3.3 — Social Functions of Market Prices

ECON 306 · Microeconomic Analysis · Fall 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microF20

microF20.classes.ryansafner.com

The Model is Not the Reality I

This course is about economic modeling and formal theory

Applications in ECON electives

Models help us understand reality, but they are not reality!

- Don't mistake the map for the territory itself

"All models are wrong. Some are useful" - George Box

The Model is Not the Reality II

Our models so far have given us interesting results,

- Markets reach equilibrium

- Economic profits are zero in the long run in competitive markets

Both are fictional

But the models still show us useful insights about how a market economy works

Some readings in today's readings page to help you understand

Why Markets Tend to Equilibrate, Redux

The Law of One Price I

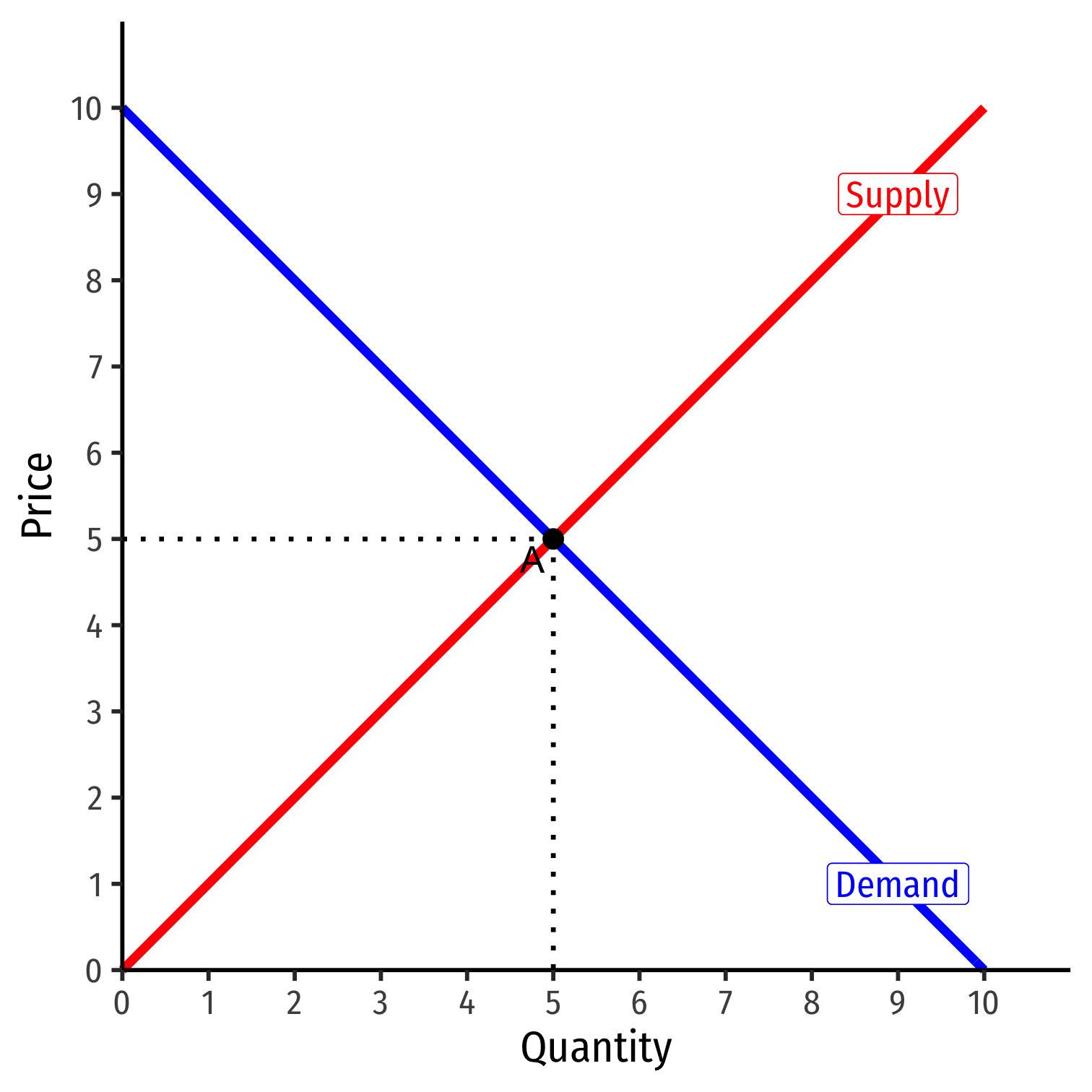

- Law of One Price: all units of the same good exchanged on the market will tend to have the same market price (the market-clearing price, p∗)

The Law of One Price II

Consider if there are multiple different prices for same good:

Arbitrage opportunities: optimizing individuals recognize profit opportunity:

- Buy at low price, resell at high price!

