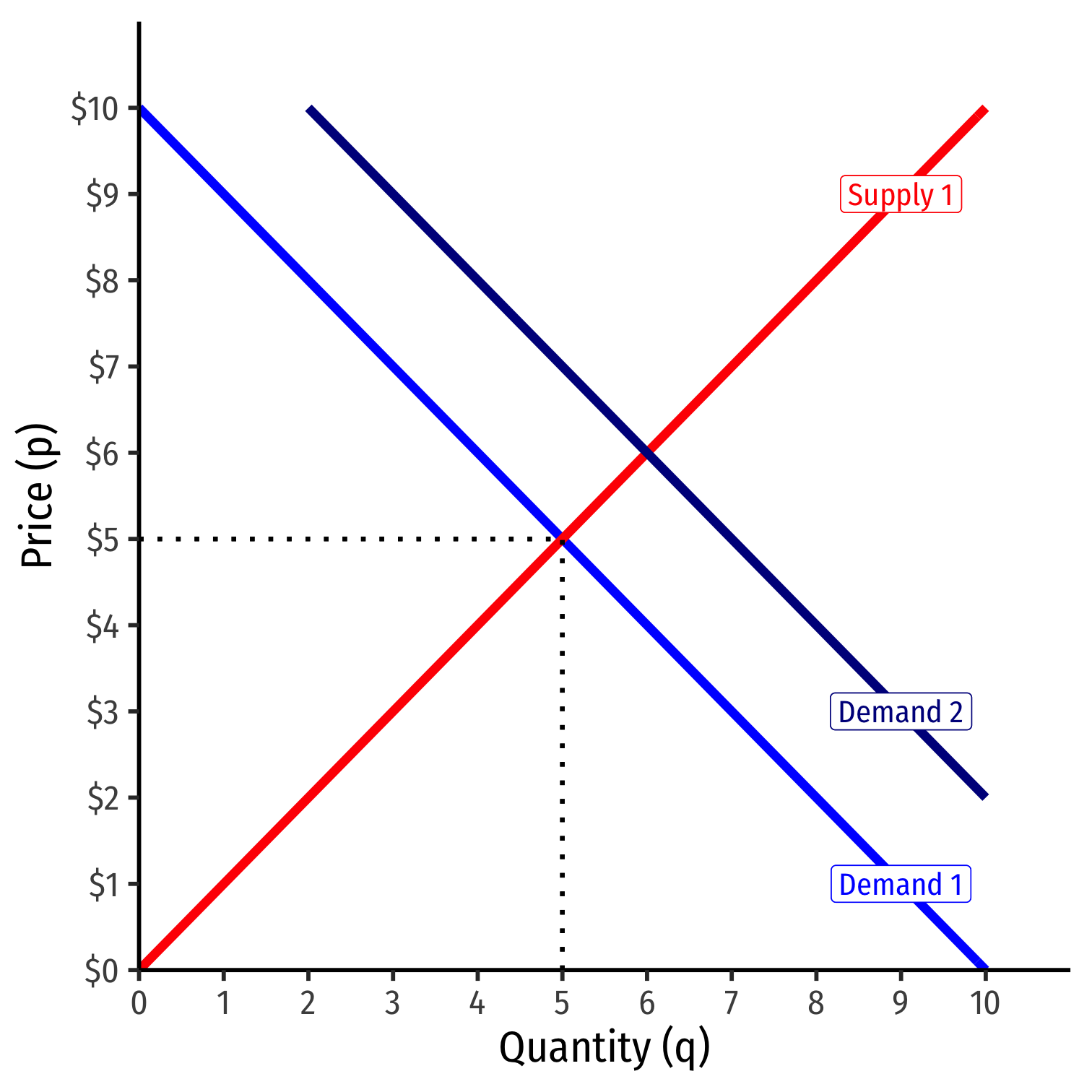

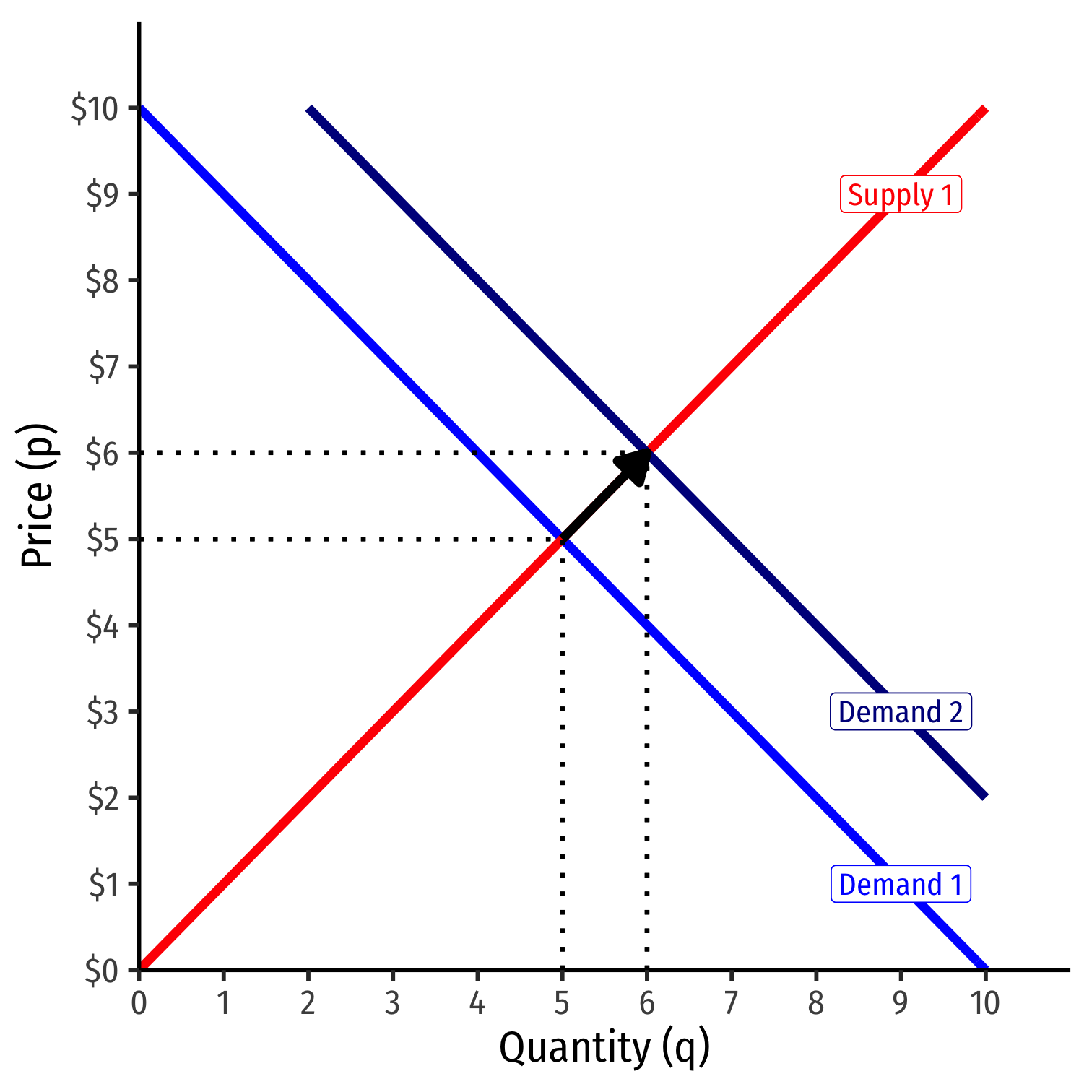

Increase in Demand

Increase in Demand

More individuals want to buy more of the good at every price

Entire demand curve shifts to the right

Increase in Demand

More individuals want to buy more of the good at every price

