3.5 — Intro to Political Economy

ECON 306 · Microeconomic Analysis · Fall 2020

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/microF20

microF20.classes.ryansafner.com

Welfare Economics, Reminder

Markets are great when:

- They are Competitive: many buyers and many sellers

- They each equilibrium (prices are free to adjust): absence of transactions costs or policies preventing prices from adjusting to meet supply and demand

- There are no externalities are present: costs and benefits are fully internalized by the parties to transactions

If any of these conditions are not met, we have market failure

- May be a role for governments, other institutions, or entrepreneurs to fix

Welfare Economics, Reminder

Markets are great when:

- They are Competitive: many buyers and many sellers

- They each equilibrium (prices are free to adjust): absence of transactions costs or policies preventing prices from adjusting to meet supply and demand

- There are no externalities are present: costs and benefits are fully internalized by the parties to transactions

If any of these conditions are not met, we have market failure

- May be a role for governments, other institutions, or entrepreneurs to fix

- Let’s first talk about #2

Policies That Raise Transaction Costs & Prevent Equilibrium

Dis-equilibrated Markets

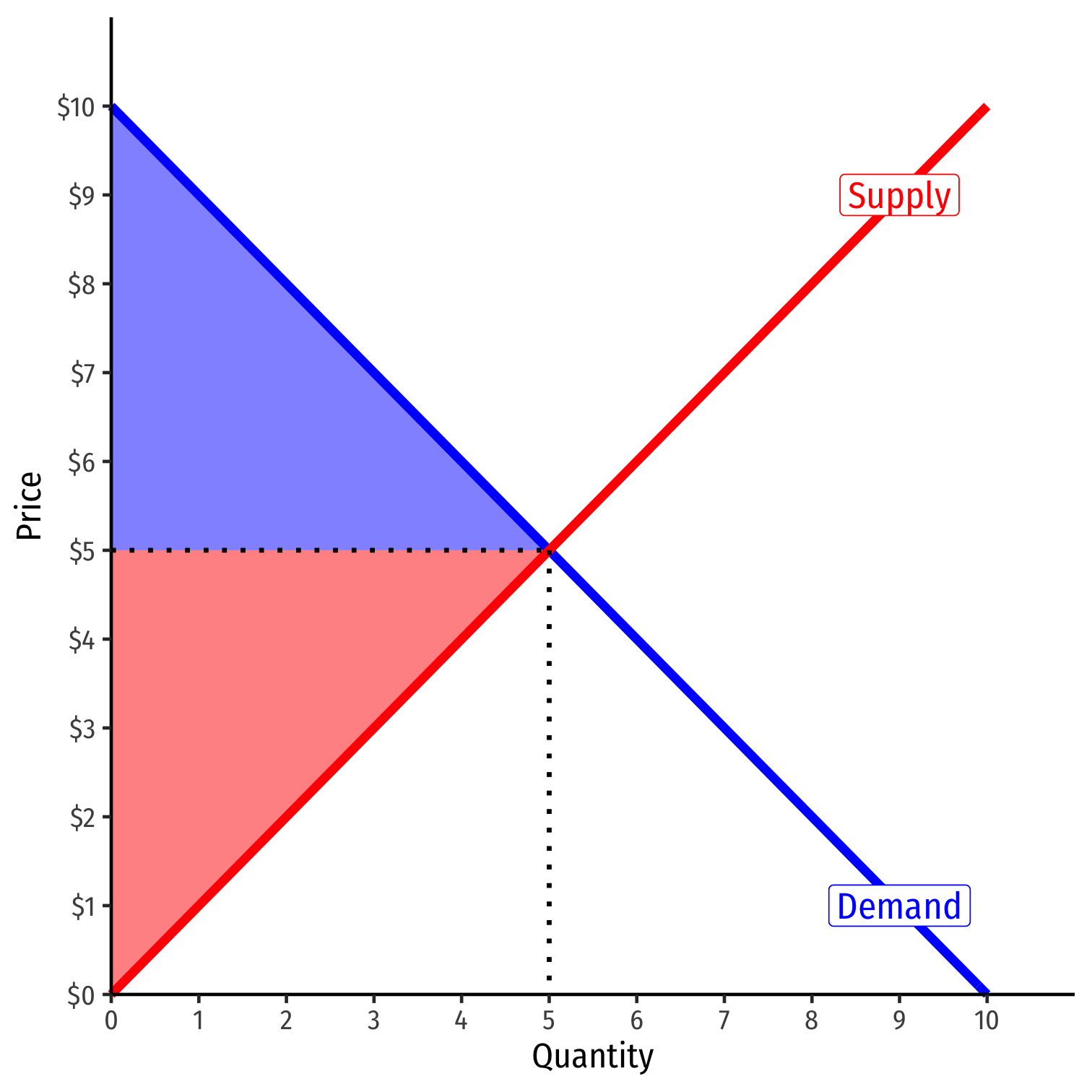

The static benefits of markets all come from markets being in equilibrium:

- allocative efficiency (CS+PS)

- Pareto efficiency

- productive efficiency

But don’t forget the dynamic benefits of markets as a discovery process! (class 3.3)

- discovery of better allocations of resources

- creation & elimination of profit opportunities

- entrepreneurship & innovation

Dis-equilibrated Markets

To reach equilibrium, market prices need to be able to adjust

- Shortage: price needs to rise

- Surplus: price needs to fall

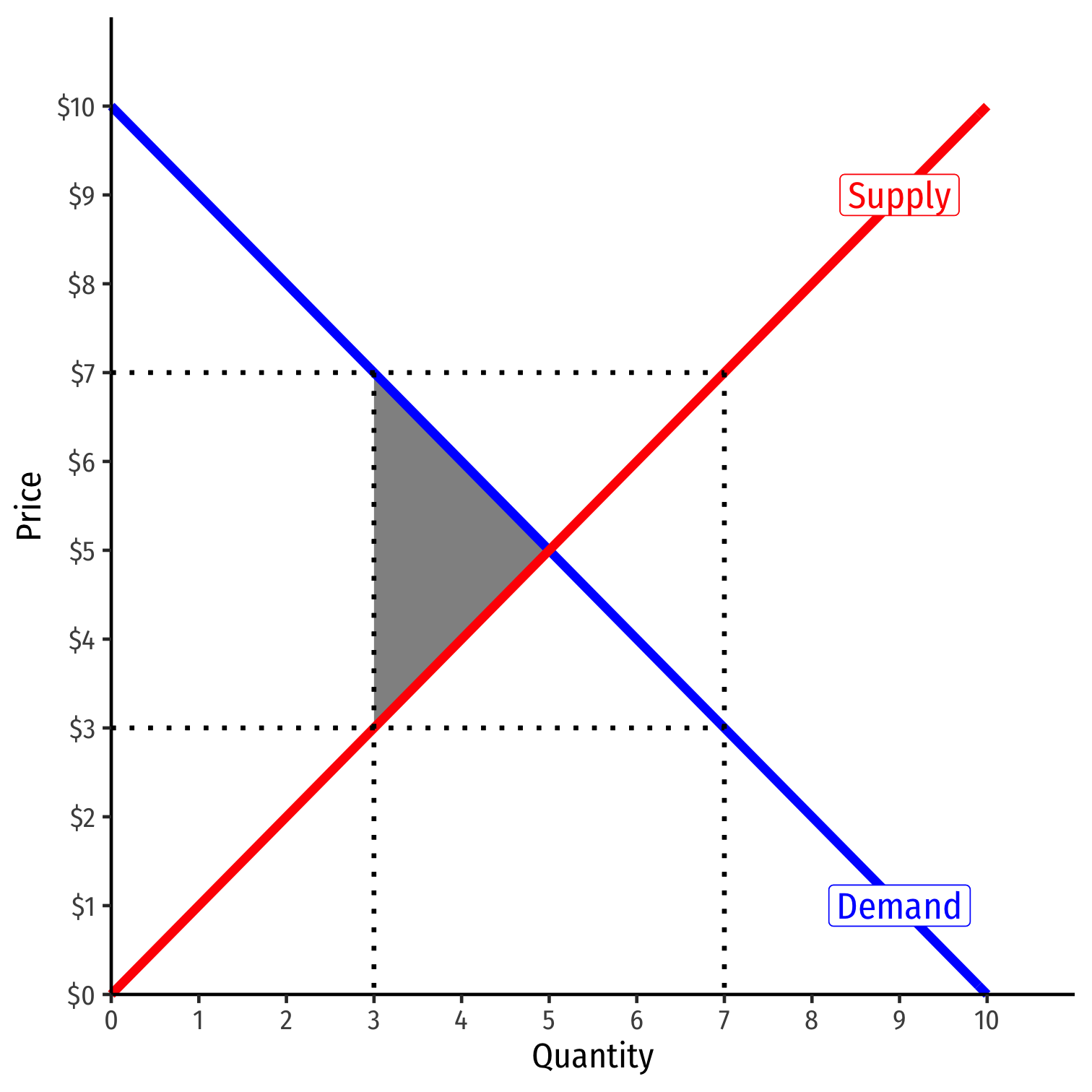

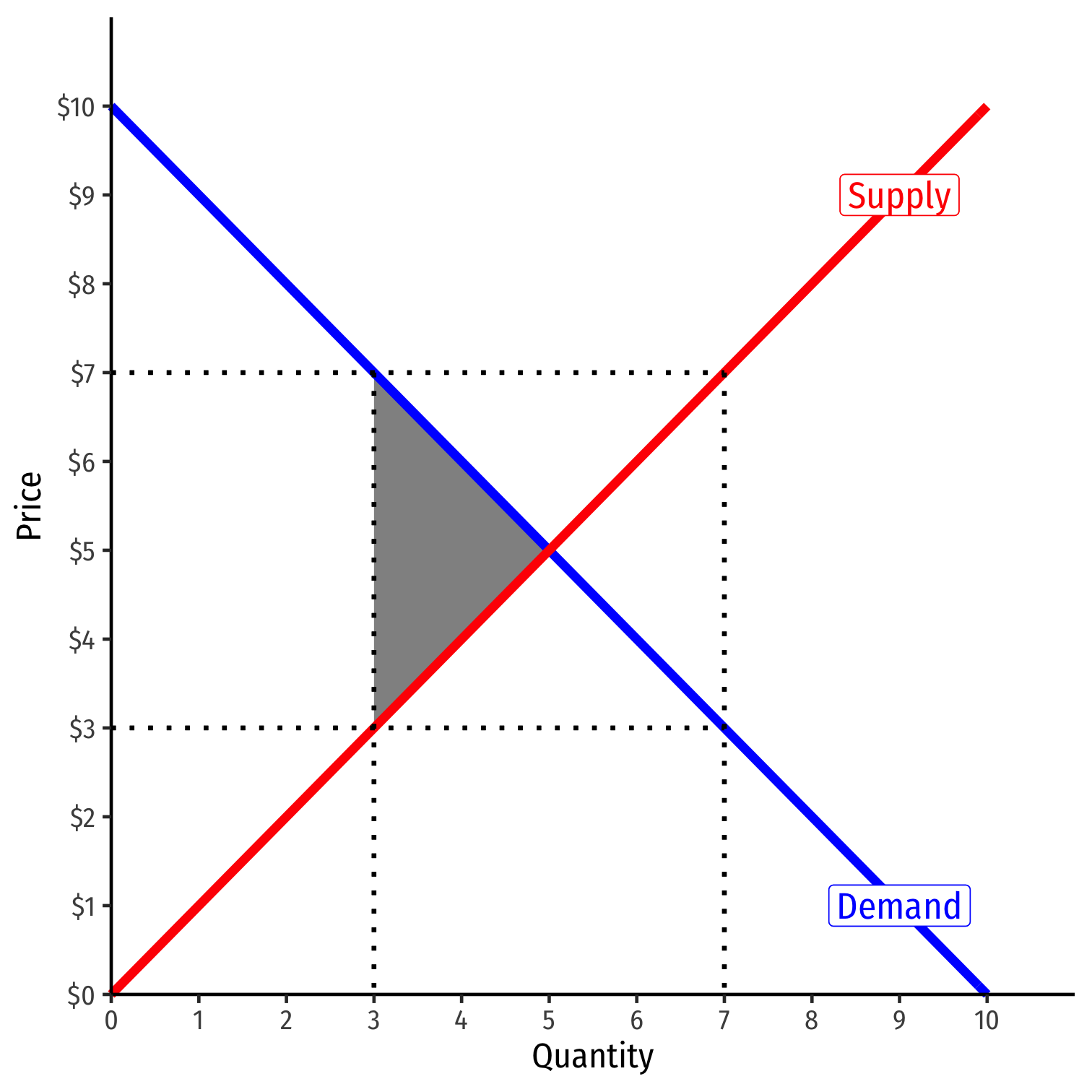

There are unrealized gains from trade that exist in disequilibrium (shaded)

- Buyers & sellers both can be made better off if they can adjust the price

Dis-equilibrated Markets

If market prices are prevented from adjusting, shortage/surplus becomes permanent

Lost CS and/or PS: Deadweight loss (DWL)

- inefficiency created by (permanent) diseq.