- There are possible gains from trade or gains from innovation to be had

Entrepreneurship: recognizing profit opportunities and entering a market as a seller to try to capture gains from trade/innovation

Arbitrage and Entrepreneurship I

Arbitrage and Entrepreneurship II

Arbitrage and Entrepreneurship III

Uncertainty ≠ Risk

Uncertainty ≠ Risk

"Known knowns": perfect information

"Known unknowns": risk

- We know the probability distribution of states that could happen

- We just don't know which state will be realized

- We can estimate probabilities, maximize expected value, minimize variance, etc.

Uncertainty ≠ Risk

- "Unknown unknowns: uncertainty

- We don’t even know the probability distribution of states that could happen

- No model to optimize in a world of uncertainty!

The Role of Entrepreneurial Judgment

Frank H. Knight

1885-1972

“Knightian uncertainty”: not that we can’t assign probabilities to each outcome; we do not even have the knowledge necessary to list all possible outcomes!

Requires entrepreneurial judgment to both:

- estimate possible actions and

- estimate the likelihood of their success

Entrepreneur is central player, earns pure profits (a residual) for bearing uncertainty

Entrepreneurial Judgment

Henry Ford

1863-1947

“If I had asked people what they wanted, they would have said faster horses.” - Henry Ford

Entrepreneurial Judgment

“It's really hard to design products by focus groups. A lot of times, people don't know what they want until you show it to them.” - Steve Jobs

Uncertainty and Entrepreneurship

Mark Zuckerberg

1984-

"Why were we the ones to build [Facebook]? We were just students. We had way fewer resources than big companies. If they had focused on this problem, they could have done it. The only answer I can think of is: we just cared more. While some doubted that connecting the world was actually important, we were building. While others doubted that this would be sustainable, we were forming lasting connections."

How Markets Get to Equilibrium I

Nobody knows "the right price" for things

Each Buyer and Seller only knows their own reservation prices

Buyers and sellers adjust their bids/asks

Markets do not start competitive, but monopolistic!

New entrepreneurs enter to try to capture gains from trade/innovation

As these gains are exhausted, prices converge to equilibrium

How Markets Get to Equilibrium II

Errors and imperfect information ⟹ multiple prices

- ⟹ arbitrage opportunities ⟹ entrepreneurship

- ⟹ correcting mistakes ⟹ people update their behavior & expectations

Markets are discovery processes that discover the right prices, the optimal uses of resources, and cheapest production methods, none of which can be known in advance!

How Markets Get to Equilibrium III

Economy as a cat-and-mouse game between:

- "Underlying variables": preferences, technology, and resource availability

- "Response variables": market prices, least-cost technologies

Response variables always chasing underlying variables

- Underlying variables always changing

- Any time underlying ≠ response variables: profit opportunities

IF underlying variables froze, market would rest at equilibrium

The Social Functions of Market Prices

Prices are Signals I

Prices are Signals II

Markets are social processes that generate information via prices

Prices are never "given", prices emerge dynamically from negotiation and market decisions of entrepreneurs and consumers

Competition: is a discovery process which discovers what consumer preferences are and what technologies are lowest cost, and how to allocate resources accordingly

The Social Functions of Prices I

A relatively high price:

Conveys information: good is relatively scarce

Creates incentives for:

- Buyers: conserve use of this good, seek substitites

- Sellers: produce more of this good

- Entrepreneurs: find substitutes and innovations to satisfy this unmet need

The Social Functions of Prices II

A relatively low price

Conveys information: good is relatively abundant

Creates incentives for:

- Buyers: substitute away from expensive goods towards this good

- Sellers: Produce less of this good, talents better served elsewhere

- Entrepreneurs: talents better served elsewhere: find more severe unmet needs

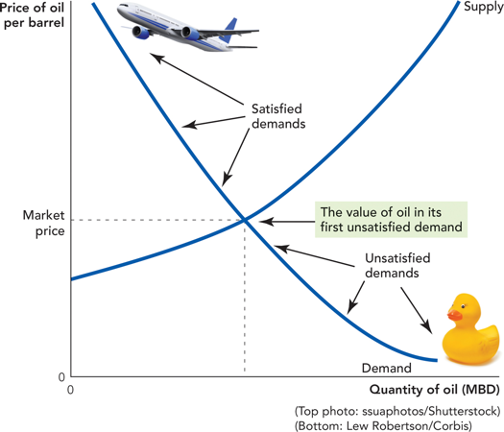

The Social Functions of Prices III

Prices tell us how to allocate scarce resources among competing uses

Think of diminishing marginal utility:

- allocate scarce good to highest-valued use first

- as supply becomes more plentiful (price falls), can allocate more units of the good to lower-valued uses (higher-valued uses already satisfied)