Entire demand curve shifts to the right

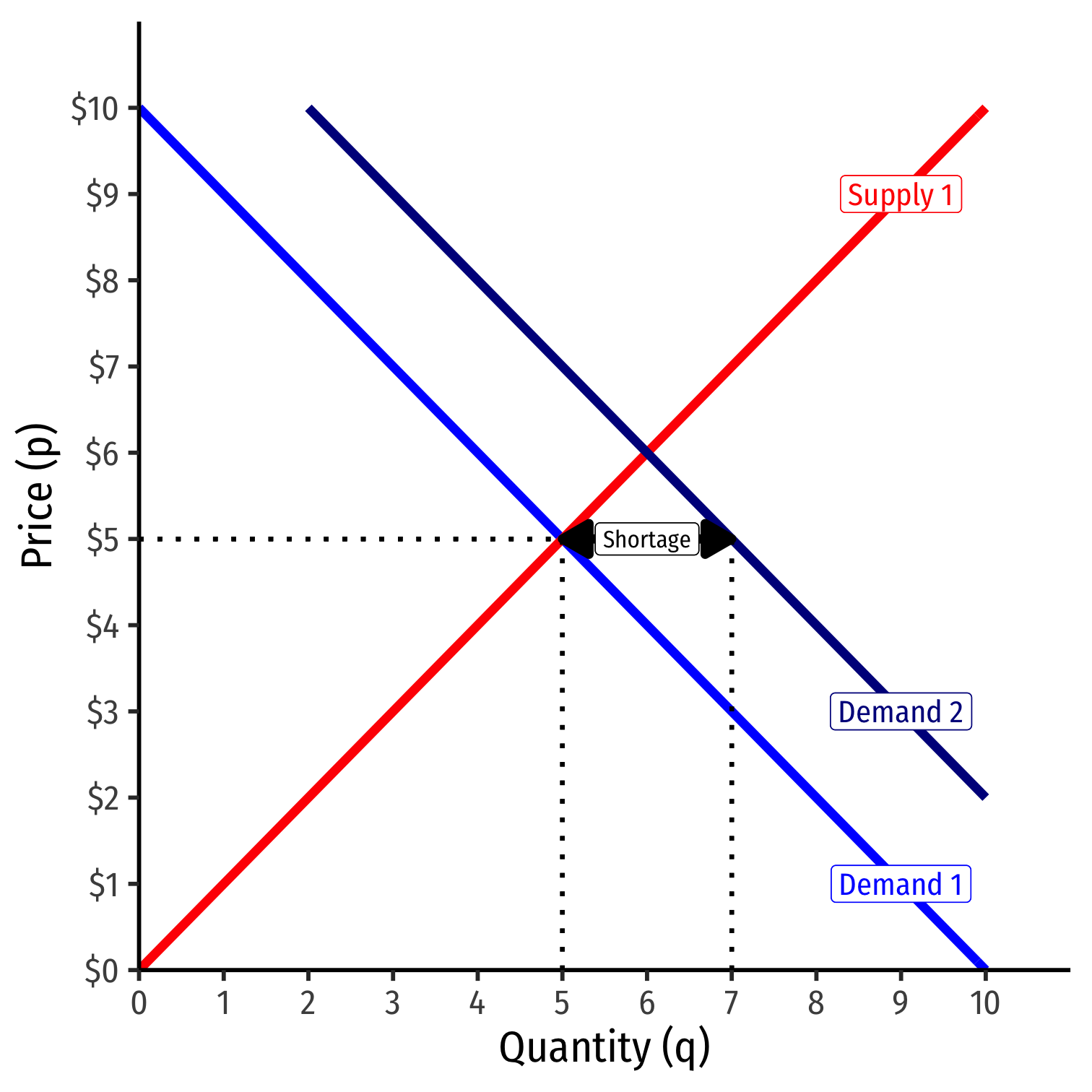

At the original market price, a shortage! (qD>qS)

Increase in Demand

More individuals want to buy more of the good at every price

Entire demand curve shifts to the right

At the original market price, a shortage! (qD>qS)