Various government policies can prevent markets from equilibrating & create DWL:

- Price regulations (price ceiling like rent control, price floor like minimum wage)

- Taxes, subsidies, tariffs, quotas†

- These should have been covered in Principles

† Some may be necessary (taxes fund government), but create market inefficiencies.

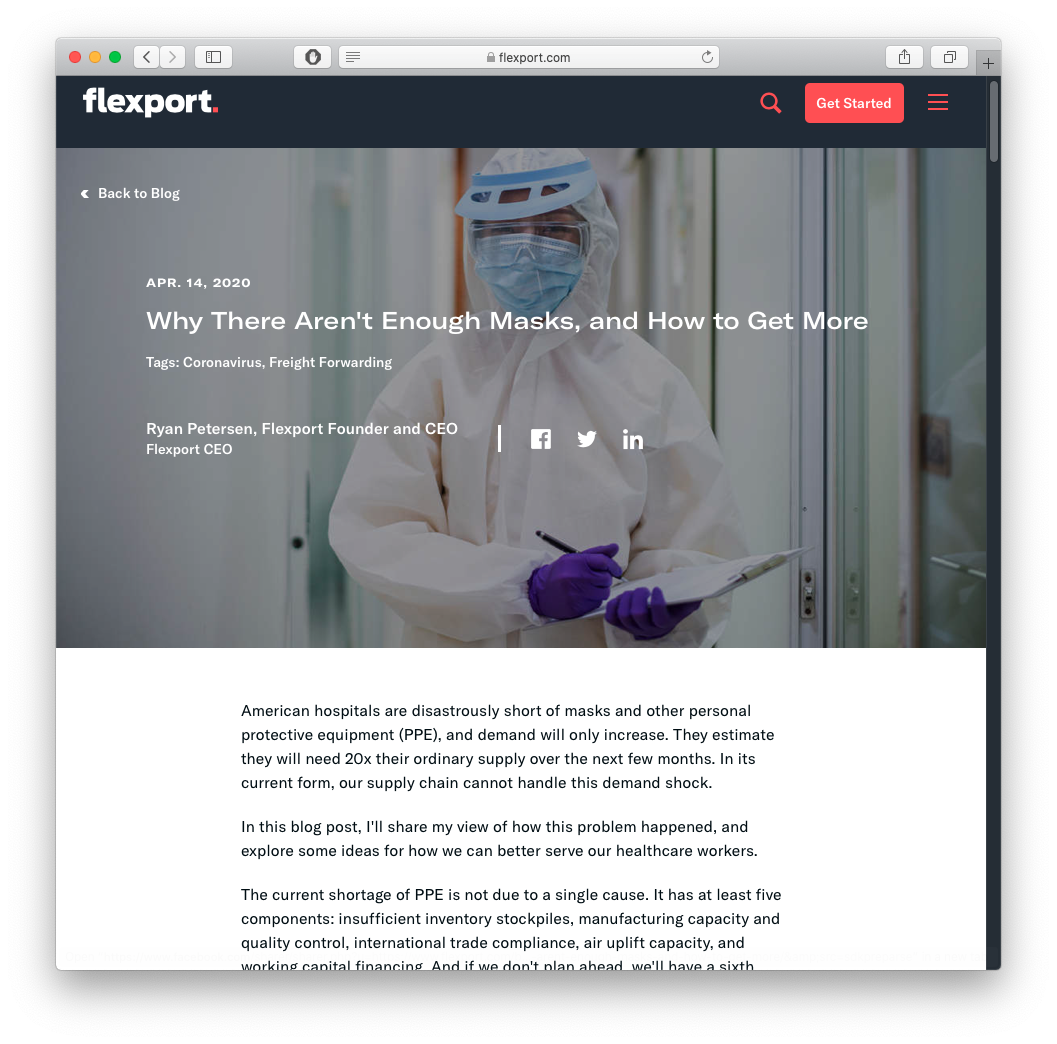

An Example: Some Economic Impacts of Covid

An Example: Some Economic Impacts of Covid

The toilet paper aisle of my Giant grocery store, March 2020

Where did all of the ... go?

- Toilet paper

- Hand sanitizer

- Masks

- PPE

- Ventilators

Three major issues:

- price elasticity of supply

- price gouging laws

- restrictions & regulations on supply

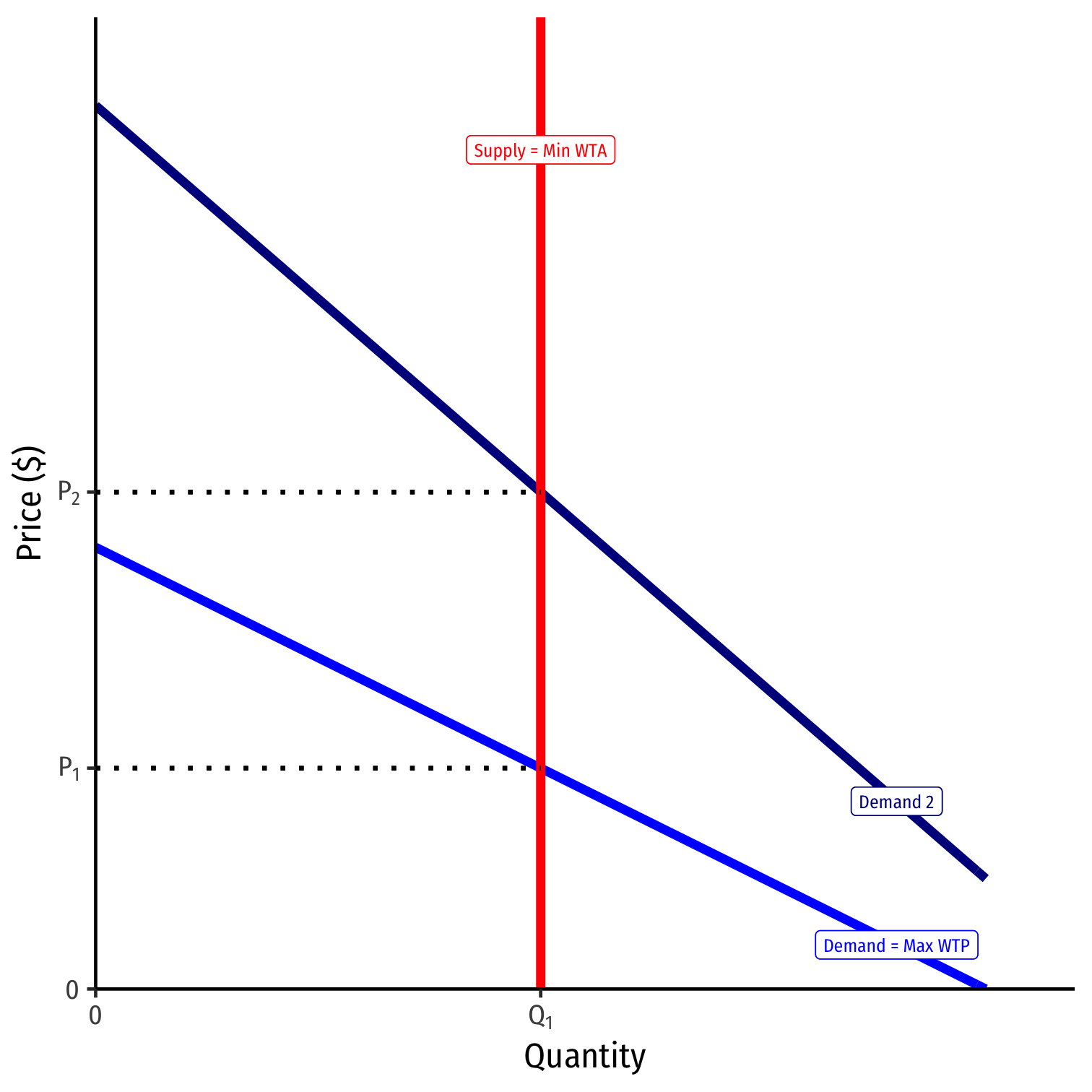

Increase in Demand

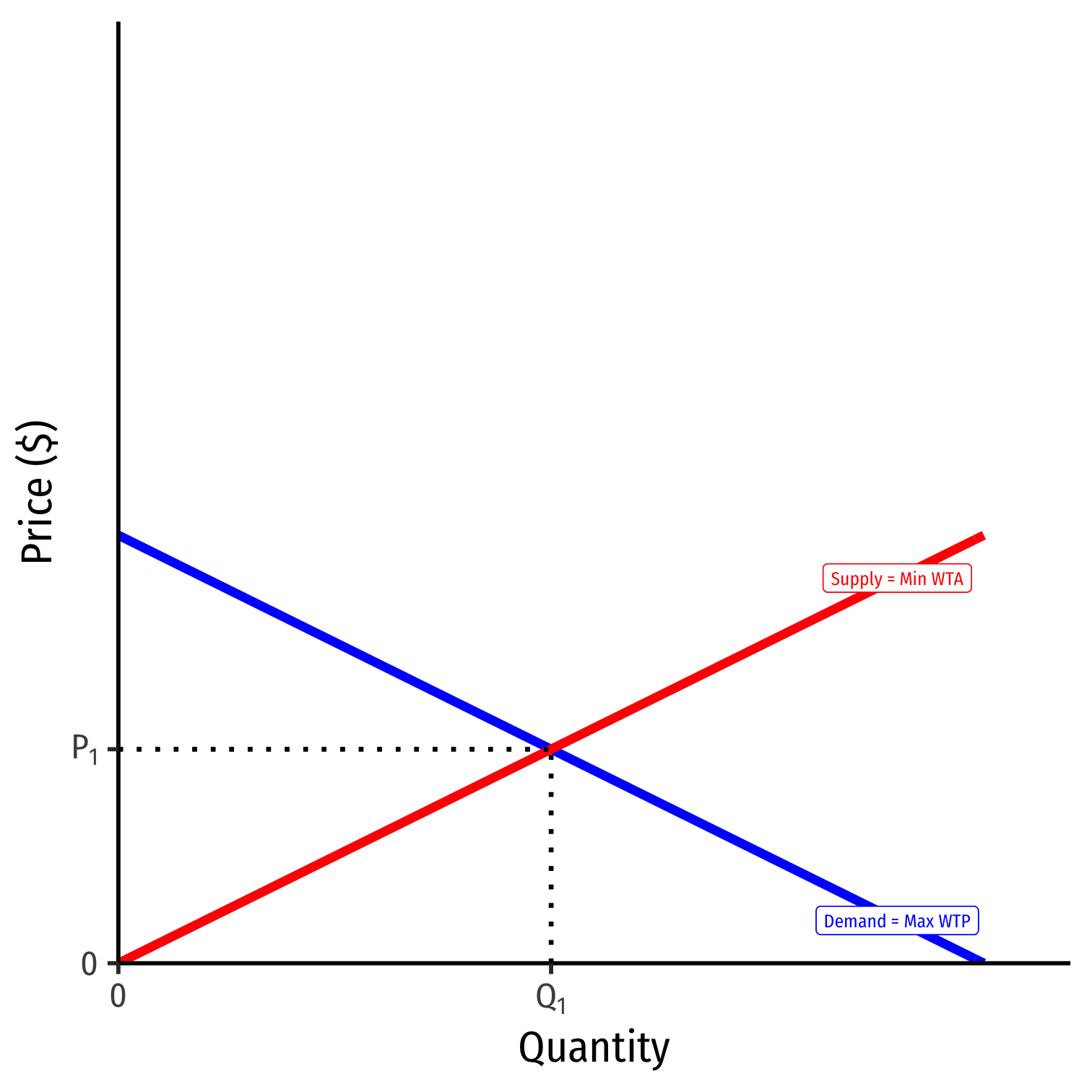

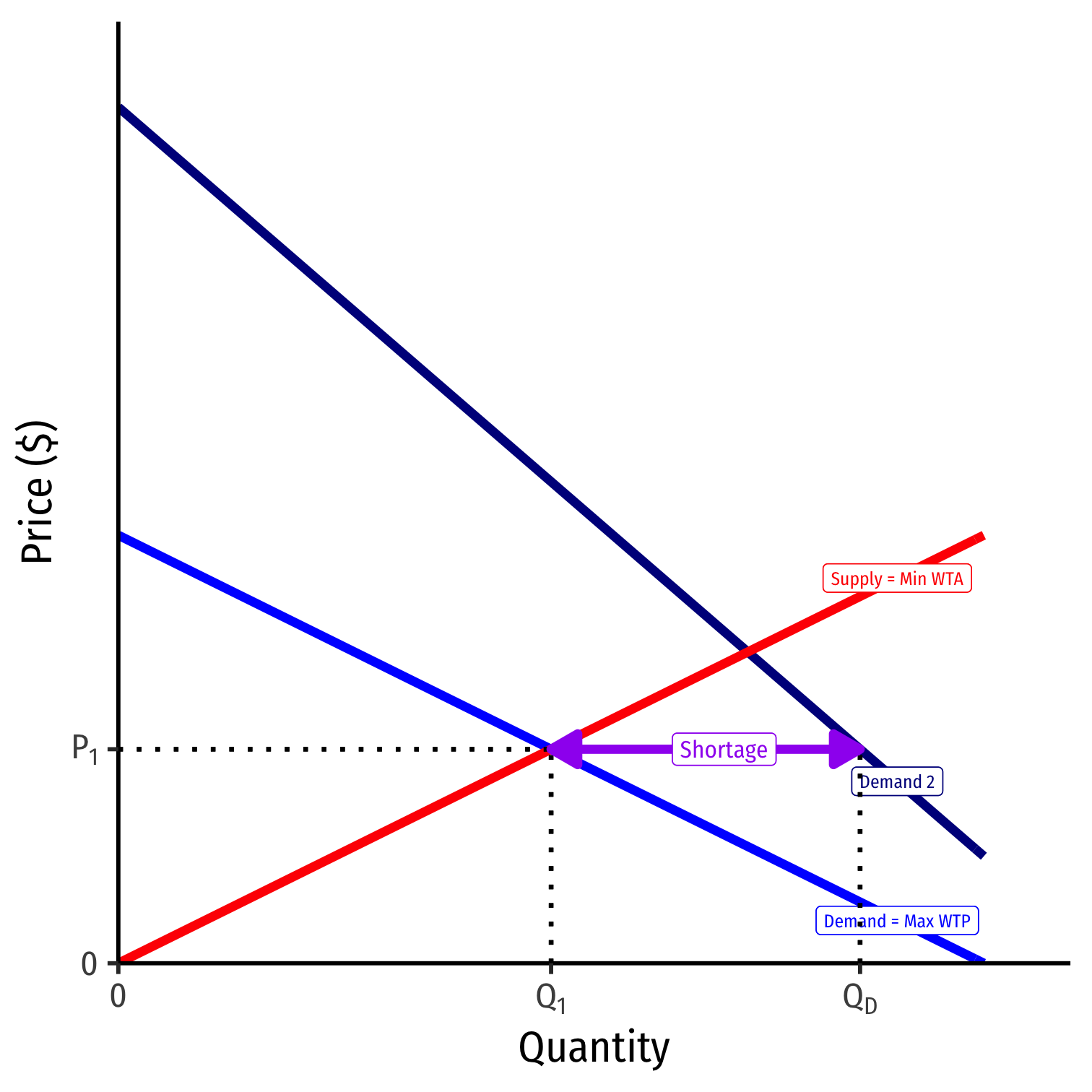

- Consider a market for a good in equilibrium, P1

Increase in Demand

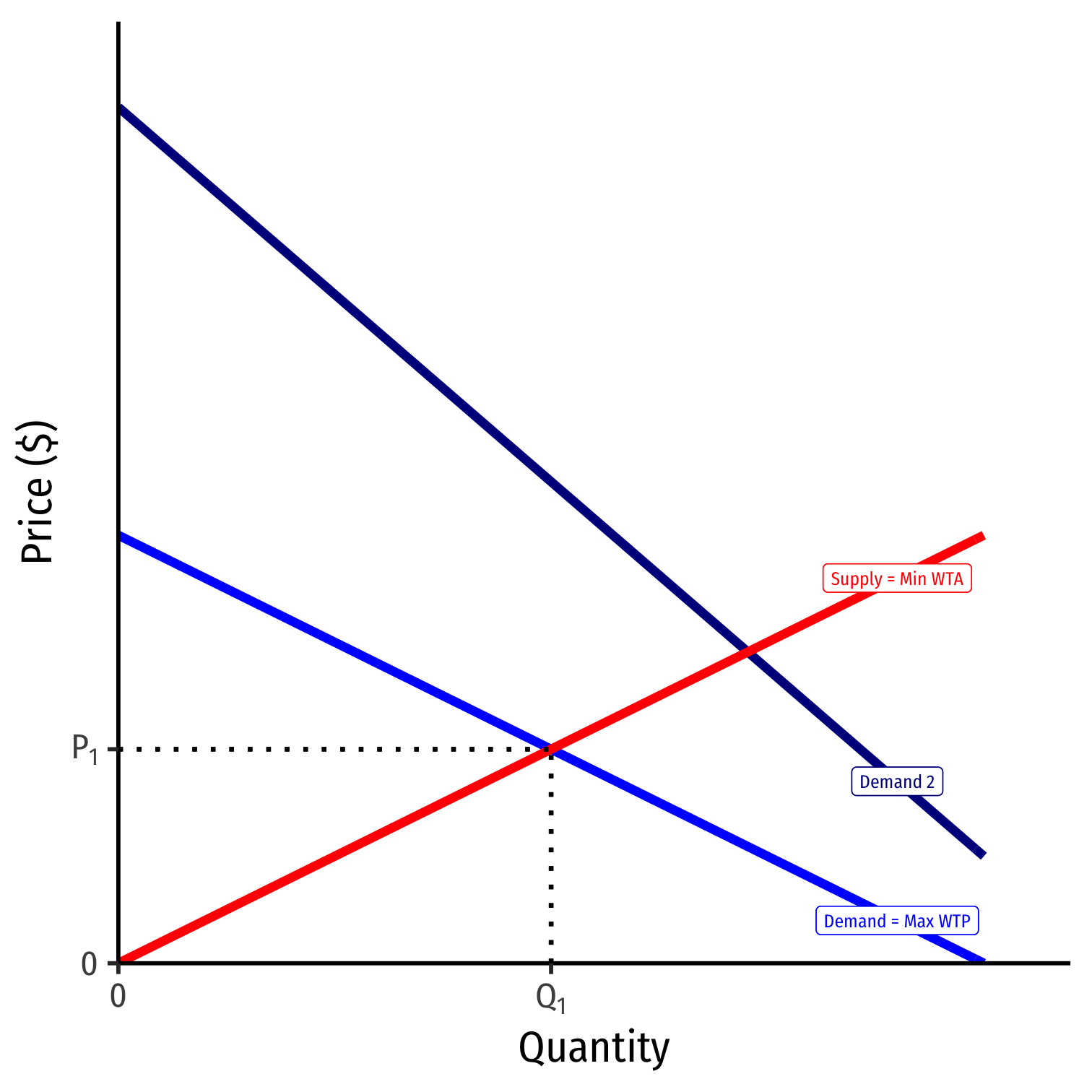

More individuals want to buy more of the good at every price

Demand increases, becomes less elastic

Increase in Demand

More individuals want to buy more of the good at every price

Demand increases, becomes less elastic

At the original market price, a shortage! (qD>qS)

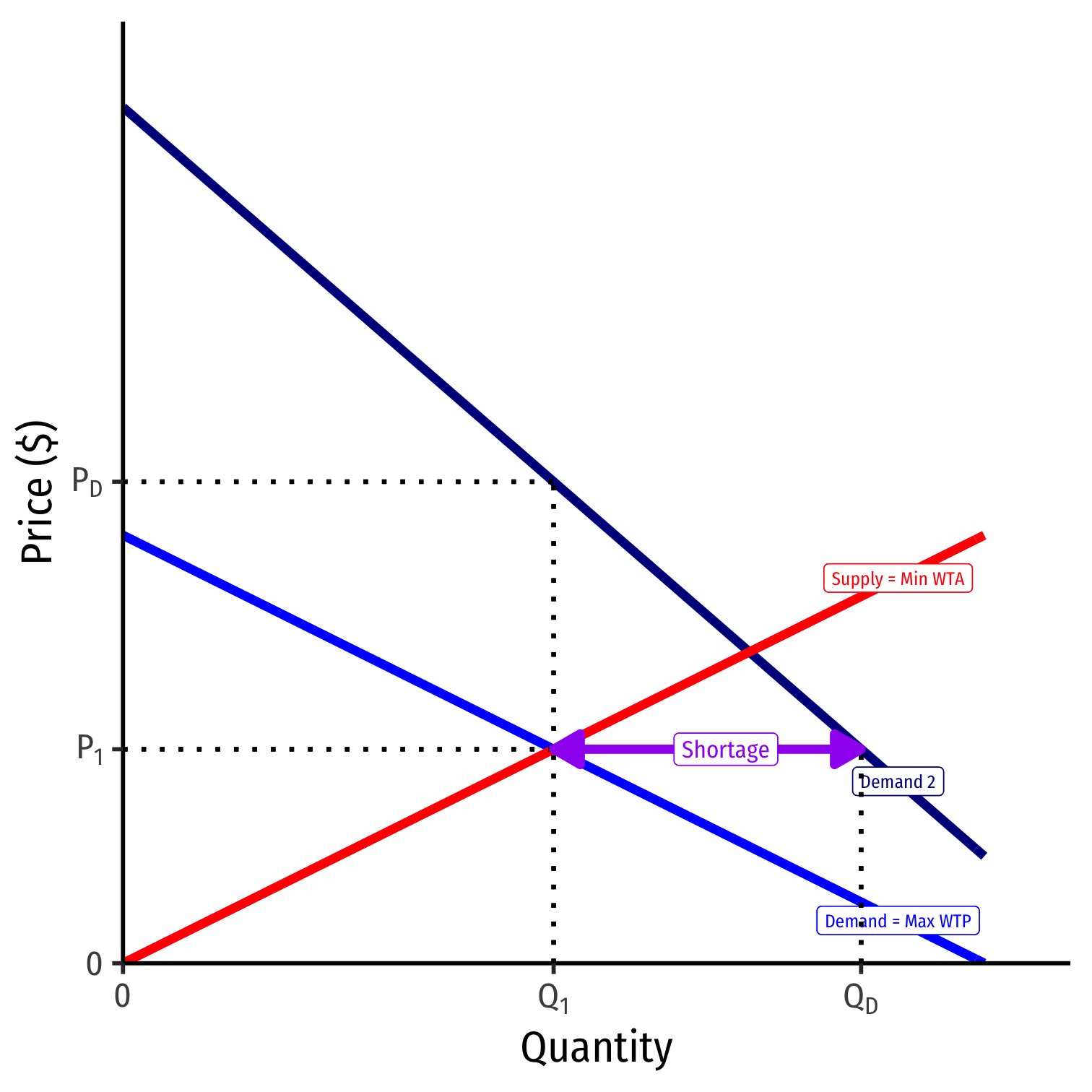

Increase in Demand

More individuals want to buy more of the good at every price

Demand increases, becomes less elastic

At the original market price, a shortage! (qD>qS)