Knowledge, “Speculation,” and Prices

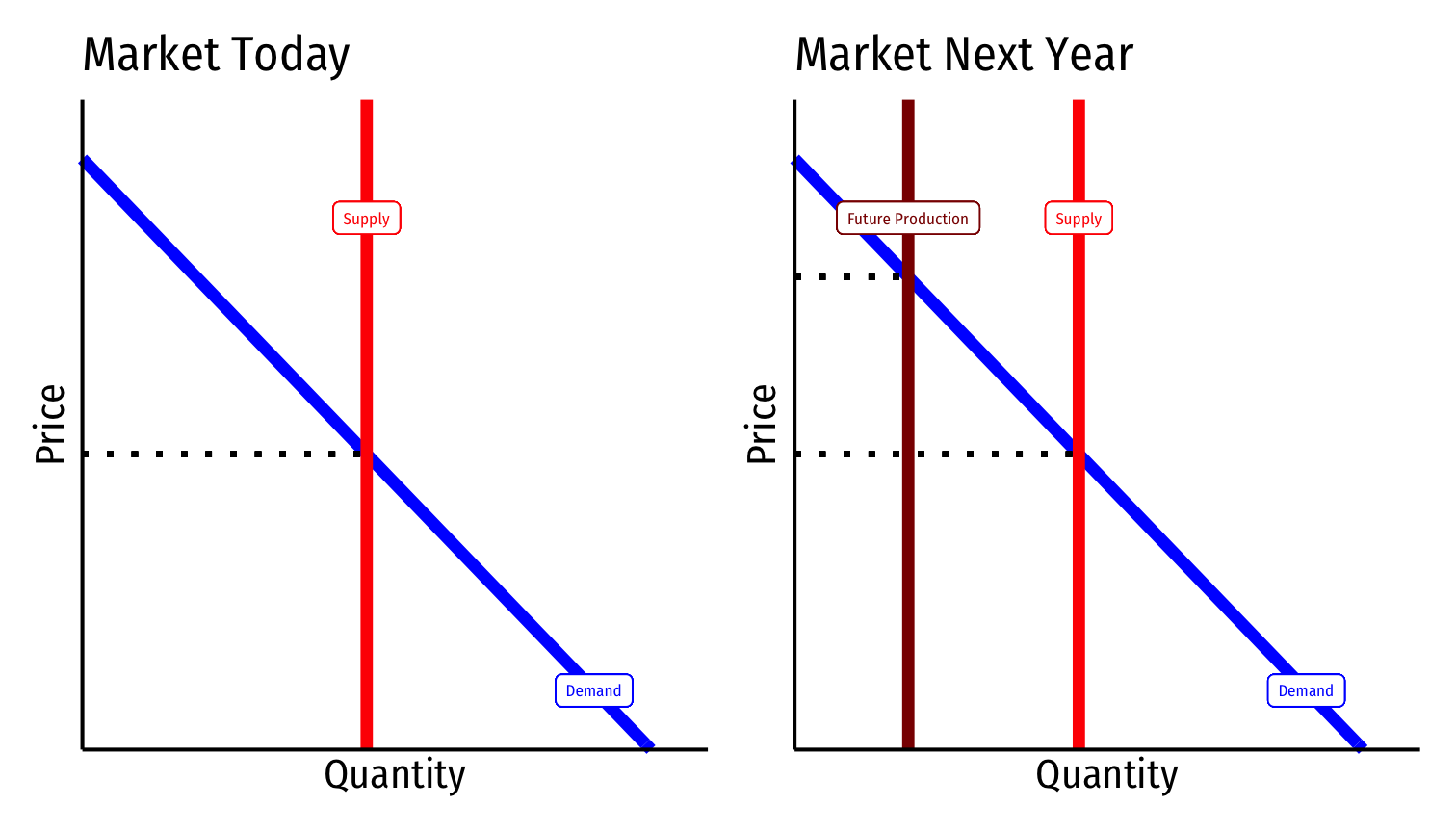

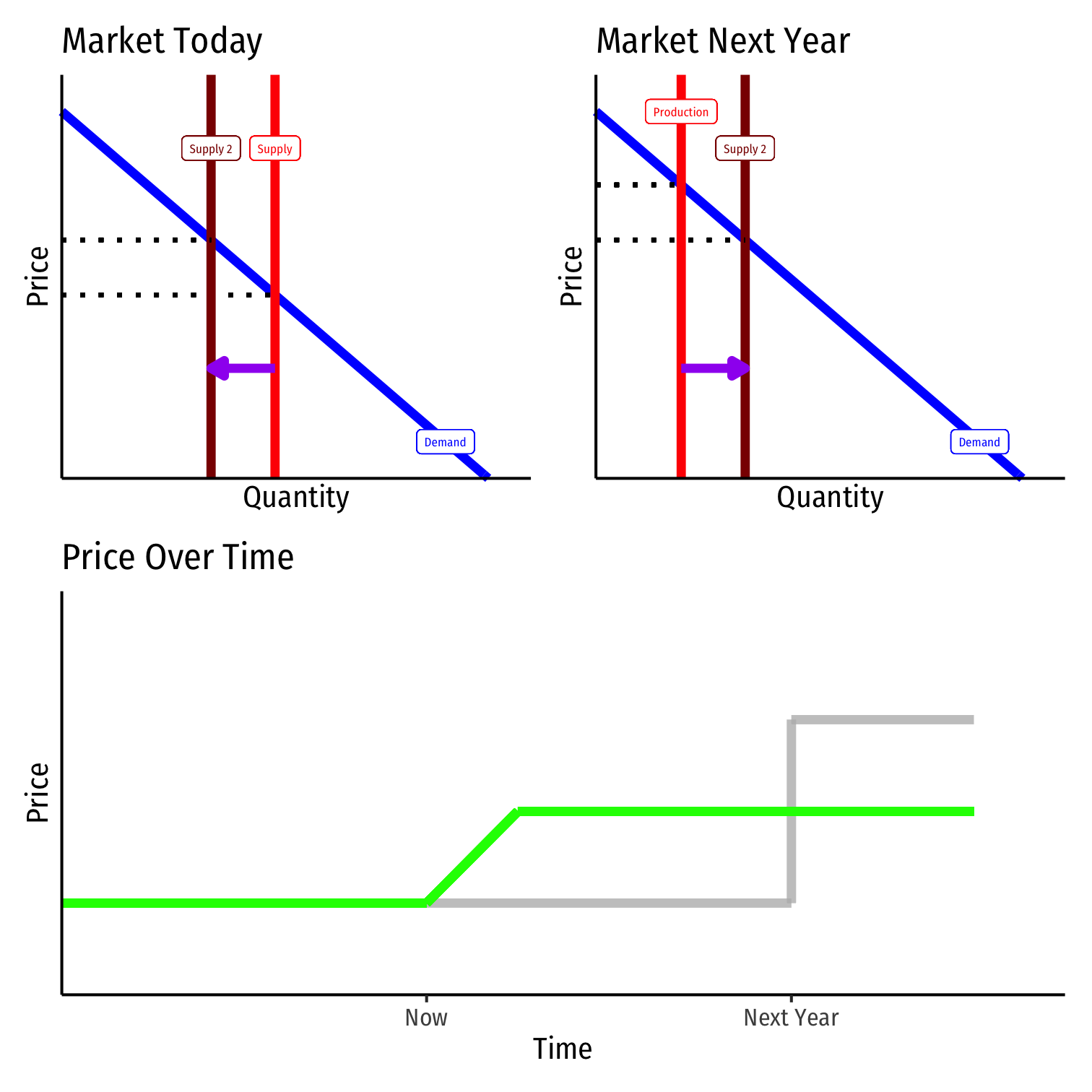

- Suppose (oil) producers believe there is going to be a shortage (of oil) in a year