Some buyers willing to pay more at this quantity

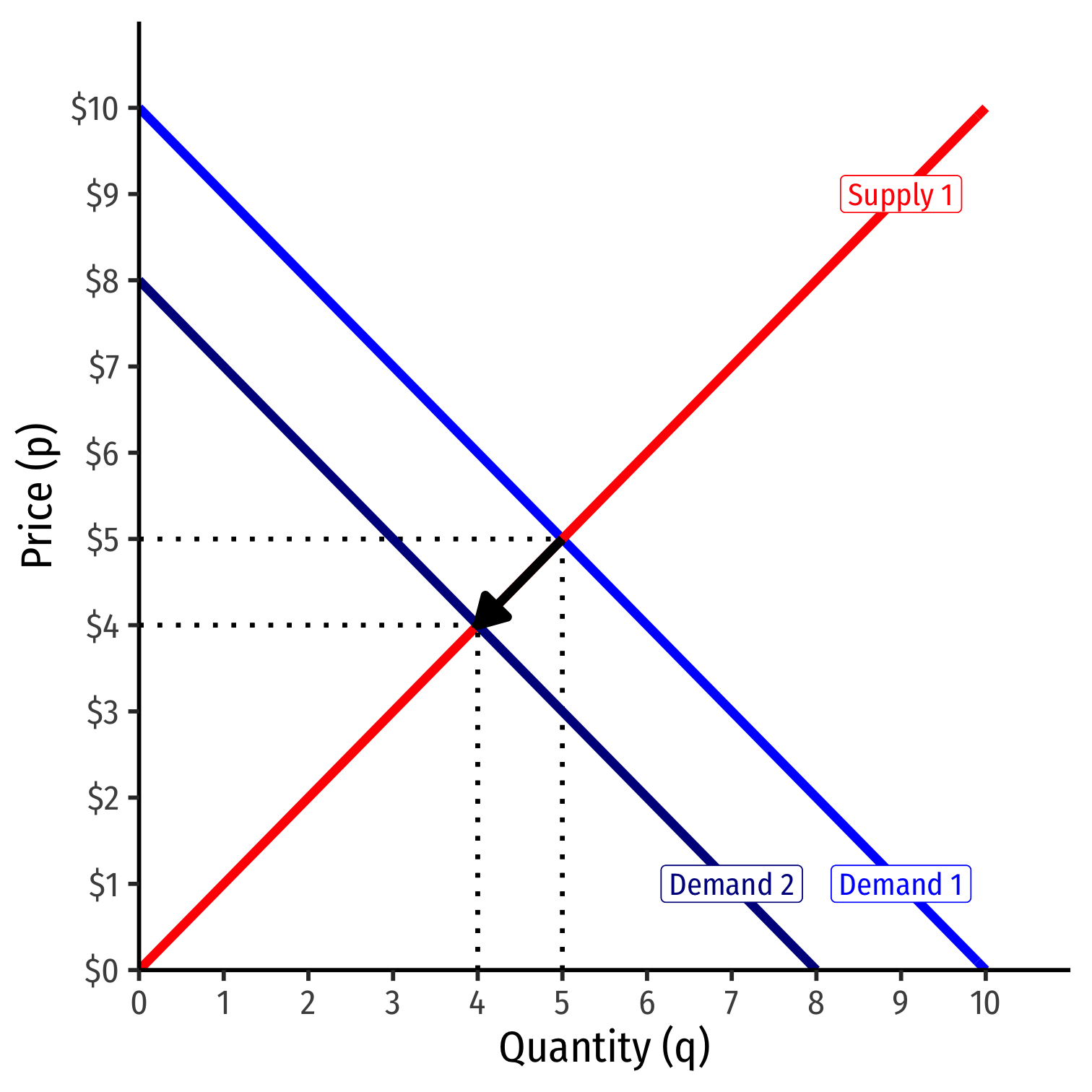

Increase in Demand

More individuals want to buy more of the good at every price

Entire demand curve shifts to the right

At the original market price, a shortage! (qD>qS)

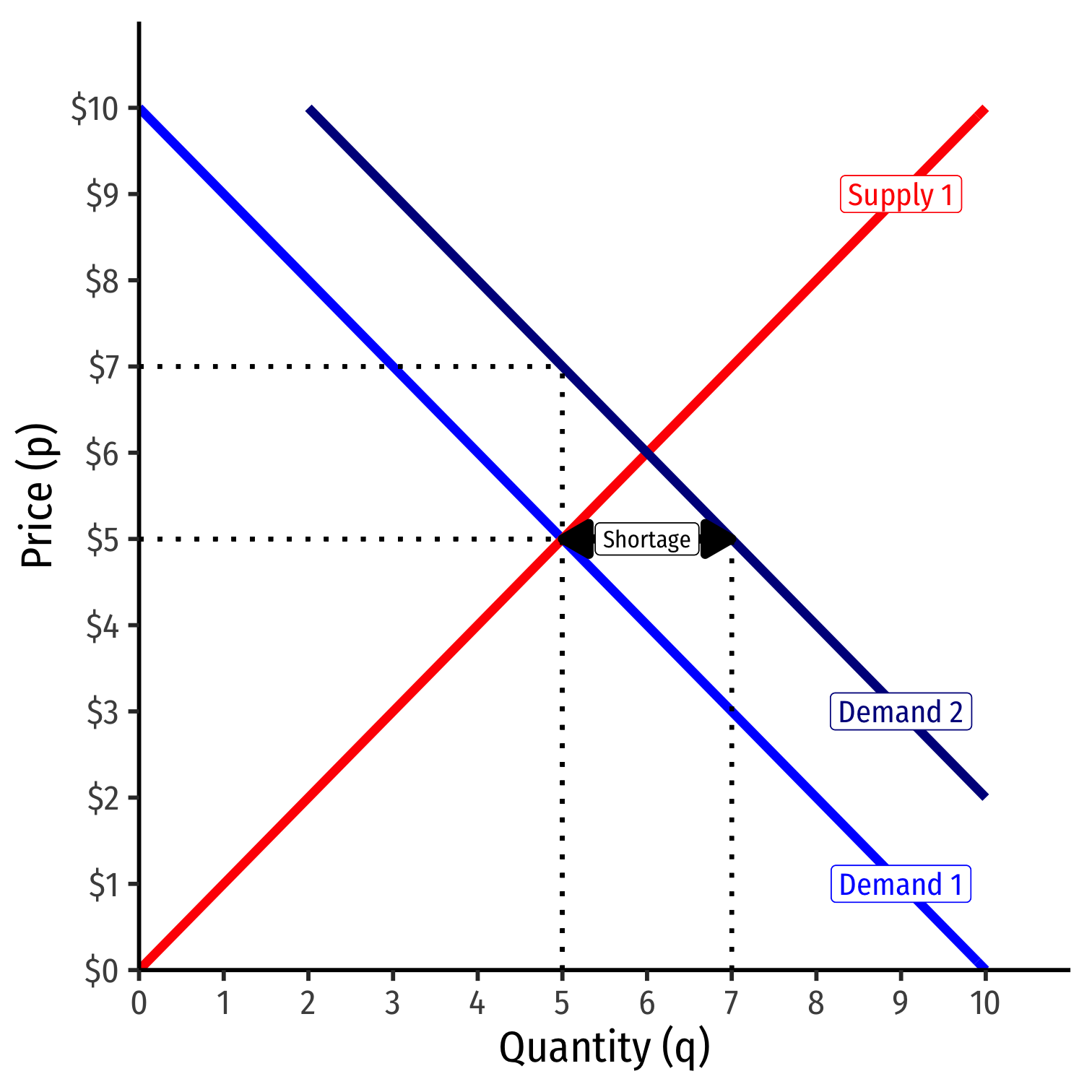

Some buyers willing to pay more at this quantity

Buyers raise bids, inducing sellers to sell more

Reach new equilibrium with:

- higher market-clearing price

- larger market-clearing quantity exchanged

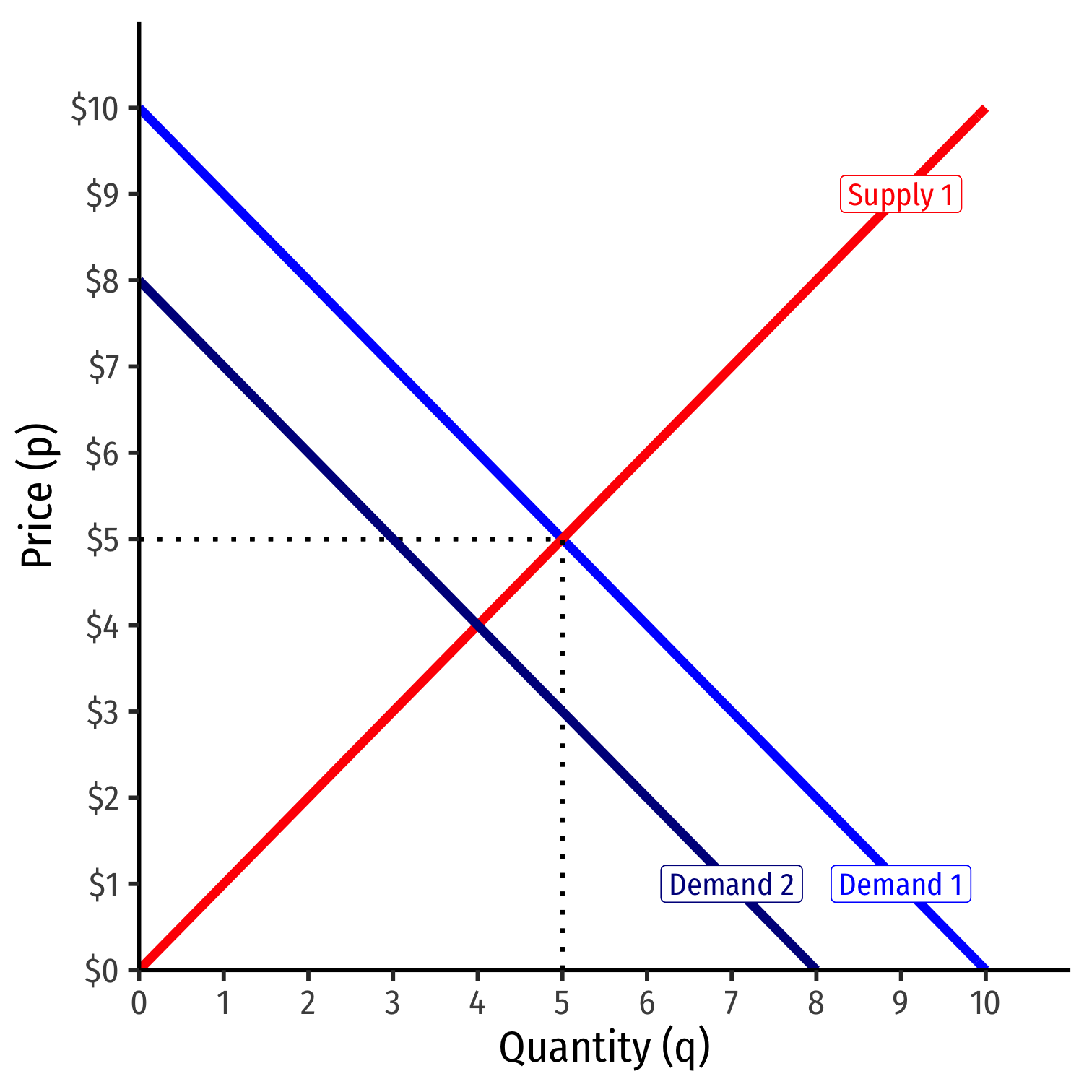

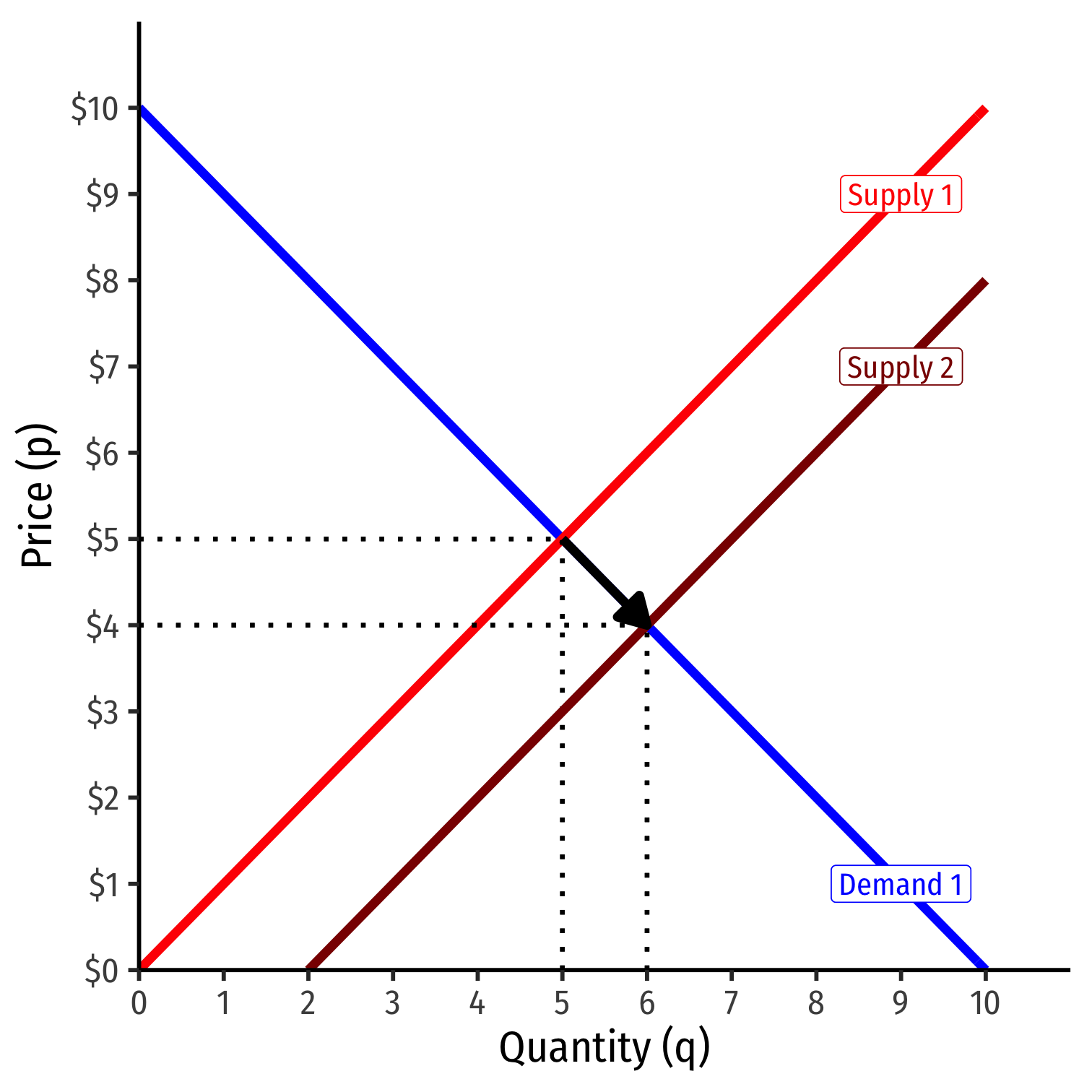

Decrease in Demand

Decrease in Demand

Fewer individuals want to buy less of the good at every price

Entire demand curve shifts to the left

Decrease in Demand

Fewer individuals want to buy less of the good at every price

Entire demand curve shifts to the left

At the original market price, a surplus! (qD<qS)