Sellers are supplying Q1, but some buyers willing to pay more for Q1

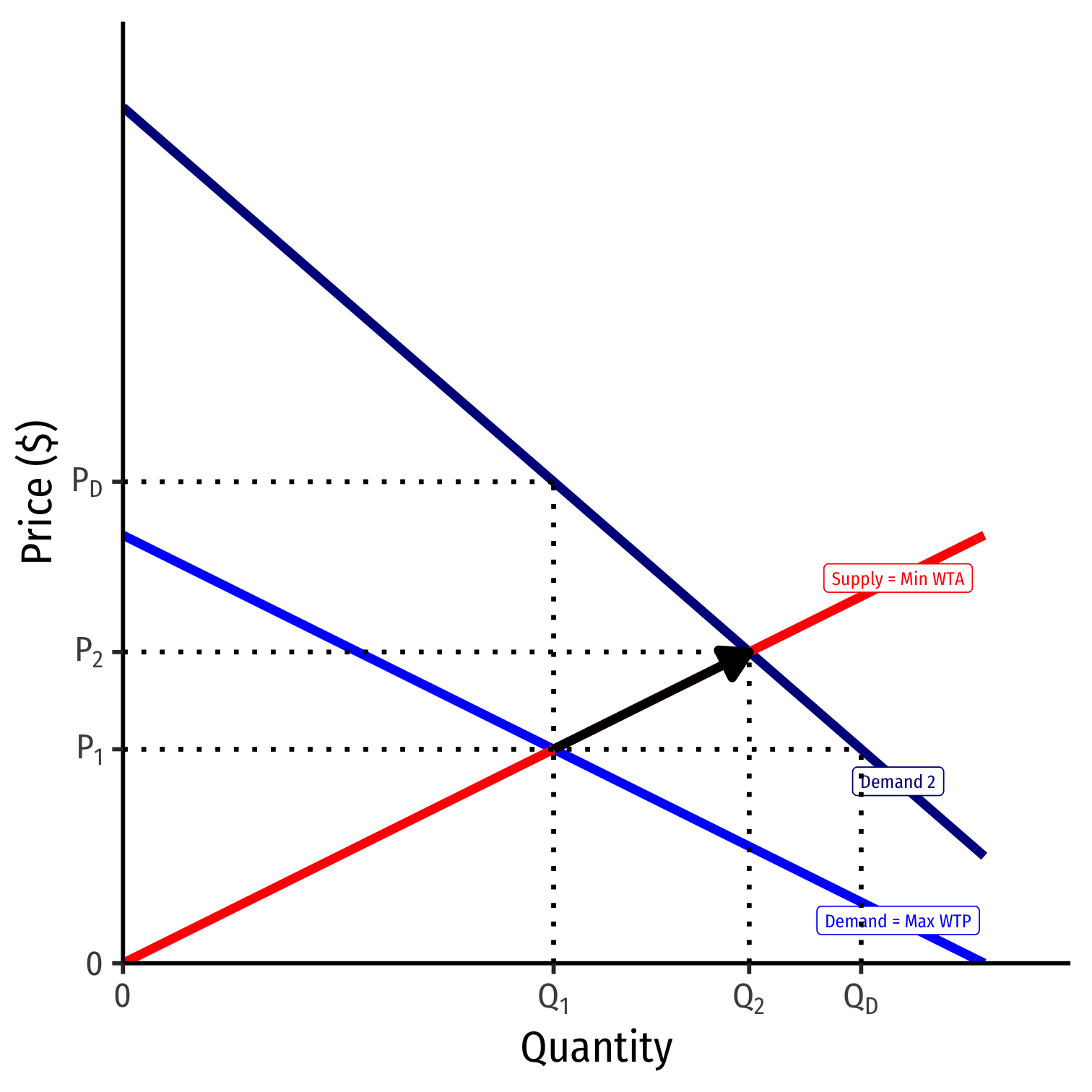

Increase in Demand

More individuals want to buy more of the good at every price

Demand increases, becomes less elastic

At the original market price, a shortage! (qD>qS)

Sellers are supplying Q1, but some buyers willing to pay more for Q1

Buyers raise bids, inducing sellers to sell more

Reach new equilibrium with:

- higher market-clearing price (P2)

- larger market-clearing quantity exchanged (Q2)

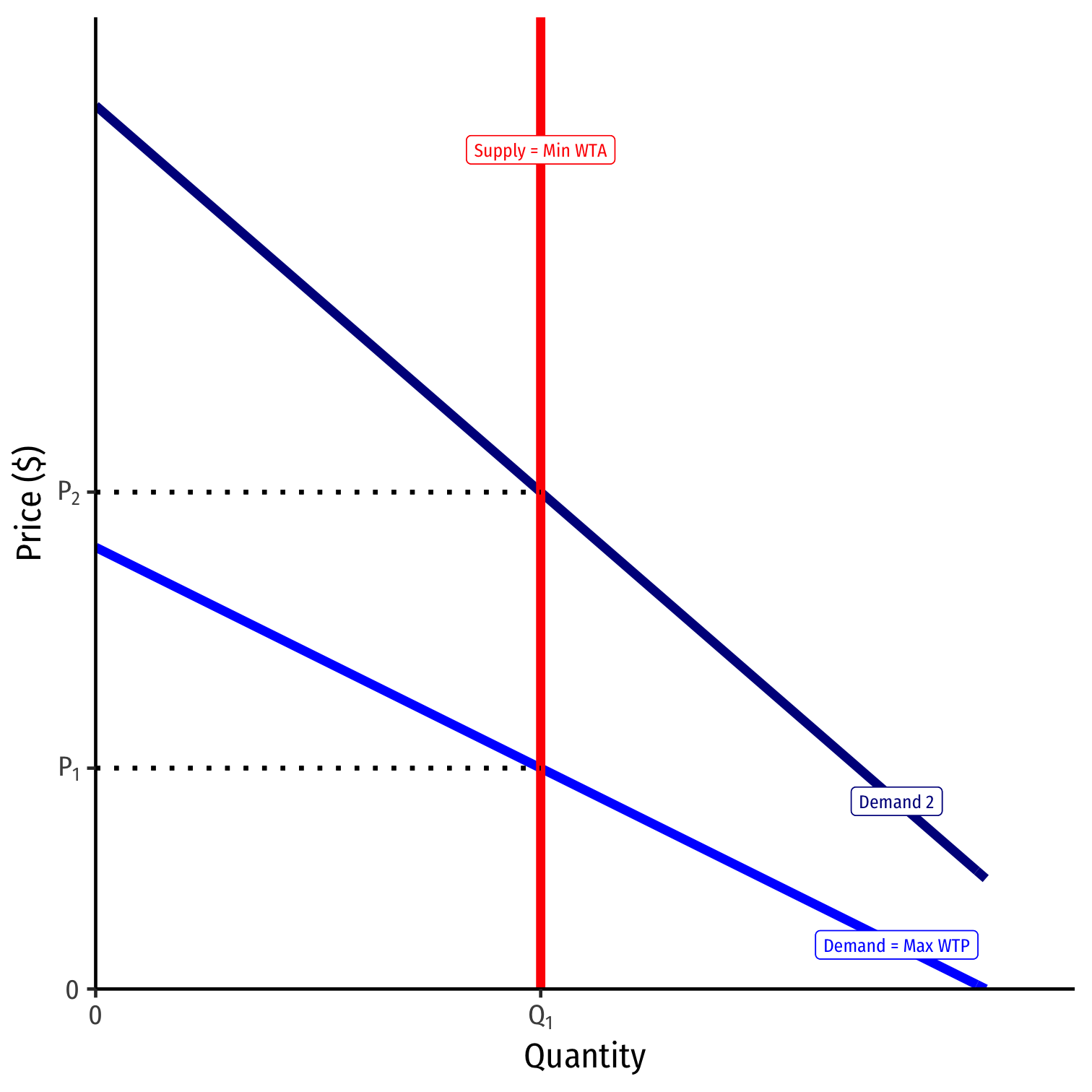

One Possibility: Inelastic Supply

It might that supply is very inelastic

- Here: perfectly inelastic (for convenience)

Suppliers can’t produce and sell more units even if they want to at very high price demanded

- sudden shock to inventories (short run)

- rising production costs

- government regulations & restrictions

Thus, the new high price is an equilibrium that will persist for a while

- no “inefficiency,” just a fixed supply of goods we cannot easily change

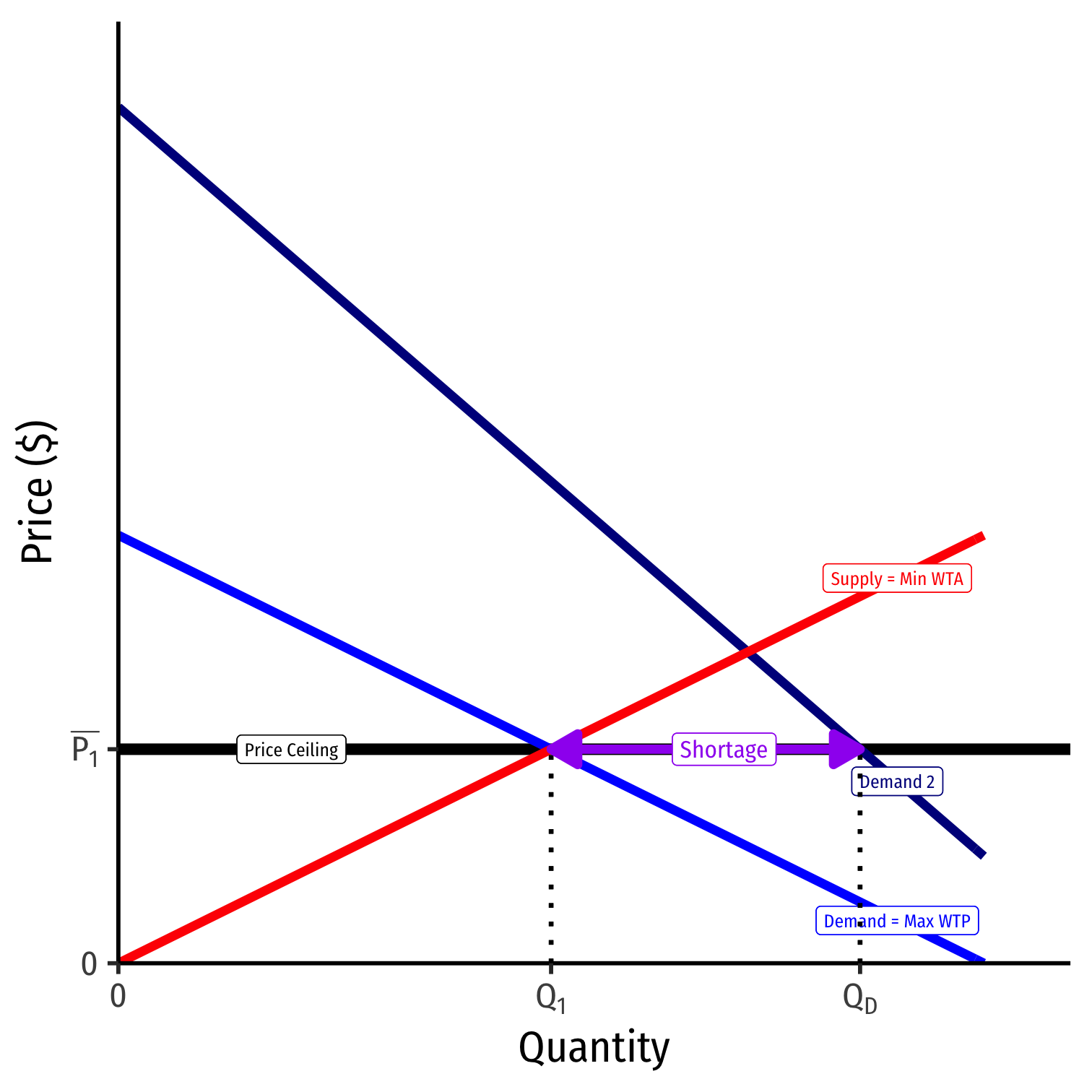

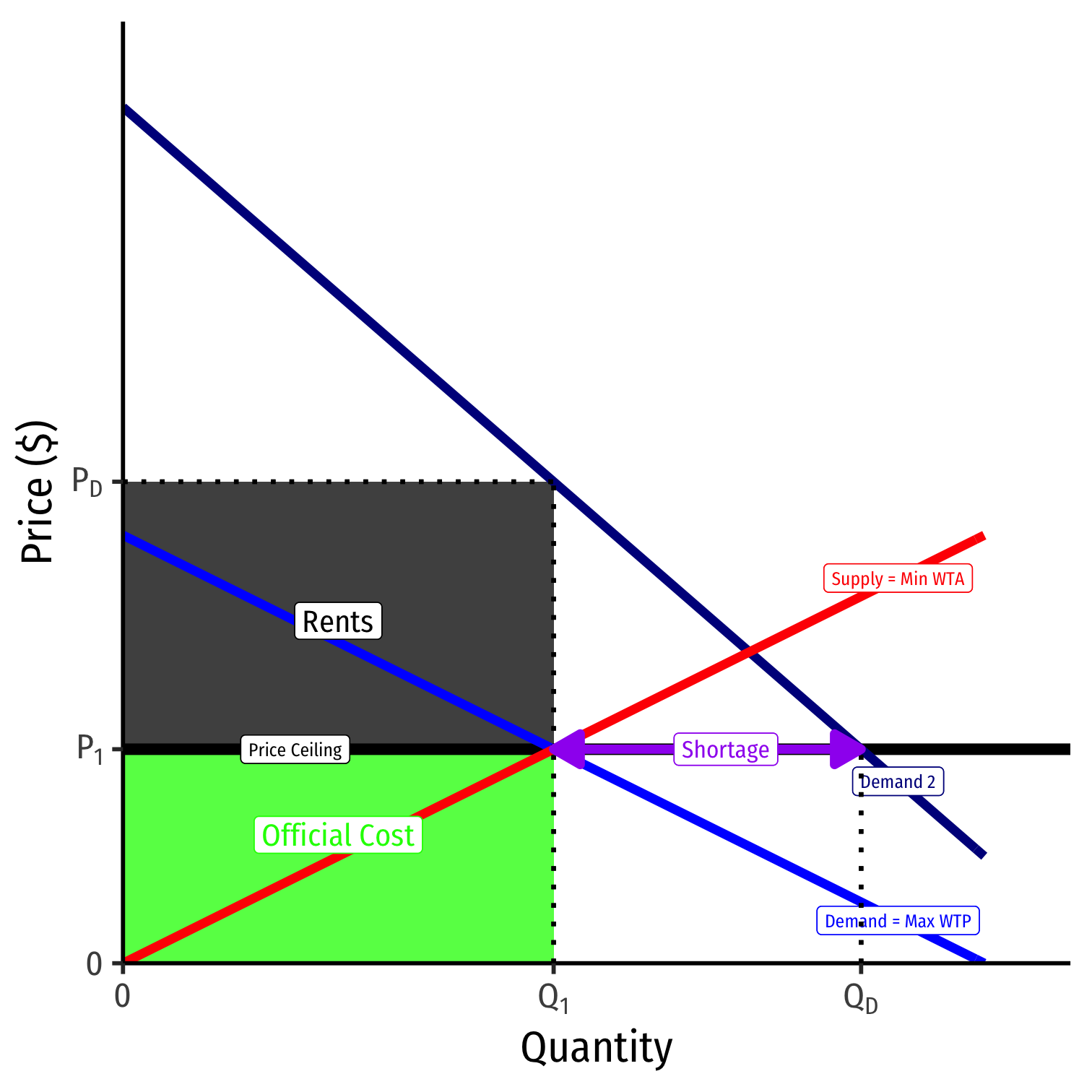

Price Gouging Laws

Additionally, government has anti-price-gouging laws, a price ceiling at the original price, P1

Qd>Qs: excess demand, a shortage!