Knowledge, “Speculation,” and Prices

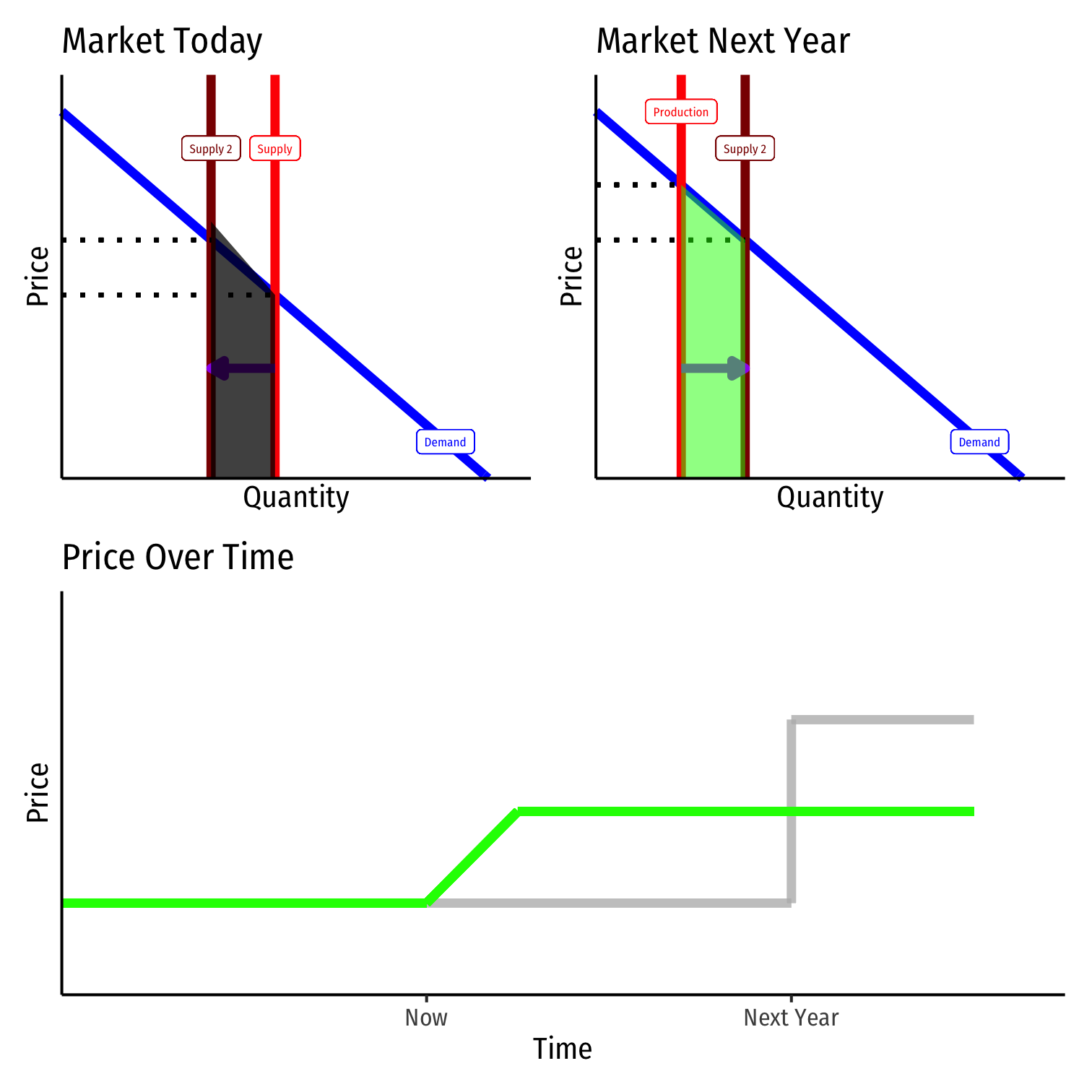

Suppose (oil) producers believe there is going to be a shortage (of oil) in a year

Suppose they do nothing

In the future, a sudden spike in price