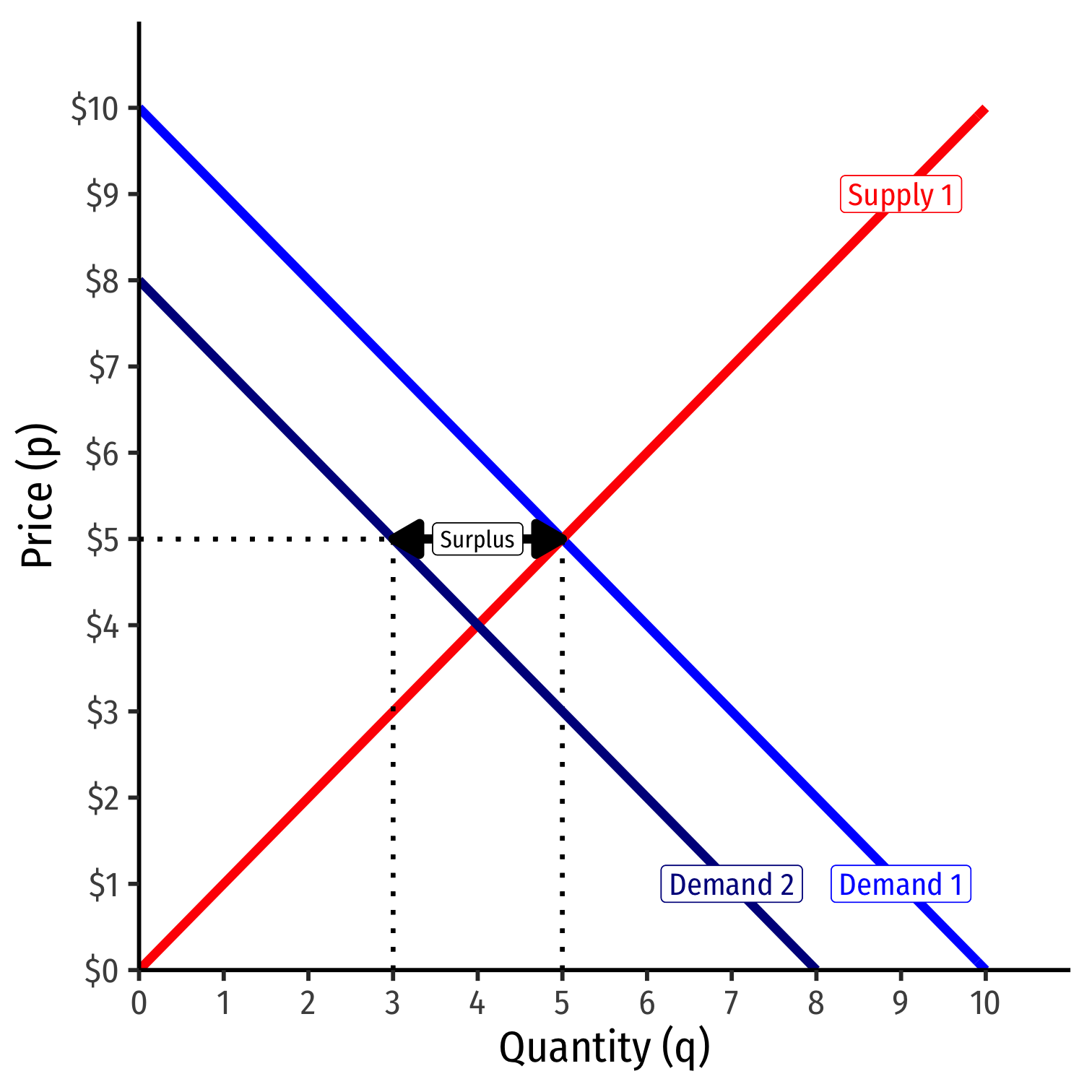

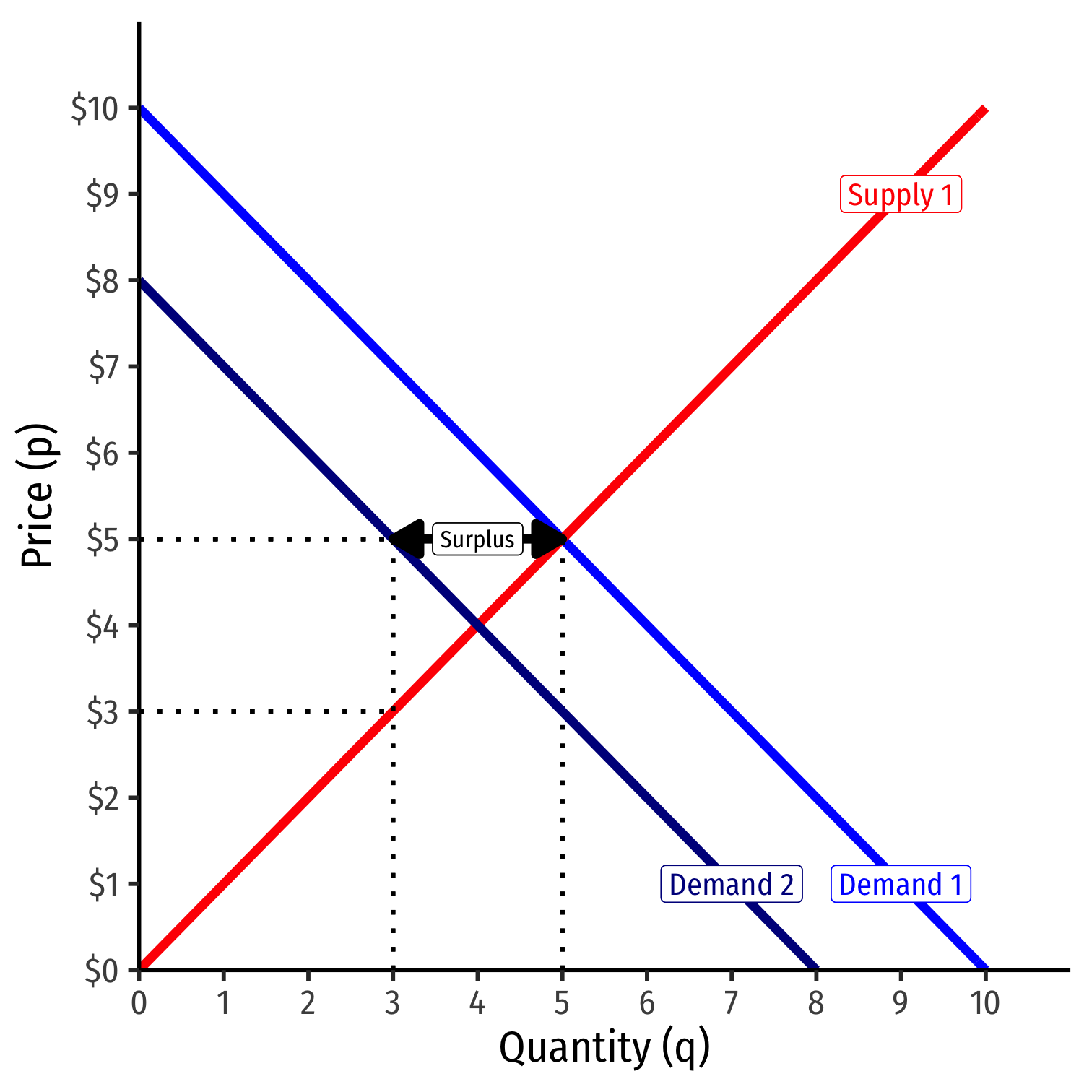

Decrease in Demand

Fewer individuals want to buy less of the good at every price

Entire demand curve shifts to the left

At the original market price, a surplus! (qD<qS)