Sellers will not supply more than Q1 at price ¯P1

Price Gouging Laws

Additionally, government has anti-price-gouging laws, a price ceiling at the original price, P1

Qd>Qs: excess demand, a shortage!

Sellers will not supply more than Q1 at price ¯P1

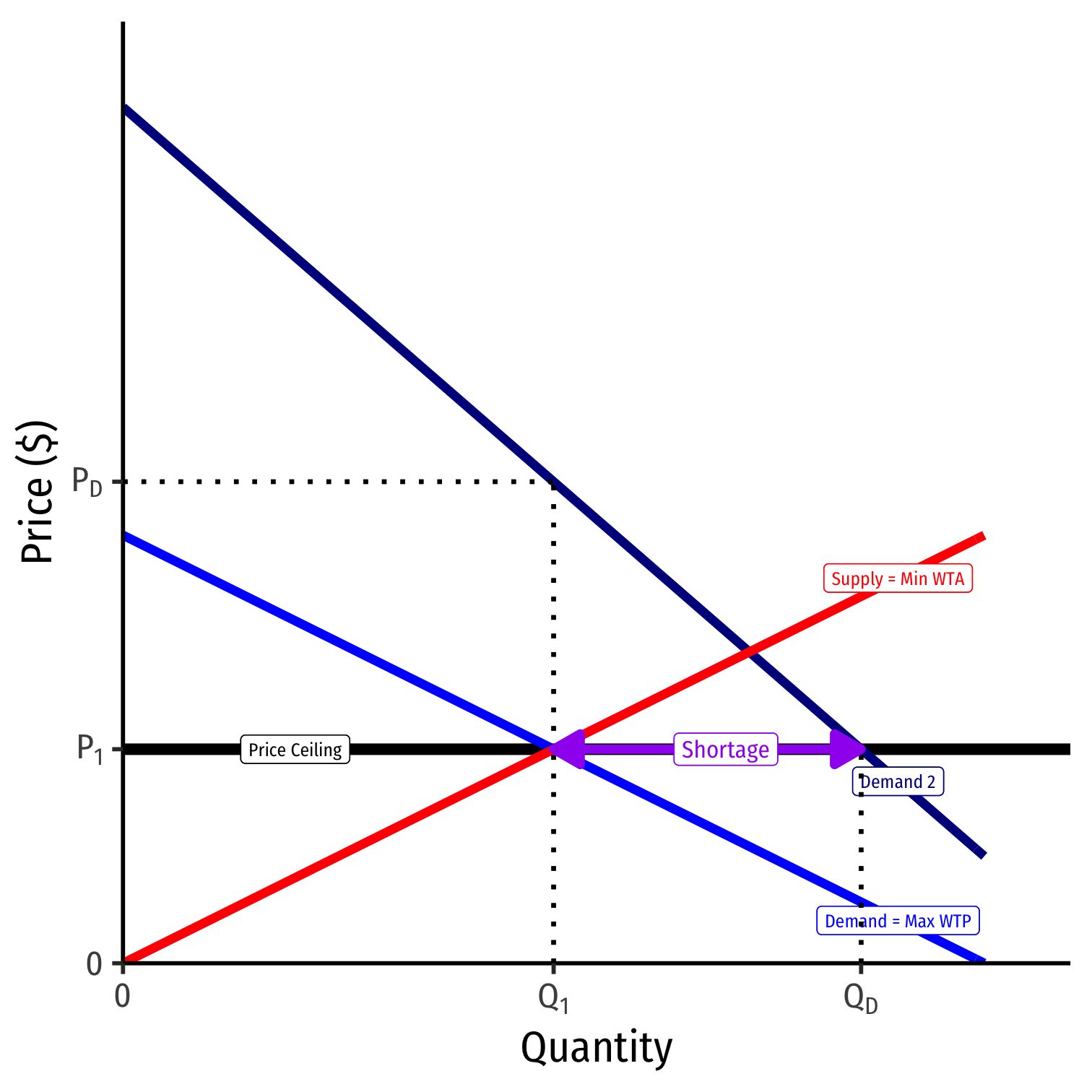

For Q1 units, buyers are willing to pay PD!

Price Gouging Laws

If prices were allowed to adjust: buyers would bid higher prices to get the scarce Qs goods

Sellers would respond to rising willingness to pay, and produce and sell more

But the price is not allowed to rise above ¯P1!

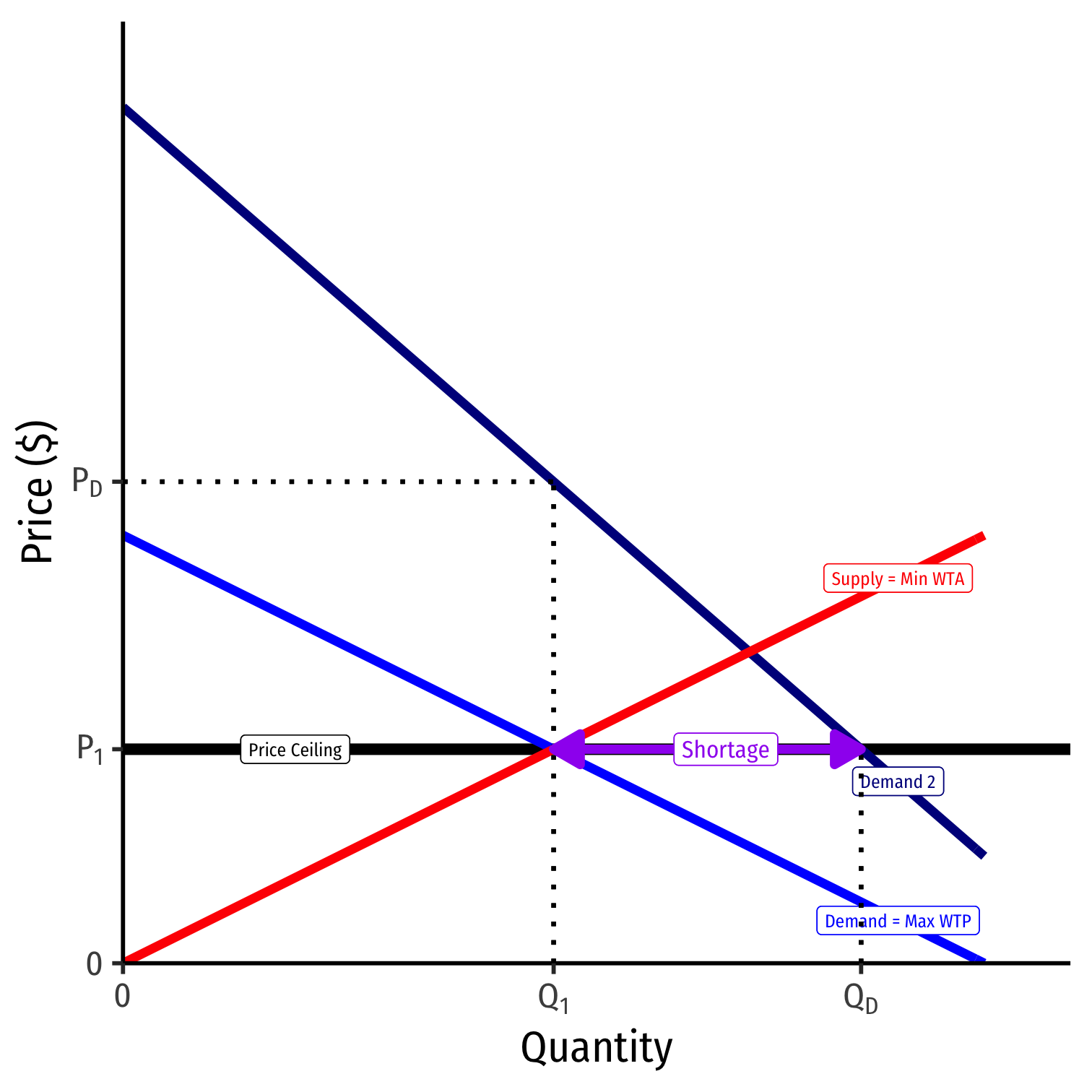

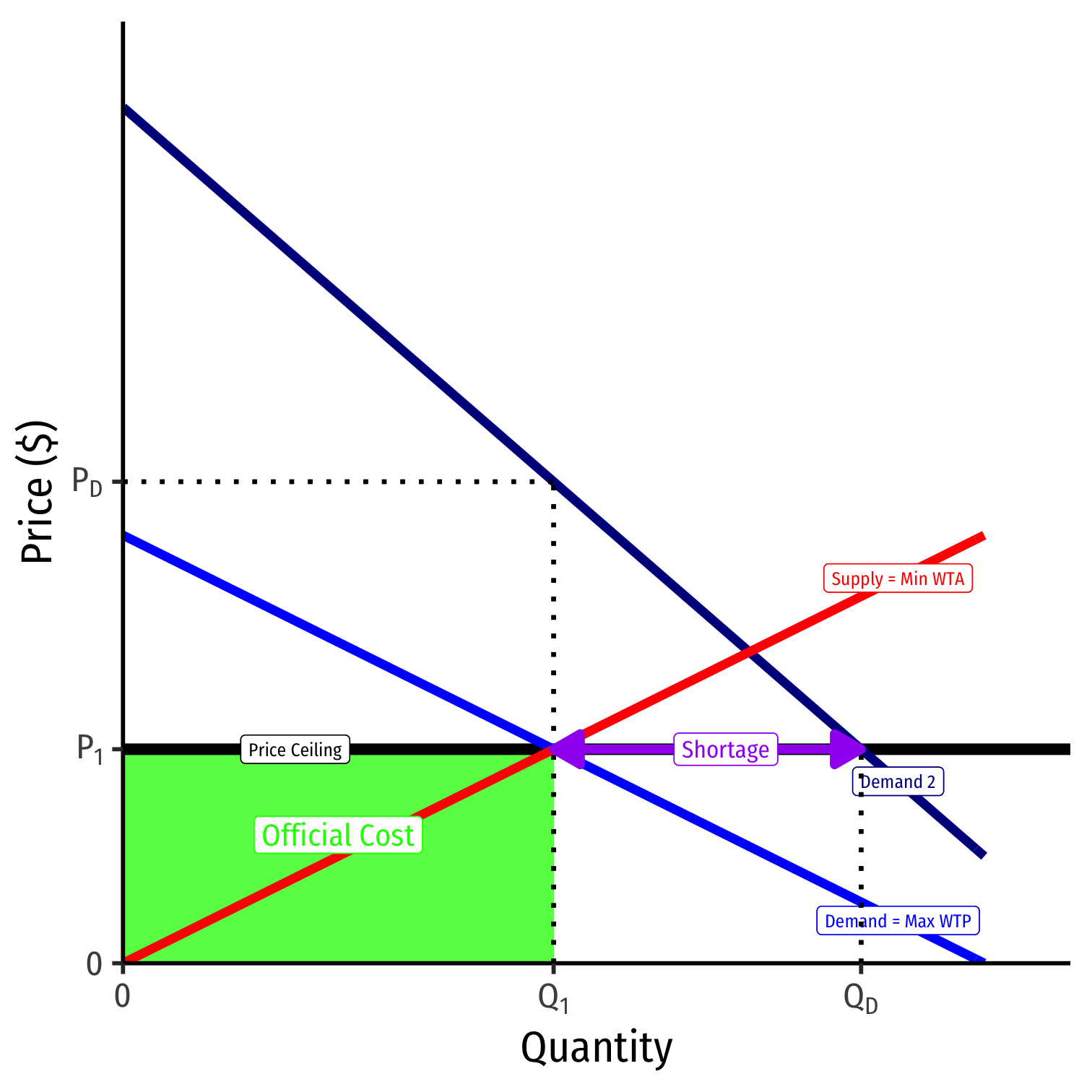

Price Gouging Laws

- Official price is ¯P1, sellers gain monetary revenues

Price Gouging Laws

Official price is ˉP, sellers gain monetary revenues

Competition exists between buyers to obtain scarce Qs goods

- Buyers willing to pay PD unofficially

Goods are distributed by non-market means:

- Queuing

- Black markets

- Political connections, favors, corruption

Economic rents: excess resturns (above cost) go to those who own & distribute the scarce goods

(Temporarily) Raising Prices Can Solve the Shortage

A relatively high price:

Conveys information: good is relatively scarce

Creates incentives for:

- Buyers: conserve use of this good, seek substitites

- Sellers: produce more of this good

- Entrepreneurs: find substitutes and innovations to satisfy this unmet need

(Temporarily) Raising Prices Can Solve the Shortage

"The Canadian National Post, citing the Canadian Food Inspection Agency, says that 'There are no shortages or disruptions to [food] production, importation or export,' and that 'the shelves remain stocked.' ... 'A price surge as a result of natural market forces is not something that is regulated by Canadian competition laws or otherwise. Canada’s competition laws generally don’t interfere with the free market.' ... Canadians will have enough food to eat. But it will be more expensive.