- Demand is inelastic to sudden changes, consumers can’t adjust on the fly

- A lot of lost economic surplus (shaded)

Knowledge, “Speculation,” and Prices

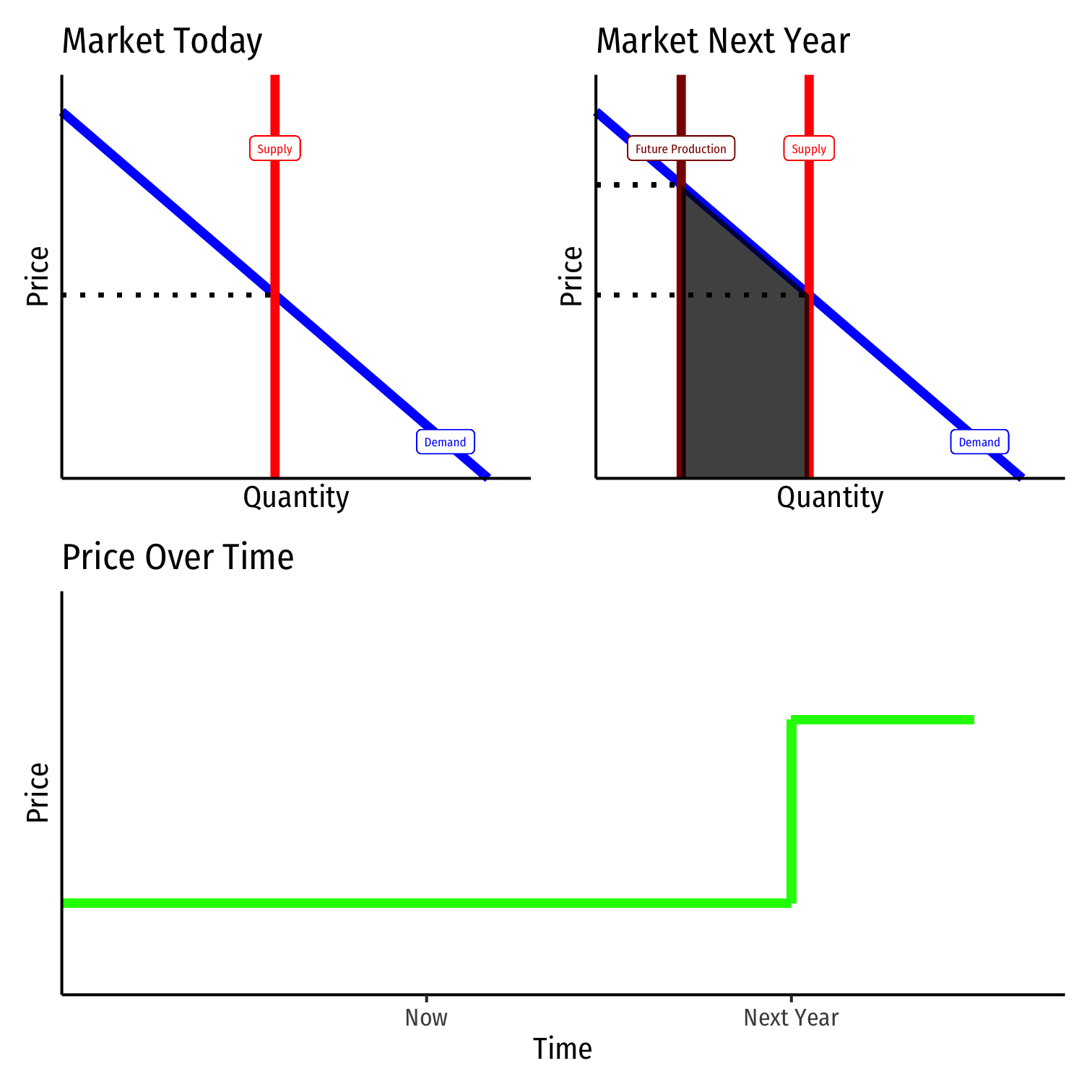

Suppose (oil) producers believe there is going to be a shortage (of oil) in a year