Some sellers willing to accept less at this quantity

Decrease in Demand

Fewer individuals want to buy less of the good at every price

Entire demand curve shifts to the left

At the original market price, a surplus! (qD<qS)

Some sellers willing to accept less at this quantity

Sellers lower asks, inducing buyers to buy more

Reach new equilibrium with:

- lower market-clearing price

- smaller market-clearing quantity exchanged

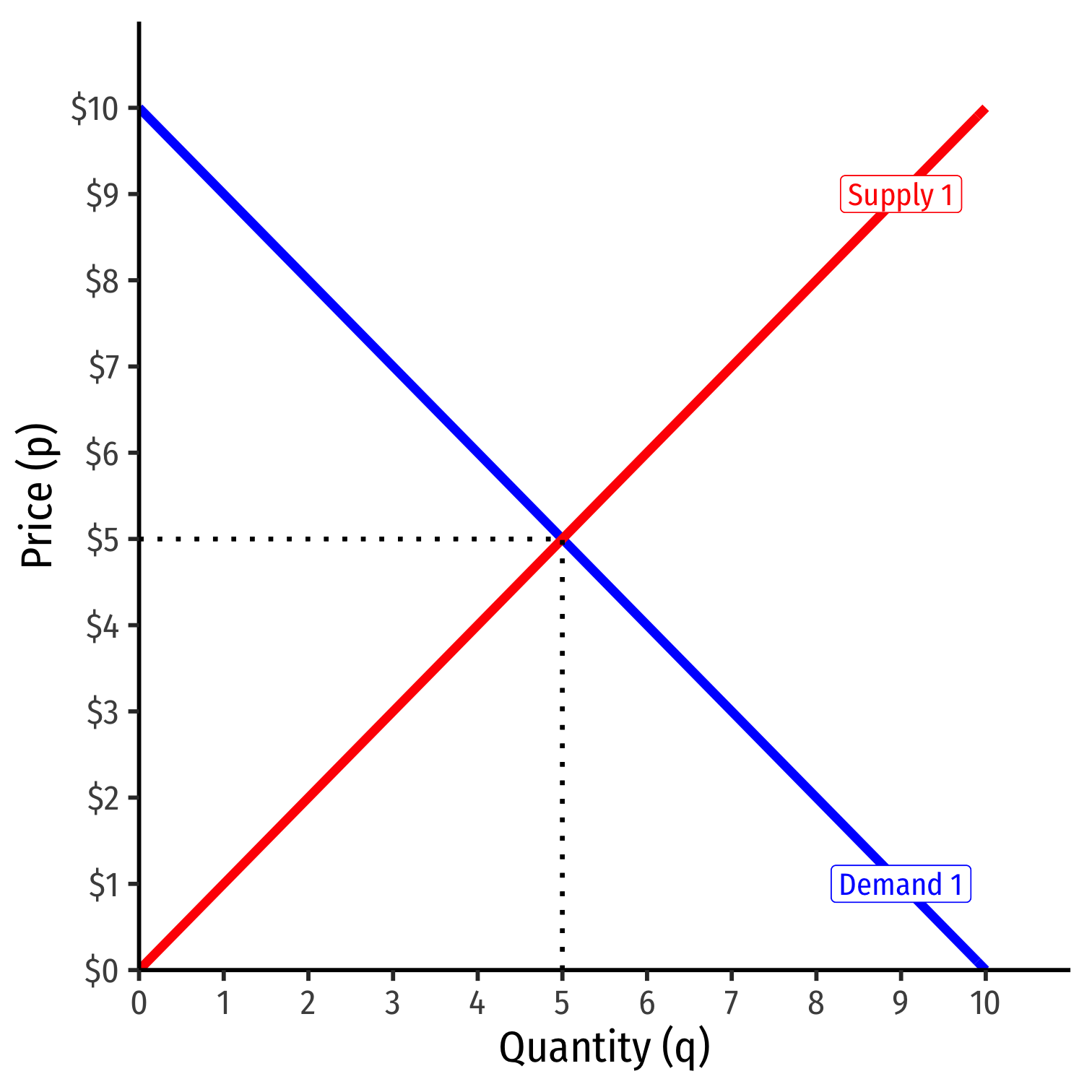

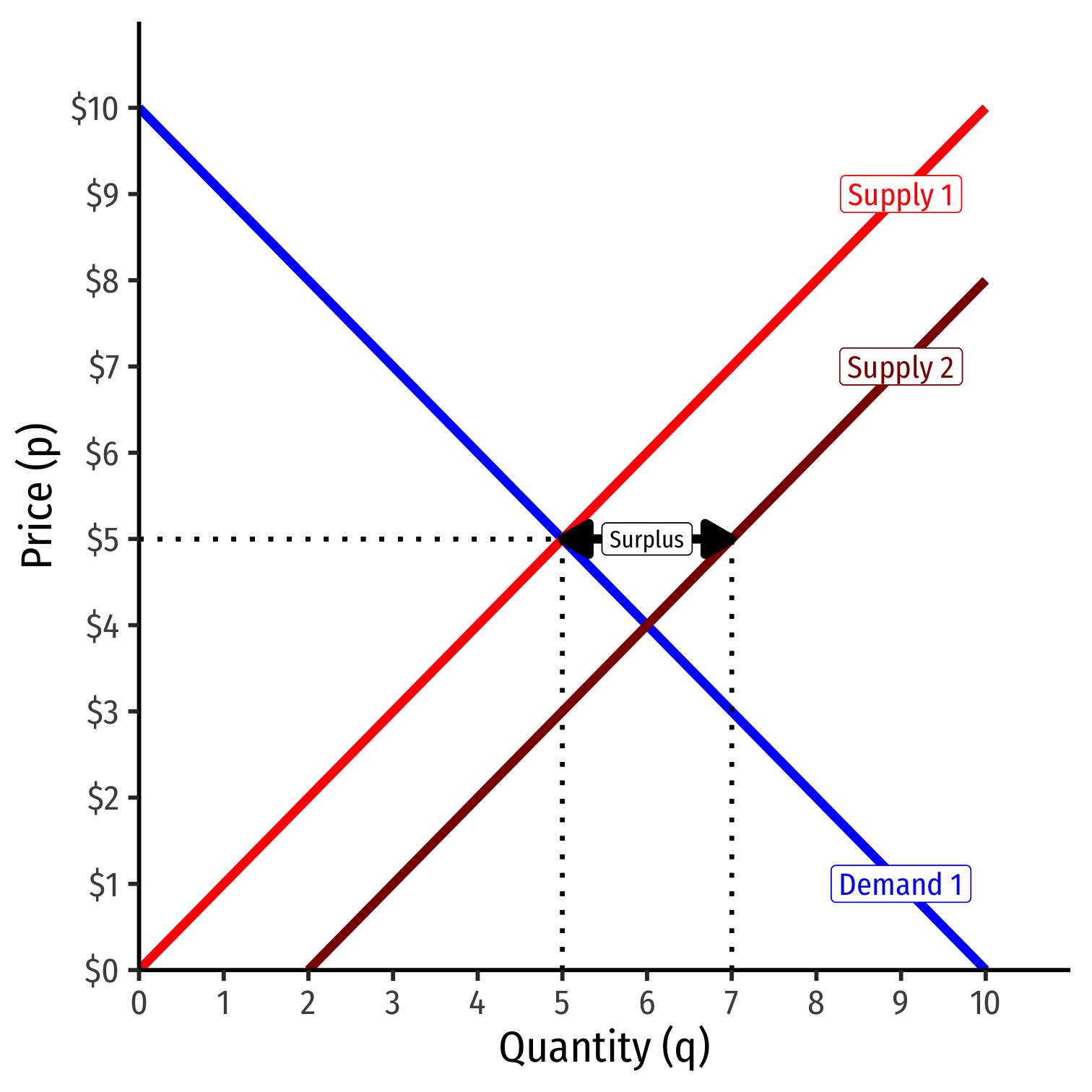

Increase in Supply

Increase in Supply

More individuals want to sell more of the good at every price

Entire supply curve shifts to the right

Increase in Supply