(Temporarily) Raising Prices Can Solve the Shortage

A supermarket in Denmark got tired of people hoarding hand sanitizer, so came up with their own way of stopping it.

— Birger (@Birger_s) March 18, 2020

1 bottle kr40 (€5.50)

2 bottles kr1000 (€134.00) each bottle.

Hoarding stopped!#COVID19 #Hoarding pic.twitter.com/eKTabEjScc (via @_schuermann) cc @svenseele

Forcing Low Prices Doesn't Solve the Shortage

Supply-Side Restrictions & Regulatory Burden

"As the nation’s economy and health-care system struggle to adjust to the pandemic, more and more states are reexamining some of their oldest occupational and business regulations—rules that, although couched as protecting consumers, do far more to limit competition...While some states have ordered their occupational-licensing boards to speed up the licensure of new health-care practitioners, others...are granting immediate licensing reciprocity to any practitioner licensed in any state...Even Florida, which has long jealously guarded its occupational-licensing regime to prevent semiretired snowbirds from poaching on the locals’ turf, [is] allowing out-of-state health-care providers to practice telemedicine in the state without a license."

Supply-Side Restrictions & Regulatory Burden

"Illinois has waived licensure fees for retired medical practitioners who wish to resume practice. Oklahoma and Massachusetts have eliminated restrictions that required doctors to have a preexisting doctor-patient relationship before they could offer telemedicine services."

Supply-Side Restrictions & Regulatory Burden

"Also being reexamined are state certificate-of-need, or CON, laws. A product of 1970s-era economic regulation, CON laws require health-care providers to prove that new services are “needed” before they may purchase certain large equipment, open new or expanded facilities, or—as is crucial now—offer home health-care services. Often, these laws give an effective veto power to existing medical providers, allowing them to torpedo new competition for their own benefit...Basic economics predicts that competition reduces prices for consumers, and occupational licensing works directly to stifle competition."

Supply-Side Restrictions & Regulatory Burden

"The University of Minnesota economist Morris Kleiner, a leading researcher on occupational licensing, estimates that licensing costs consumers nearly $200 billion annually. This might be justifiable if licensing produced substantial improvements in quality, yet most research has failed to find a connection between licensure and service quality or safety."

Supply-Side Restrictions & Regulatory Burden

How did the U.S. government only manage to produce a fraction as many testing kits as its peer countries? There have been three major regulatory barriers so far to scaling up testing by public labs and private companies: 1) obtaining an Emergency Use Authorization (EUA); 2) being certified to perform high-complexity testing consistent with requirements under Clinical Laboratory Improvement Amendments (CLIA);...

Supply-Side Restrictions & Regulatory Burden

...and 3) complying with the Health Insurance Portability and Accountability Act (HIPAA) Privacy Rule and the Common Rule related to the protection of human research subjects. On the demand side, narrow restrictions on who qualified for testing prevented the U.S. from adequately using what capacity it did have.

Making Fair Comparisons

Two Fundamental Problems of Political Economy

- All societies face two fundamental problems, which institutions emerge (or are created) to address:

The Knowledge Problem: How to coordinate the tacit, fragmented knowledge of opportunities and conditions dispersed across millions of individuals (and accessible to none in total) in order to maximize the ability of individuals to achieve their goals

Two Fundamental Problems of Political Economy

- All societies face two fundamental problems, which institutions emerge (or are created) to address:

The Knowledge Problem: How to coordinate the tacit, fragmented knowledge of opportunities and conditions dispersed across millions of individuals (and accessible to none in total) in order to maximize the ability of individuals to achieve their goals

The Incentives Problem: How to structure incentives that individuals face in a way that maximizes cooperative behavior (voluntary exchange and association) and minimizes non-cooperative behavior (cheating, opportunism, exploitation, violence, rent-seeking)

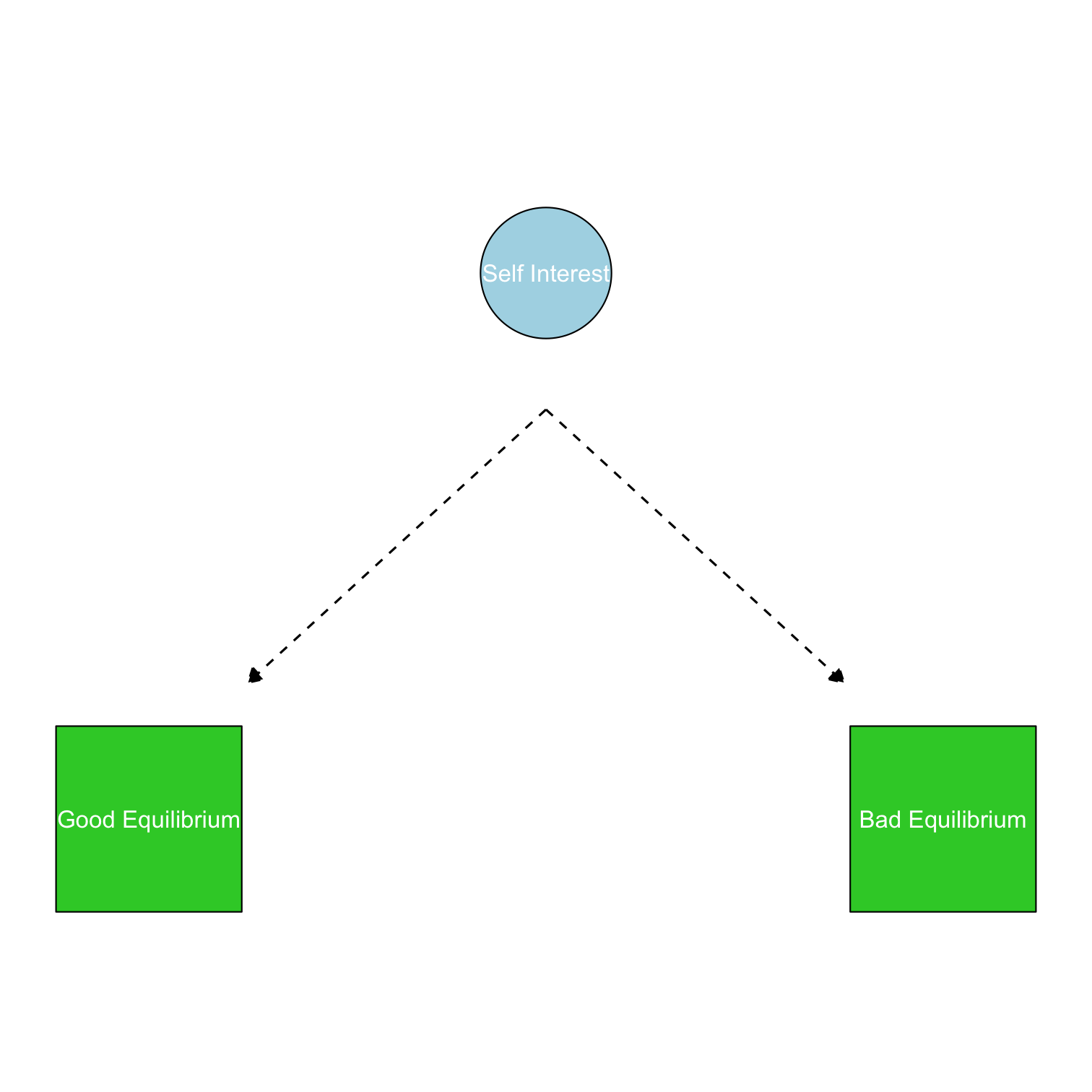

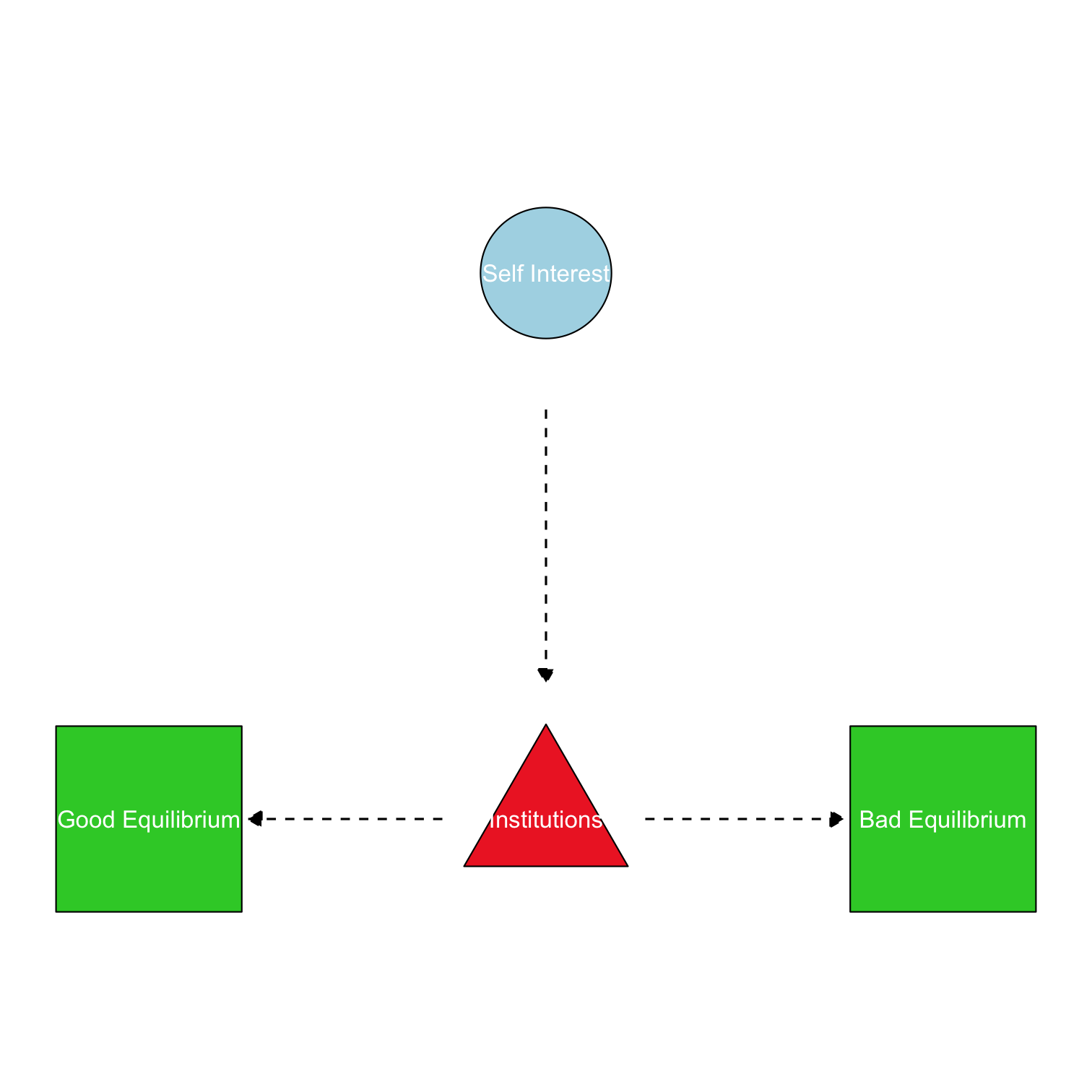

Robust Political Economy

No system is perfect

We need to find arrangements that are robust to knowledge & incentive problems

Easy (unpersuasive) case: perfect information & pure benevolence

- every system works in theory!