Suppose instead they speculate, and try to profit from the future price change

- TODAY: put some inventory into storage (take off market)

- FUTURE: when price is higher, sell more from inventories

Knowledge, “Speculation,” and Prices

Suppose (oil) producers believe there is going to be a shortage (of oil) in a year

Suppose instead they speculate, and try to profit from the future price change

- TODAY: put some inventory into storage (take off market)

- FUTURE: when price is higher, sell more from inventories

Price-smoothing over time

- Small loss in the present (gray shaded), larger gain in the future (green shaded)

- Allows consumers to adjust their plans more over time (more elastic demand)

Knowledge, “Speculation,” and Prices

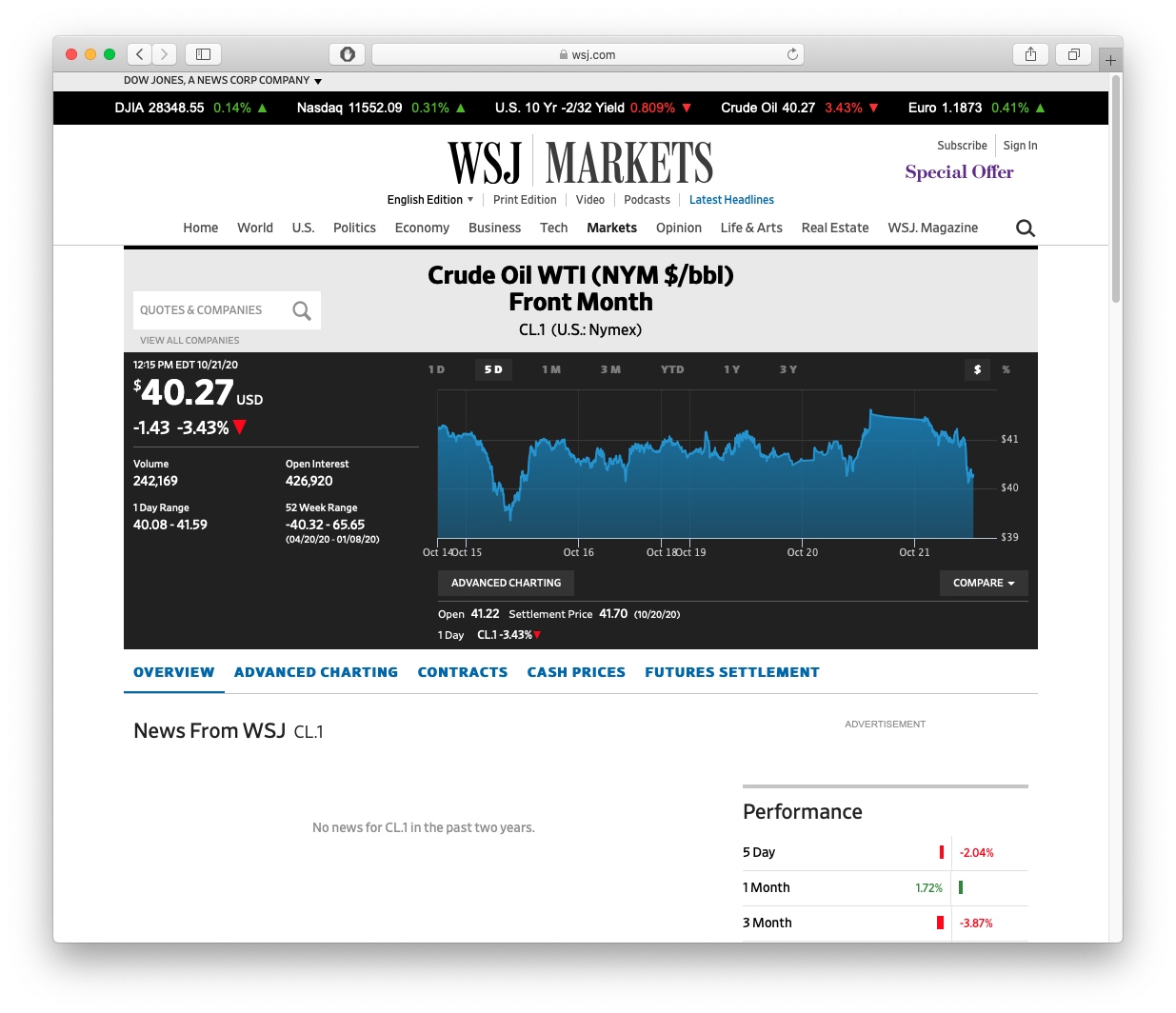

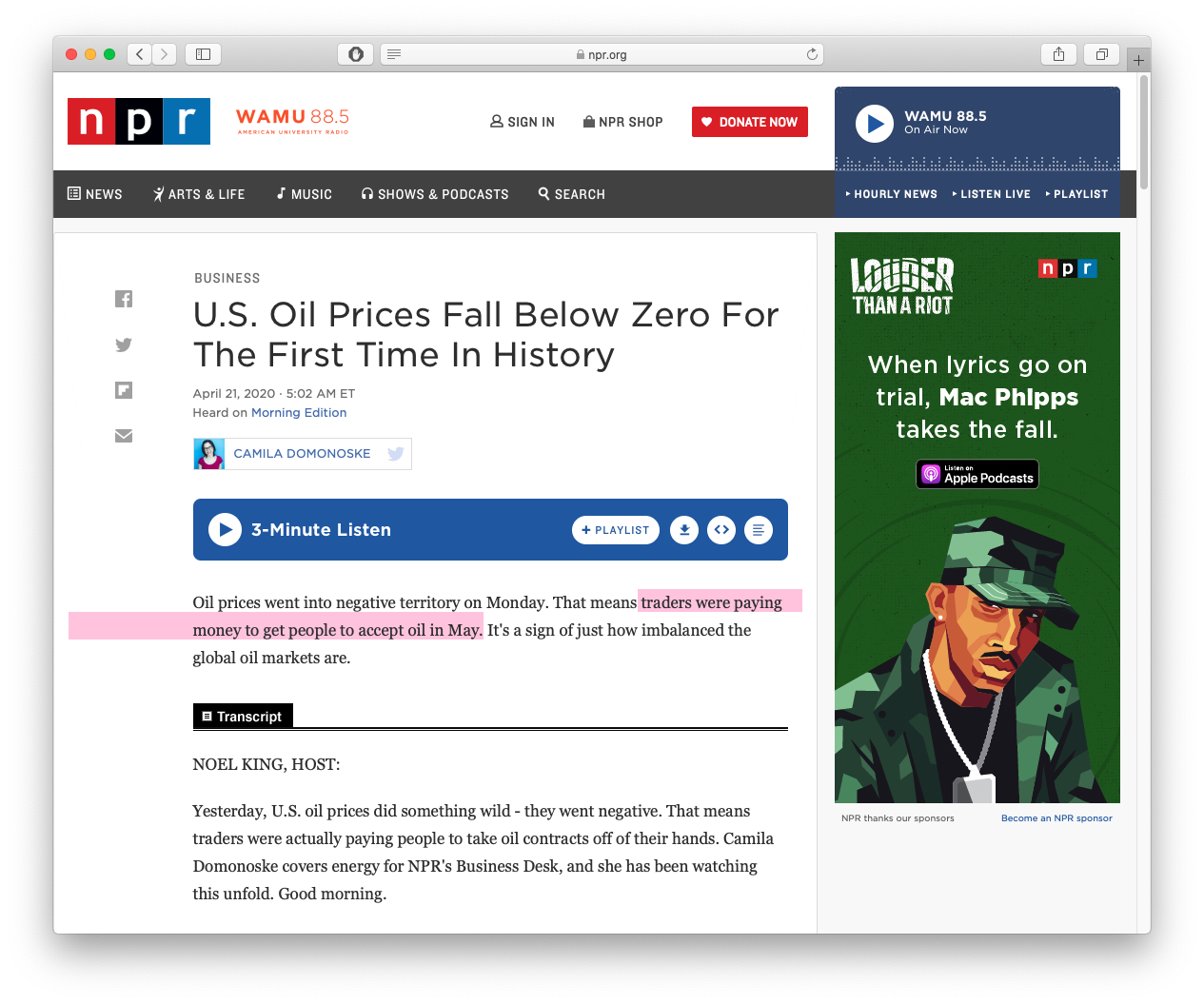

- Futures markets: where people buy/sell claims on future goods at specified prices

- e.g. “10 barrels of oil at $30/barrel, delivered on November 2021”