More individuals want to sell more of the good at every price

Entire supply curve shifts to the right

At the original market price, a surplus! (qD<qS)

Increase in Supply

More individuals want to sell more of the good at every price

Entire supply curve shifts to the right

At the original market price, a surplus! (qD<qS)

Some sellers willing to accept less at this quantity

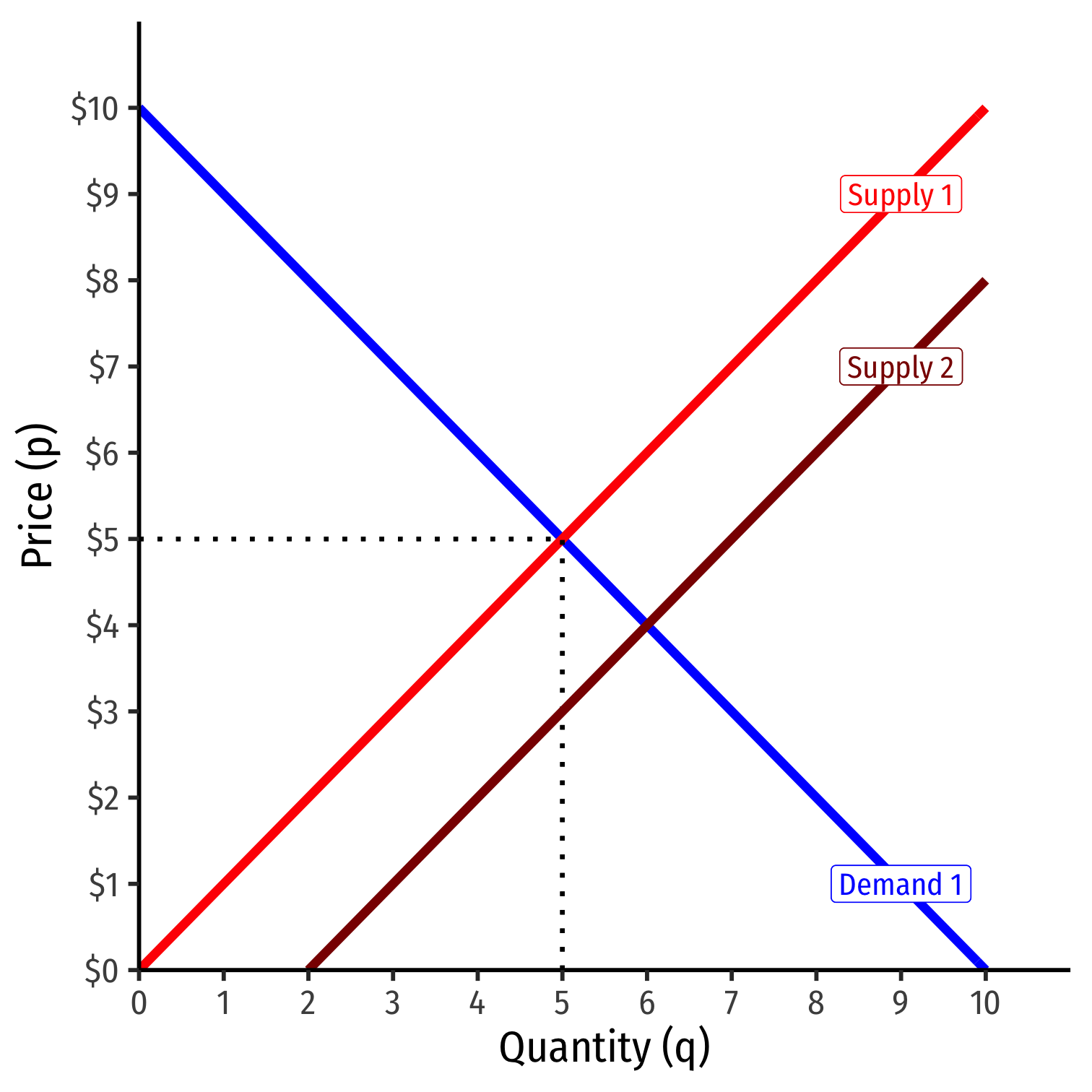

Increase in Supply

More individuals want to sell more of the good at every price

Entire supply curve shifts to the right

At the original market price, a surplus! (qD<qS)

Some sellers willing to accept less at this quantity

Sellers lower asks, inducing buyers to buy more

Reach new equilibrium with:

- lower market-clearing price

- larger market-clearing quantity exchanged

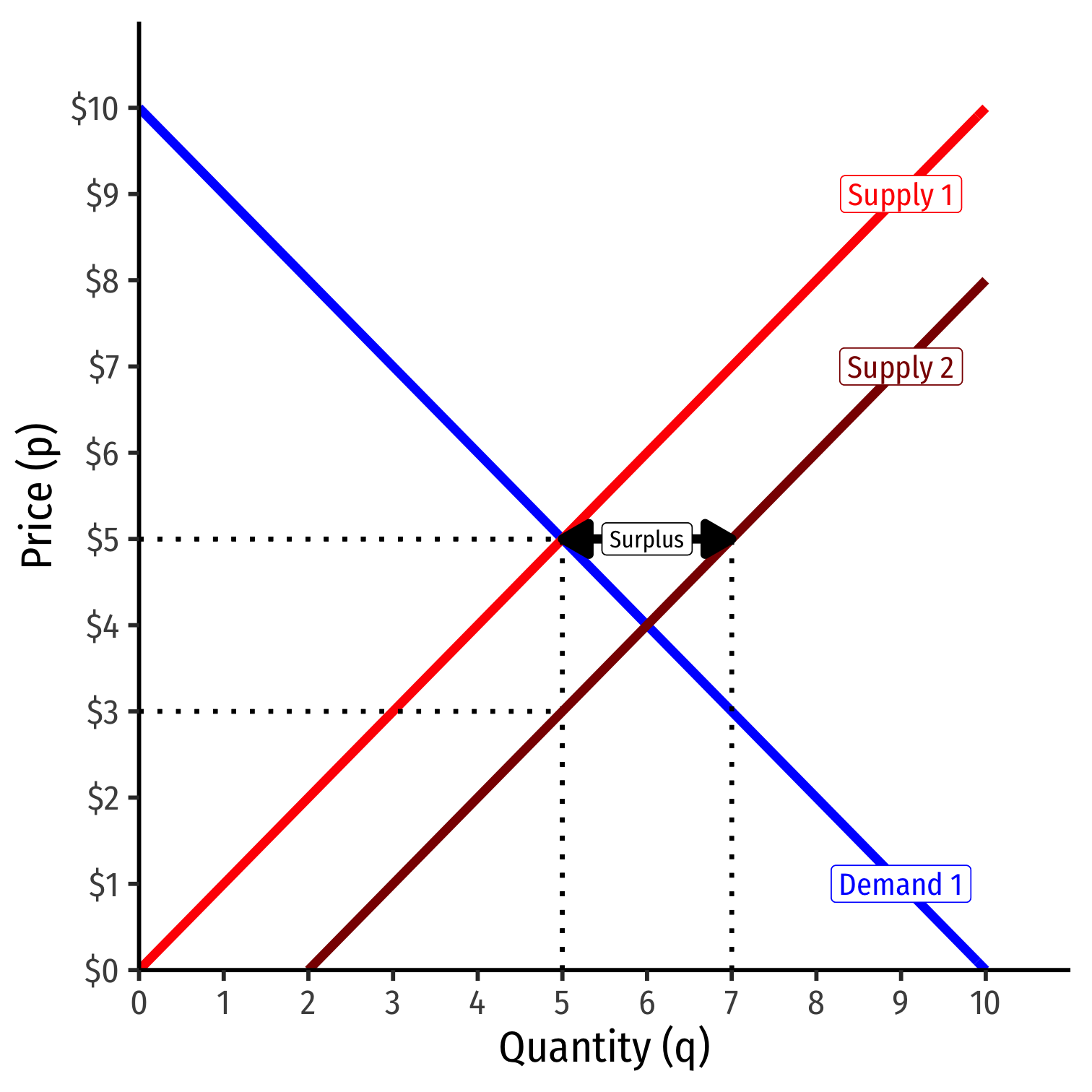

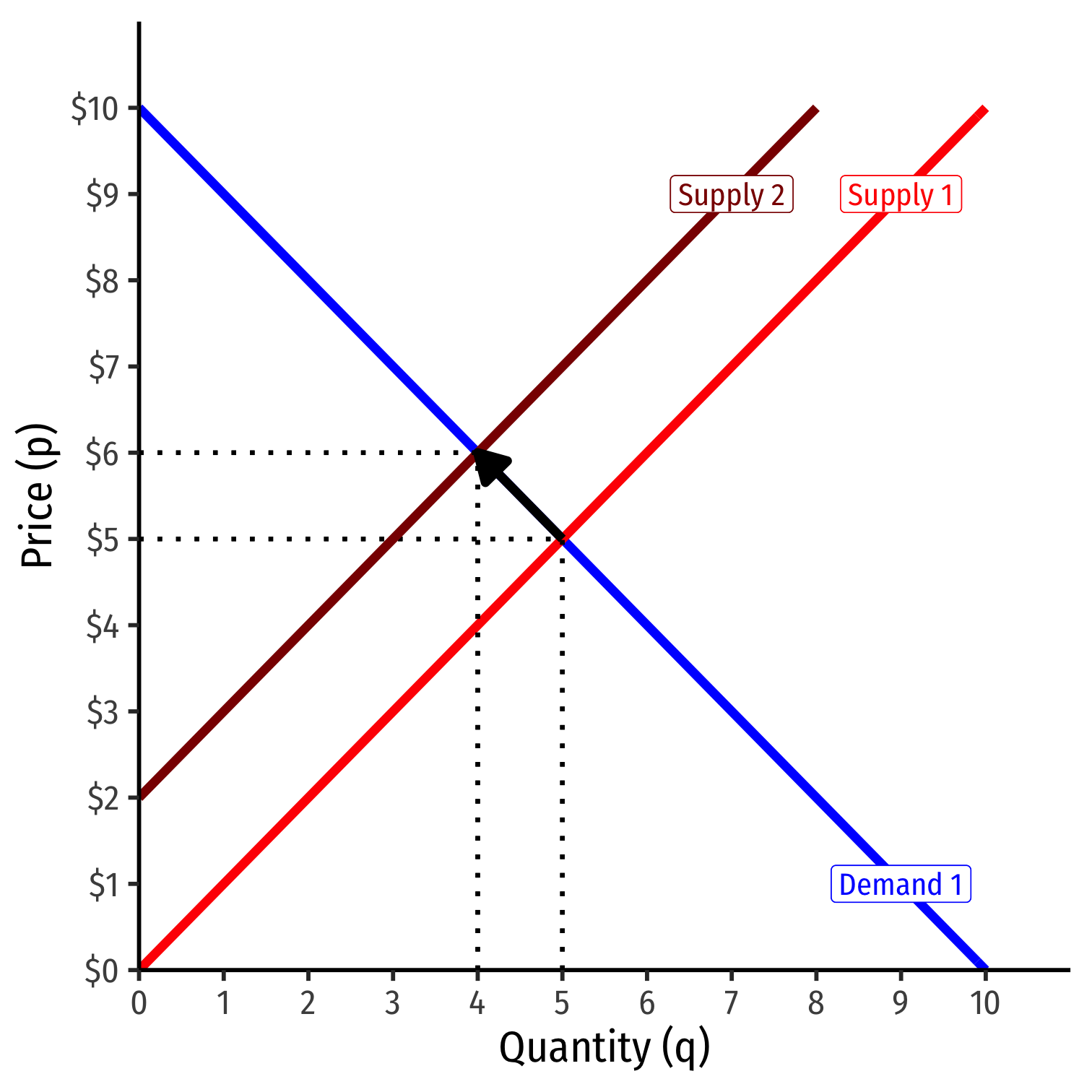

Decrease in Supply

Decrease in Supply

Fewer individuals want to sell less of the good at every price

Entire supply curve shifts to the left

Decrease in Supply

Fewer individuals want to sell less of the good at every price

Entire supply curve shifts to the left

At the original market price, a shortage! (qD>qS)

Decrease in Supply

Fewer individuals want to sell less of the good at every price

Entire supply curve shifts to the left

At the original market price, a shortage! (qD>qS)

Some buyers willing to pay more at this quantity

Decrease in Supply

Fewer individuals want to sell less of the good at every price

Entire supply curve shifts to the left

At the original market price, a shortage! (qD>qS)

Some buyers willing to pay more at this quantity

Buyers raise bids, inducing sellers to sell more

Reach new equilibrium with:

- higher market-clearing price

- smaller market-clearing quantity exchanged

Equilibrium Tendencies

Equilibrium is a tendency we can predict with our models

Buyers and sellers raise and lower their bids and asks to adjust to competition from other buyers and sellers, moving the market price

Ceterus paribus, market prices will settle on an equilibrium given existing conditions

But conditions are always changing (and so are prices)!