Hard (persuasive) case: uncertainty & selfish behavior

- what works best in practice?

Treat people as they are: sometimes good, bad, smart, stupid, opportunistic, altruistic, depending on the institutions they face!

Robust Political Economy

Robust Political Economy

People often recommend optimal policies as if they could be installed by a benevolent dictator

- A dispassionate ruler with total control, perfect information, and selfless incentives to implement optimal policy

- A “1st-best solution”

In reality, 1st-best policies are distorted by the knowledge problem, the incentives problem, and politics

- Real world: 2nd-to-nth-best outcomes

Comparative Institutional Analysis

Compare imperfections of feasible and relevant alternative systems

- The “Nirvana Fallacy”: comparing an imperfect system in reality with an ideal system in theory

Economics: think on the margin!

- One system's “failure” does not automatically imply another will be “successful”!

- Real world requires tradeoffs

- “economics puts parameters on people's utopias”

- “compared to what?”

Institutions: Operationalizing Adam Smith

Adam Smith

1723-1790

“[Though] he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention...By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it,” (Book IV, Chapter 2.9).

Smith, Adam, 1776, An Enquiry into the Nature and Causes of the Wealth of Nations

Institutions: Operationalizing Adam Smith

“[Though] he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention...By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it,” (Book IV, Chapter 2.9).

Smith, Adam, 1776, An Enquiry into the Nature and Causes of the Wealth of Nations

Institutions: Operationalizing Adam Smith

"[Though] he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention...By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it," (Book IV, Chapter 2.9).

Smith, Adam, 1776, An Enquiry into the Nature and Causes of the Wealth of Nations