- allows producers to minimize their exposure to major price swings

Knowledge, “Speculation,” and Prices

Knowledge, “Speculation,” and Prices

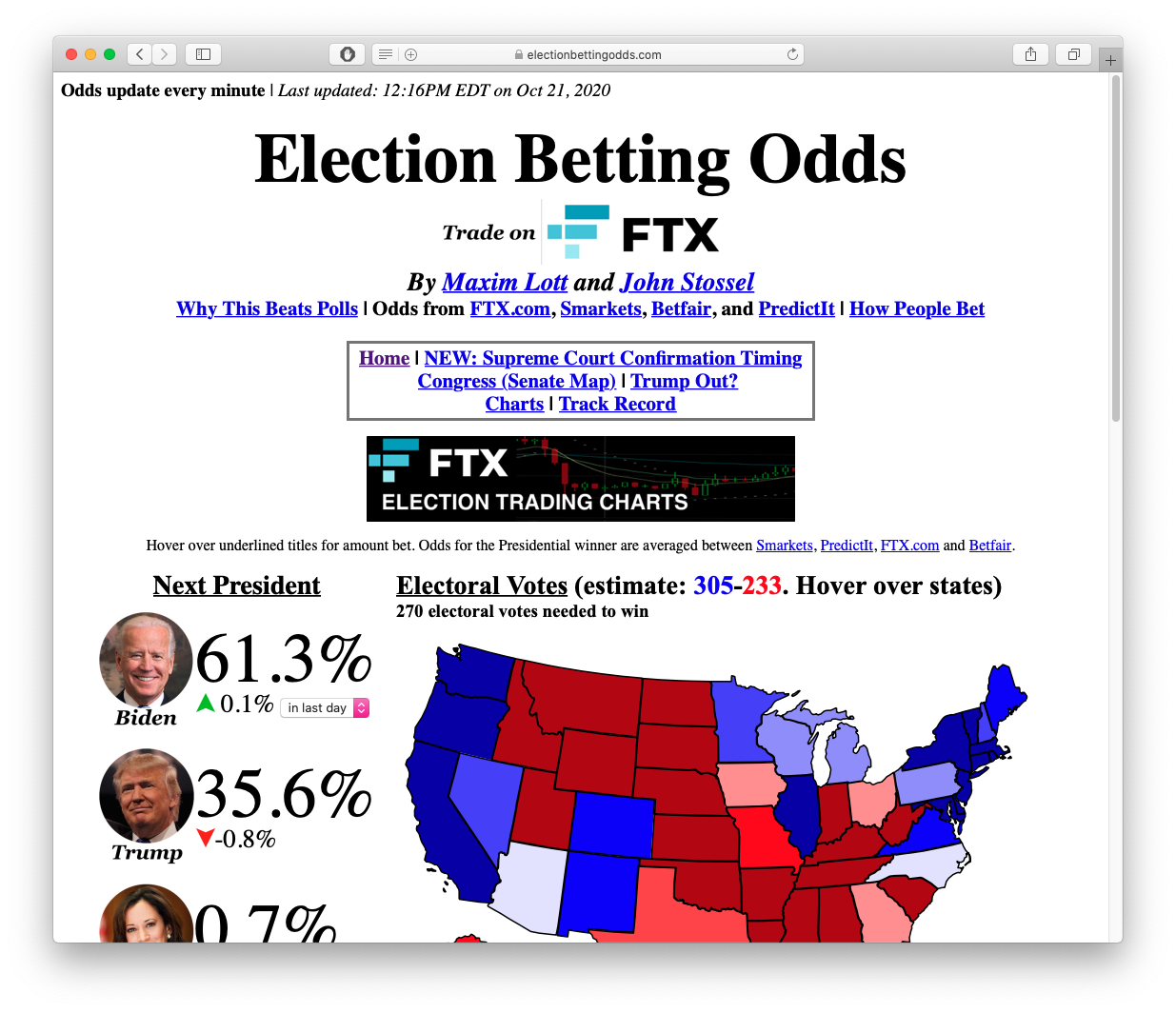

Prediction markets: where people buy/sell claims on verifiable future outcomes at specified prices

- Hope to profit on information you believe to be true

- Provides incentives for people to reveal private information for public benefit

If you want to know what somebody truly believes, leverage the power of prices and make a bet

- Forces them to “put their money where their mouth is” and make a costly tradoff: false beliefs vs. losing money

Knowledge, “Speculation,” and Prices

Uncertainty, Tacit Information, and Profit I

Economic theory: in a perfectly competitive market, in the long run, economic profit → to zero

Real world: there are often economic profits

Our blackboard models assume perfect information

In reality we have to deal with uncertainty

Uncertainty, Tacit Information, and Profit II

People don't know what the right price is: mispricing and multiple prices → arbitrage/profit opportunities

- Some people recognize opportunities ($20 bills) that others do not see

In a world of certainty, there would be no profit

Uncertainty, Tacit Information, and Profit III

Reminder: Profits and Entrepreneurship

In markets, production faces profit-test:

- Is consumer's willingness to pay > opportunity cost of inputs?

Profits are an indication that value is being created for society

Losses are an indication that value is being destroyed for society

Survival for sellers in markets requires firms continually create value and earn profits or die

Why We Need Prices, Profits, and Losses I

People often confuse the economic problem with a technological problem

Technological problem: how to allocate scarce resources to accomplish a particular goal

- e.g. buy the right combination of goods to maximize utility

- e.g. buy the right combination of inputs and produce output to maximize profits

- given stable prices, preferences, and technologies, a computer can solve this problem

Why We Need Prices, Profits, and Losses II

Economic calculation problem: how to determine which of the infinite technologically-feasible options are economically viable?

How to best make use of dispersed knowledge to coordinate conflicting plans of individuals for their own ends?

ONLY through competition, prices, profits, and losses

What if there Were No Prices? I

What if there Were No Prices? II

So How Did The Soviet Union “Work” For So Long?

See lesson 11 in my Economics of Development Course: Russia and the Post-Communist Transition