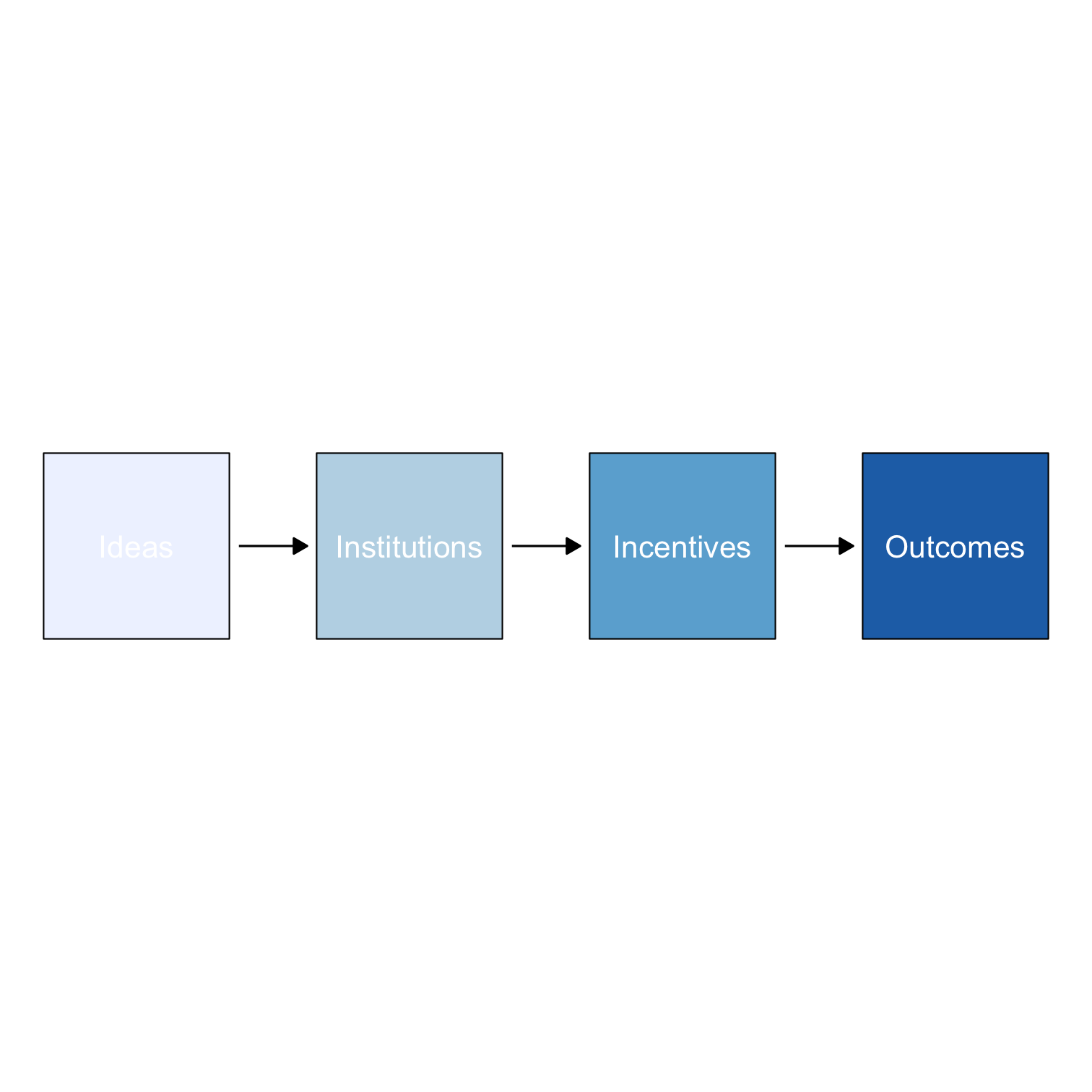

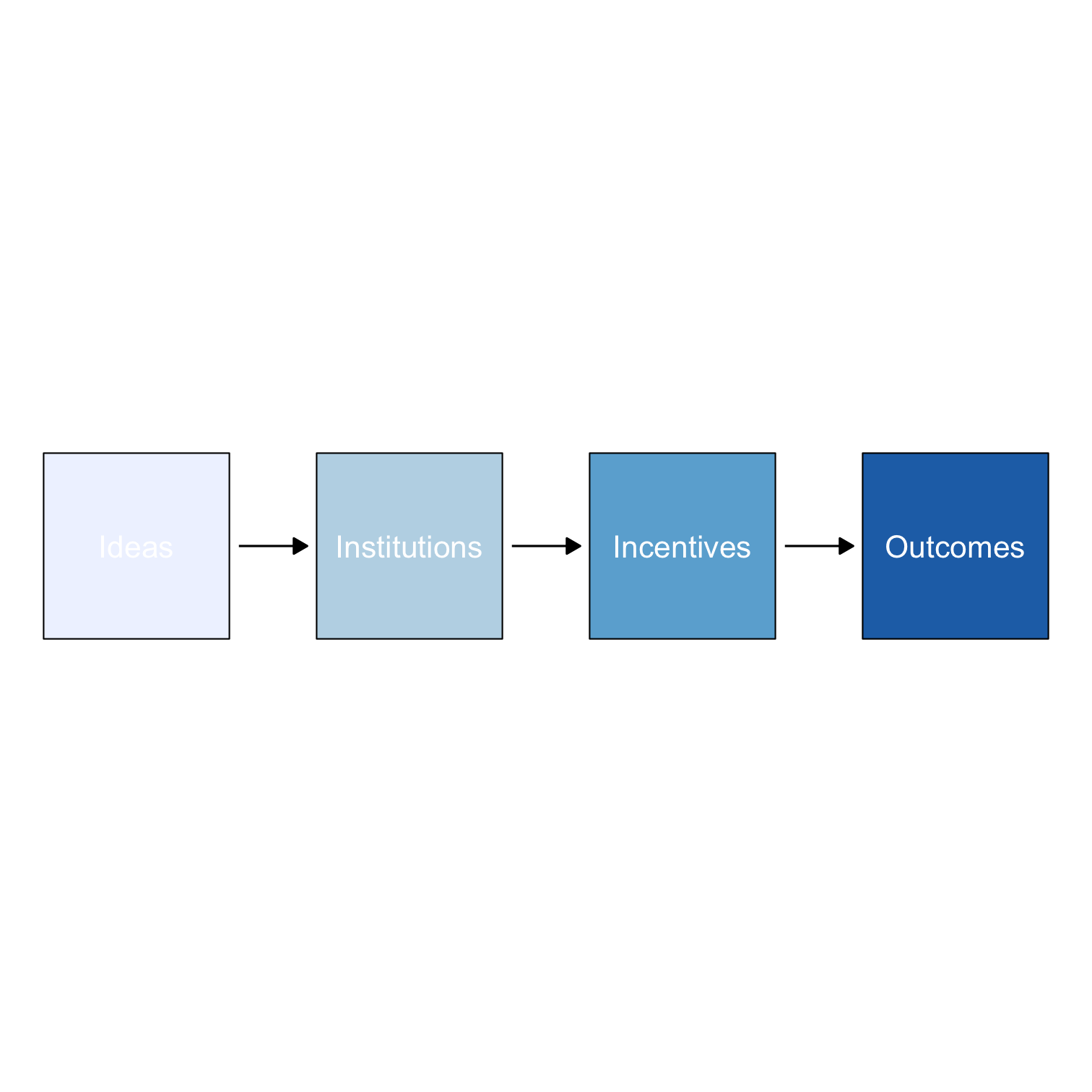

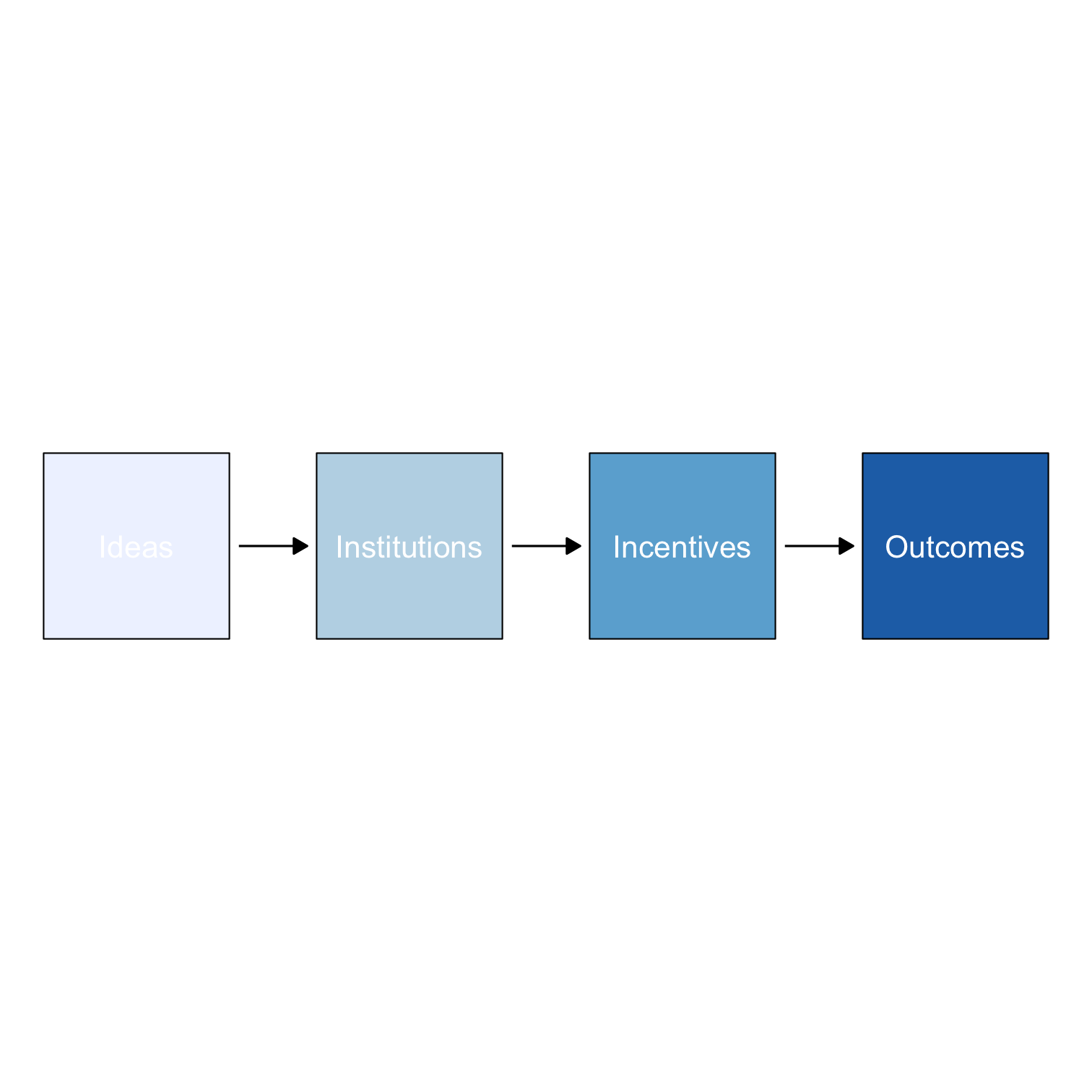

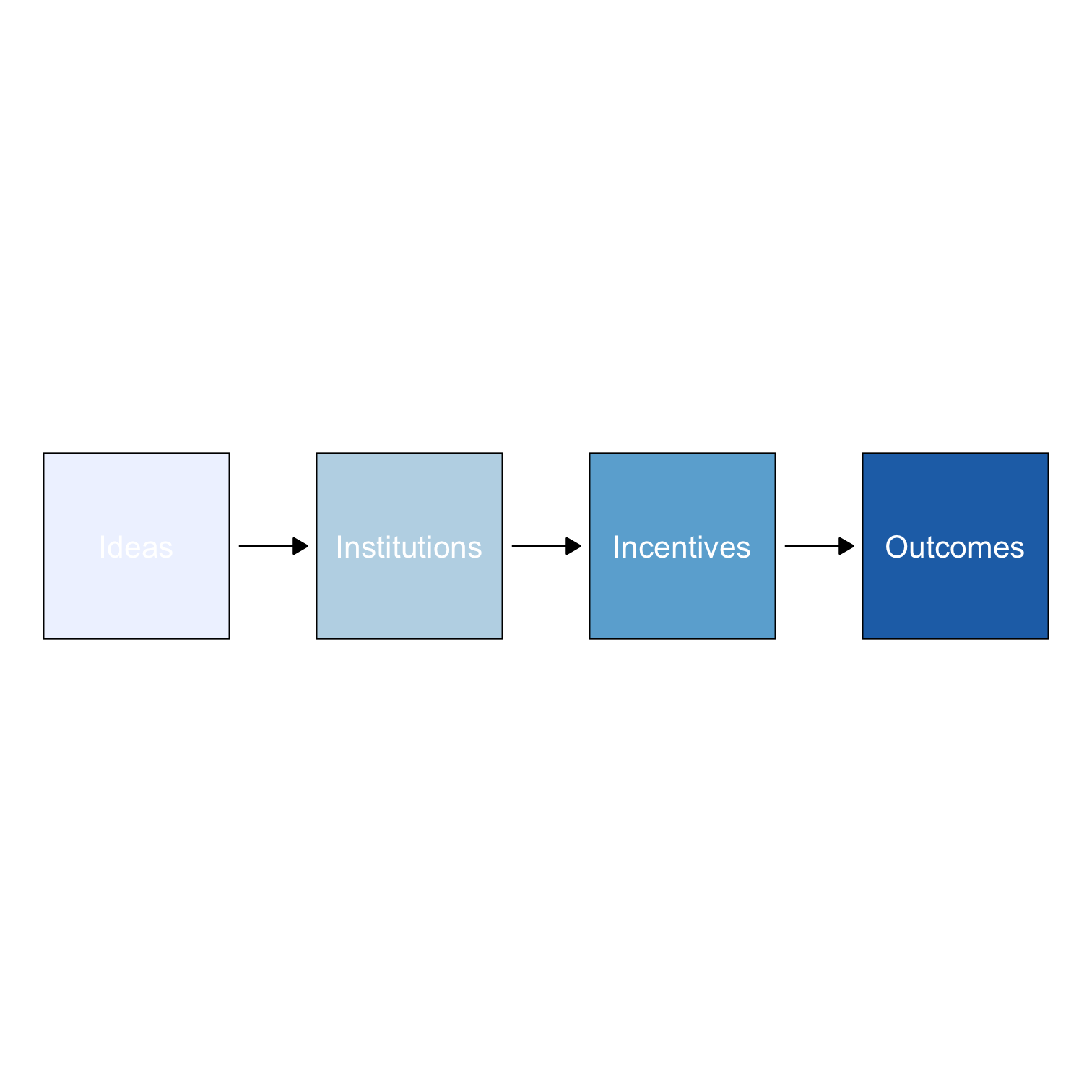

A Logical Framework for Political Economy

- Outcomes:

- relative level of wealth or poverty

- relative level of equality or inequality

- stability of politics, finance, macroeconomy

A Logical Framework for Political Economy

- Outcomes:

- relative level of wealth or poverty

- relative level of equality or inequality

- stability of politics, finance, macroeconomy

- ...are determined by Incentives:

- relative prices or costs of various choices

- profits and losses

- information

A Logical Framework for Political Economy

- Outcomes:

- relative level of wealth or poverty

- relative level of equality or inequality

- stability of politics, finance, macroeconomy

- ...are determined by Incentives:

- relative prices or costs of various choices

- profits and losses

- information

- ...are determined by Institutions:

- allocation of rights, property, & power

- (in)equality before the law or corruption

- constraints on politics and economics

A Logical Framework for Political Economy

- Outcomes:

- relative level of wealth or poverty

- relative level of equality or inequality

- stability of politics, finance, macroeconomy

- ...are determined by Incentives:

- relative prices or costs of various choices

- profits and losses

- information

- ...are determined by Institutions:

- allocation of rights, property, & power

- (in)equality before the law or corruption

- constraints on politics and economics

- ...are determined by Ideas:

- political and social worldview -"isms"

- which groups (should) have status

- moral and social norms

What are Institutions?

Douglass C. North

1920-2015

Economics Nobel 1993

“Institutions are the humanly devised constraints that structure political economic and social interaction. They consist of both informal constraints (sanctions, taboos, customs, traditions, and codes of conduct), and formal rules (constitutions, laws, property rights),” (p.10)

“Institutions are the rules of the game in a society,” (p.1).

North, Douglass C, (1991), "Institutions," Journal of Economic Perspectives 5(1): 97-112.

North, Douglass C, (1990), Institutions, Institutional Change, and Economic Performance

Incentives are Structured by Institutions

“Who needs this nail?”

“Don't worry about it! The main thing is that we immediately fulfilled the plan for nails!”

Incentives are Structured by Institutions

“Dear customer, in the leather goods department of our store, a shipment of 500 imported womens' purses has been recieved. Four hundred and fifty of them have been bought by employees of the store. Fourty-nine are under the counter and have been ordered in advance for friends. One purse is in the display window. We invite you to visit the leather department to buy this purse!” (p.38).

White, Lawrence H, 2012, The Clash of Economic Ideas, pp.38-9

Public Choice: The Economic Analysis of Politics

Groups Don't Choose

“Society” is not a choosing-agent or an optimization problem

Individuals have different interests in their different social capacities

- Consumers, producers

- Voters

- Interest groups

- Elected officials

- Bureaucrats

Learn more in my Public Economics course

Major Actors in a Liberal Democracy

Voters express preferences through elections

Special interest groups provide additional information and advocacy for lawmaking

Politicians create laws reflecting voter and interest gorup preferences

Bureaucrats implement laws according to goals set by politicians

Voters in a Liberal Democracy

Voters express preferences through elections

Voters as economic agents:

Choose: < a candidate >

In order to maximize: < utility >

Subject to: < constraints? >

The Collective Action Problem of Democracy

Citizens vote in politicians to enact various laws that citizens prefer -- and vote politicians out of office if they fail to deliver

A collective action problem: citizens need to monitor the performance of politicians and bureaucrats to ensure government serves voters' interests

The Collective Action Problem of Democracy

Voting is instrumental in enacting voters' preferences into policy

Good governance is a public good: an individual citizen enjoys small fraction of benefit created

Additionally, policies & elections depend on many millions of people

Individual bears a private cost of informing self and participating

Hence, a free-rider problem

The Rational Calculus of Voting

A rational individual will vote iff: p(B)+W>C

B: perceived net benefits of candidate X over Y

- p: probability individual vote will affect the outcome of the election

- W: individual's utility derived from voting regardless of the outcome (e.g. civic duty, "warm glow," etc)

- C: marginal cost of voting

The Rational Calculus of Voting

- A rational individual will vote iff:

p(B)+W>C

p≈0

- Outcome requires many votes

B is a public good

- Get small fraction of total benefit

C>0

- Cost of informing oneself and voting informed

The Rational Calculus of Voting

A rational individual will vote iff: p(B)+W>C

If citizens are purely rational, W=0

Citizens then vote if p(B)>C

Prediction: rational citizen does not vote

Voter Turnout: Presidential Elections

| Year | Turnout of Elligible Voters |

|---|---|

| 2016 | 55.7% |

| 2012 | 54.9% |

| 2008 | 58.2% |

| 2004 | 55.7% |

| 2000 | 50.3% |

| 1996 | 49.0% |

| 1992 | 55.2% |

Sources: Wikipedia, U.S. Census Bureau, Bipartisan Policy Center

The Rational Calculus of Voting

A rational individual will vote iff: p(B)+W>C

Now suppose, D>0

Citizens then vote if D>C

More importantly, the voter votes regardless of the positions of the candidates!

Vote for non-rational reasons: "more presidential looking," "taller," "a better temperament," etc.

The Rational Calculus of Voting

Many do vote, even at significant personal cost!

"Expressive voting": people vote to express identity, solidarity, tribalism, preferences, etc

Voting as a pure consumption good, not an instrumental investment to achieve policy preferences

Rational Ignorance

Model predicts rational ignorance

Not necessarily no voting, but

- Less than maximum turnout

- Voting not for instrumental, "rational" reasons, but for non-rational reasons

Rational Ignorance

Winston Churchill

Winston Churchill

1874-1965

"The best argument against democracy is a five minute conversation with the average voter."

Rational Ignorance

Somin, Ilya, 2014, Democracy and Political Ignorance

Rational Ignorance

Somin, Ilya, 2014, Democracy and Political Ignorance

Special Interest Groups in a Liberal Democracy

Special interest groups: any group of individuals that value a common cause

SIGs as economic agents:

Choose: < a candidate to support >

In order to maximize: < utility >

Subject to: < budget >

The Logic of Collective Action

But power and influence is not evenly distributed across interest groups

Logic of collective action: Smaller and more homogenous groups face lower collective action costs of organizing than larger and more heterogeneous groups

Smaller groups to whom benefit (cost) of a policy is more concentrated can outmobilize larger groups where benefit (cost) is more dispersed

The Logic of Collective Action

- Policies in representative democracies tend to feature concentrated benefits and dispersed costs

Politicians in a Liberal Democracy

Politicians create laws reflecting voter and interest gorup preferences

The politician's problem:

Choose: < a platform >

In order to maximize: < votes >

Subject to: < being re/elected >

Politician's Incentives: Who's Interests To Represent?

Rationally ignorant voters pay little attention to actual substance or policy-making; more to TV-friendly spectacles

Big speeches, ribbon cutting ceremonies, attack ads on rivals, etc

Platforms more about broad platitudes than substance "family values," "tough on crime," "change," "drain the swamp" etc.

Politician's Incentives: Who's Interests To Represent?

Special interests pay very close attention and are actively involved in policy-making and contribute to political campaigns

Politicians allocate funds towards special interests

Politician's Incentives

An Example

"In fiscal year (FY) 2013, Americans consumed 12 million tons of refined sugar, with the average price for raw sugar 6 cents per pound higher than the average world price. That means, based on 24 billion pounds of refined sugar use at a 6-cents-per-pound U.S. premium, Americans paid an unnecessary $1.4 billion extra for sugar. That is equivalent to more than $310,000 per sugar farm in the United States"

Source: Heritage Foundation

An Example

An Example

An Example

"Washington, D.C., doesn't have many farms, or farmers. Yet thousands of residents in and around the nation's capital receive millions of dollars every year in federal farm subsidies...lawyers, lobbyists and at least one psychologist collected nearly $342,000 in taxpayer farm subsidies between 2008 and 2011...[also] Gerald Cassidy, the founder of one of Washington's most powerful lobbying firms, Cassidy & Associates; Charlie Stenholm, a former congressman; and Chuck Grassley, a Republican senator from Iowa; [and former] Secretary of Agriculture Tom Vilsack..."

An Example

And yet, each individual pays maybe $1-2 a year in higher prices for sugar

Difficult to mobilize voters to petition to end the sugar subsidy to save $1

Sugar producers stand to lose a billion dollars

Sugar PACs that contribute thousands to key lawmakers

“The Government Should Do...”

People often commit the nirvana fallacy and view the government as a unicorn

“The Munger test”: replace “the government should do [X]” with:

“Politicians elected by rationally ignorant voters and capturable by lobbying by special interests should suggest to autonomous bureaucrats, to [do X]”

- If it’s still worth doing, then great, the government should do it!